The Roger Gibson Talmud Portfolio is a 3-fund portfolio comprised of stocks, REITs, and bonds. Here we’ll take a look at its components, performance, and the best ETF’s to use in its execution.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Video

Prefer video? Watch it here:

Who is Roger Gibson?

As the name suggests, the Talmud Portfolio was created by financial adviser Roger Gibson. In a 1998 paper titled Asset Allocation and the Rewards of Multiple-Asset-Class Investing, Gibson drew from the foundational work of Harry Markowitz, the father of modern portfolio theory, to show how a combination of volatile, uncorrelated assets could produce higher returns and, more importantly, higher risk-adjusted returns, with less volatility than the average of those assets held in isolation.

This of course is the same premise upon which many portfolios like the All Weather Portfolio are built. Markowitz proposed the idea of the efficient frontier for portfolios, along which we can assess expected returns for any given level of volatility, or expected volatility for any given expected return.

Gibson's book Asset Allocation: Balancing Financial Risk can be found here on Amazon. Gibson's firm is Gibson Capital.

What Is the Talmud Portfolio?

The Talmud is a central religious text of Rabbinic Judaism. In it is written:

Let every man divide his money into three parts, and invest a third in land, a third in business and a third let him keep by him in reserve.

Gibson noted this in the first edition of his book published in 1989. Translating this prescription into a modern investment portfolio, Gibson defined “land” as REITs, “business” as U.S. stocks, and “reserve” as U.S. bonds.

The one-third to “keep by him in reserve” should probably be interpreted as cash, but considering we want investment growth, a 1/3 allocation to cash or a cash-equivalent like short-term bonds is obviously much too conservative for most investors.

Like the Couch Potato Portfolio, there's actually not a strict prescription for the Talmud Portfolio for the specific assets to hold. For example, for the 1/3 U.S. stocks position, you could choose to use an S&P 500 index, the total U.S. stock market, the Russell 1000 index, etc. To broadly diversify across U.S. stocks, I'm suggesting the use of a total U.S. stock market fund.

The REITs holding is somewhat straightforward – a REITs index fund.

As for bonds, the obvious choice is a total bond market fund, but since we know treasury bonds are superior to corporate bonds, I'm suggesting intermediate treasury bonds, which should match the average duration of the total U.S. treasury bond market. Long-term treasuries are likely too volatile – and too susceptible to interest rate risk – for older investors, and short-term bonds are too conservative for young investors at a 33.3% allocation, so intermediate-term bonds offer a happy medium that is suitable for most investors.

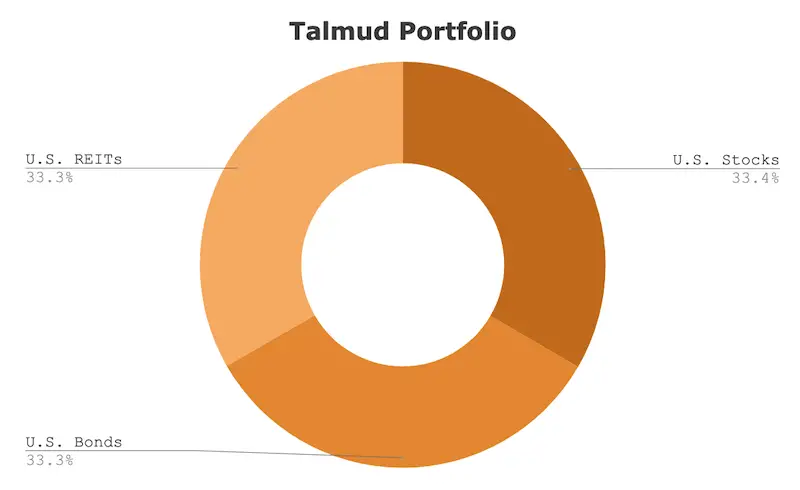

Talmud Portfolio Asset Allocation

Thus, my interpretation of the Talmud Portfolio asset allocation is as follows:

- 33.4% Total U.S. Stock Market

- 33.3% U.S. REITs

- 33.3% Intermediate-Term Treasury Bonds

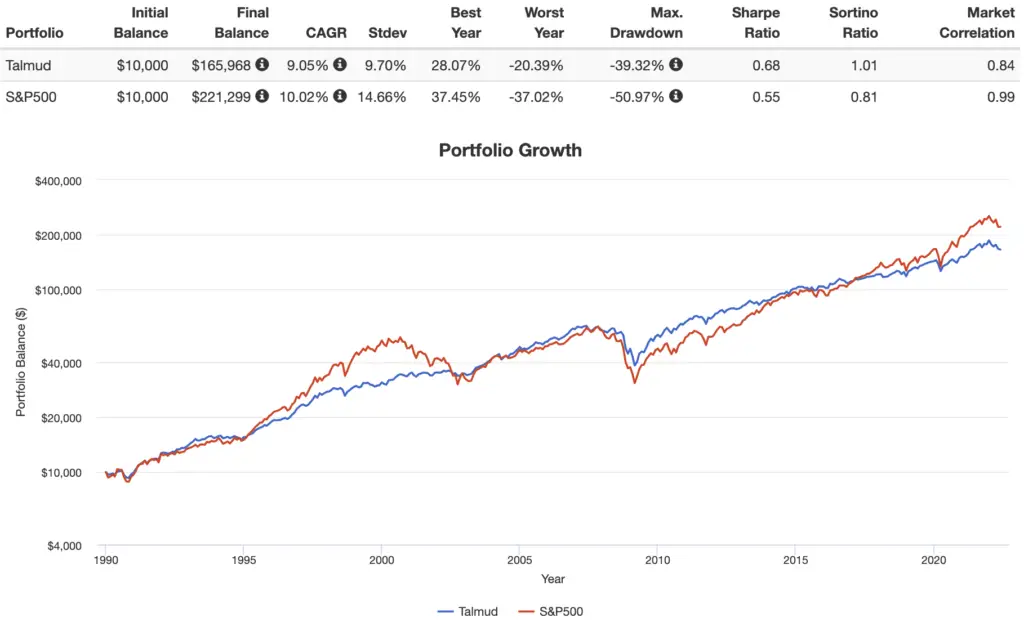

Talmud Portfolio Performance Backtest vs. the S&P 500

Here's the Talmud Portfolio's performance vs. an S&P 500 index fund from 1990 through May, 2022:

As we might expect, the Talmud Portfolio has delivered a greater risk-adjusted return (Sharpe, Sortino), with volatility about 1/3 lower than the S&P 500. This is more impressive considering the fact that REITs suffered greatly during the 2008 Global Financial Crisis, having a larger drawdown than the market.

Talmud Portfolio ETF Pie for M1 Finance

M1 Finance is a great choice of broker to implement the Talmud Portfolio because it makes regular rebalancing seamless and easy, has zero transaction fees, and incorporates dynamic rebalancing for new deposits. I wrote a comprehensive review of M1 Finance here.

Using entirely low-cost Vanguard funds, we can construct the Talmud Portfolio pie like this:

- VTI – 34%

- VNQ – 33%

- VGIT – 33%

Since M1 Finance doesn't allow fractions of 1%, I made U.S. stocks 34%.

You can add the Talmud Portfolio pie to your portfolio on M1 Finance by clicking this link and then clicking “Invest in this pie.” Investors outside the U.S. can find these ETFs on eToro.

Taking the Talmud Portfolio International

It should seem natural that the Talmud Portfolio should probably include some allocation to ex-US stocks, consistent with Gibson's promotion of diversification through holding assets that do not move in perfect lockstep. The inclusion of international stocks in diversified portfolios of U.S. investors has really only recently become a popular practice in the last 30 years or so. Prior to that, they were viewed with suspicion and uncertainty, and products to invest in them were harder to come by. Bogle didn't invest in international stocks, and Buffett still doesn't. This is likely the reason for their not being included in Gibson's original proposal of the Talmud Portfolio.

To hold both U.S. and ex-US stocks at their global market weights, we can simply replace VTI with VT, Vanguard's Total World Stock Market Fund:

- 34% VT

- 33% VNQ

- 33% VGIT

You can add this global Talmud Portfolio pie to your portfolio on M1 Finance by clicking this link and then clicking “Invest in this portfolio.” Investors outside the U.S. can find these ETFs on eToro.

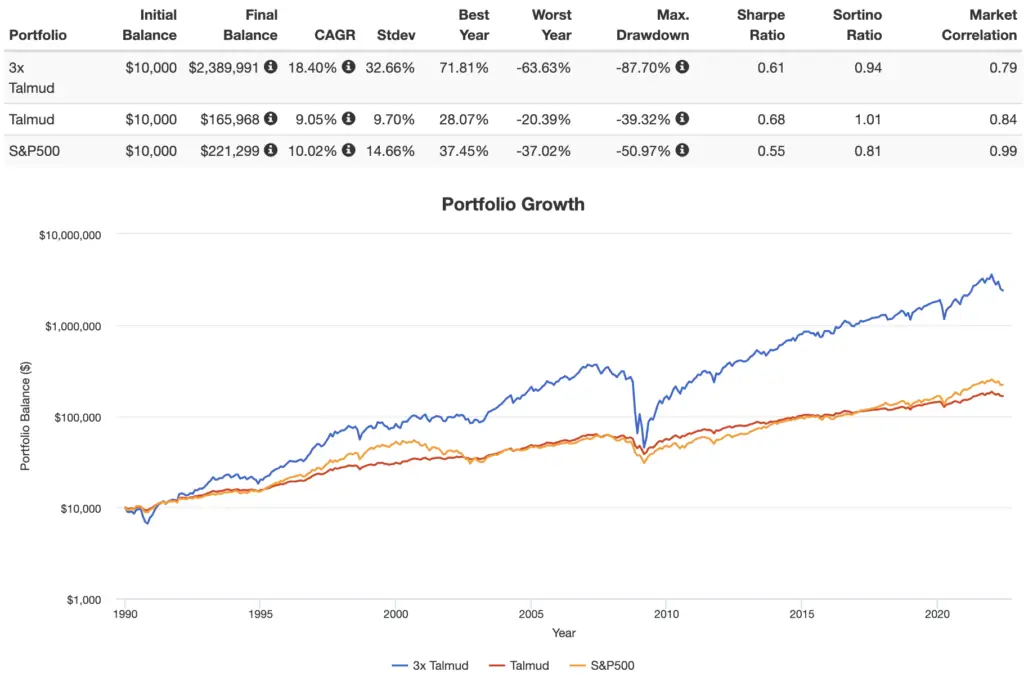

Leveraged Talmud Portfolio

We can lever up the Talmud Portfolio with 3x exposure to its 3 equally-weighted asset classes. Below is a backtest showing how this leveraged portfolio would have performed historically vs. the “normal” unleveraged Talmud Portfolio and an S&P 500 index fund for the period 1990 through May, 2022:

We can construct this leveraged Talmud Portfolio as follows:

33% UPRO (3x S&P 500)

33% DRN (3x REITs)

34% TYD (3x interm. treasuries)

You can add this pie to your M1 Finance portfolio using this link. Investors outside the U.S. can find these ETFs on eToro.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Disclosure: I am long UPRO in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Hi John,

Looking at the leveraged Talmud portfolio I thought “why doesn’t everybody do this?!” So I looked into leveraged ETFs more and came across the below link on ALLY Bank’s website telling me about “beta slippage” and it makes me wonder if your leveraged version would really work out. Anyway, take a look and let me know what you think.

https://tinyurl.com/5764tfev

Thanks, Brandon

Yea I’ve addressed beta slippage and volatility decay elsewhere in other posts about LETFs.