TQQQ has grown in popularity after a decade-long raging bull market for large cap growth stocks and specifically Big Tech. But is it a good investment for a long term hold strategy? Let's dive in.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality, ad-free content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I get if you decide to purchase through my links. Read more here.

Contents

Video – TQQQ ETF Strategy Review

Prefer video? Watch it here:

What Is TQQQ?

TQQQ is a 3x leveraged ETF from ProShares that aims to deliver 3x the daily returns of the NASDAQ 100 Index.

Explaining how a leveraged ETF works is beyond the scope of this post, but I delved into that a bit here. Basically, these funds provide enhanced exposure without additional capital by using debt and swaps. This greater exposure usually comes at a pretty hefty cost, in this case an expense ratio of 0.95% at the time of writing. The “normal” 1x fund QQQ has an expense ratio of about 1/5 that at 0.20%.

These funds are typically used by day traders, but recently there seems to be more interest in holding them over the long term. TQQQ has become extremely popular in recent years due to the bull run from large cap tech, which comprises a huge percentage of the fund. There's even an entire community on Reddit dedicated to this single fund.

But What About Volatility Decay for TQQQ?

The daily resetting of leveraged ETFs means the fund only provides the return multiple relative to the underlying index on a daily basis, not necessarily over the long term. Because of this, volatility of the index can eat away at gains; this is known as volatility decay or beta slippage.

Unfortunately, the financial blogosphere took the scary-sounding “volatility decay” and ran with it to erroneously conclude that holding a leveraged ETF for more than a day is a cardinal sin, ignoring the simple underlying math that actually helps on the way up. In short, volatility decay is not as big of a deal as it's made out to be, and we would expect the enhanced returns to overcome any volatility drag and fees.

That said, note that leveraged ETFs typically carry hefty fees. TQQQ has an expense ratio of 0.95%.

Drawdowns Are Important

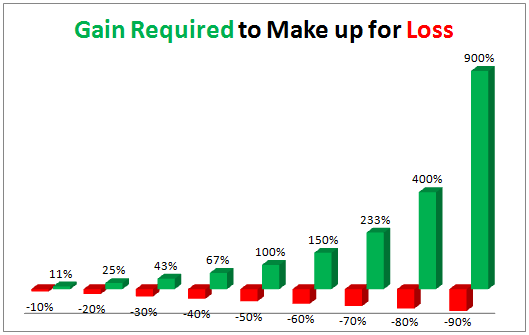

I'm not one to parrot the “leveraged ETFs can be wiped out” idea (thanks to modern circuit breakers, meaning mechanically TQQQ can't go to zero because trading would be halted before the underlying is able to drop by 33.4% in a single day), but if QQQ drops by 5%, TQQQ drops by 15%. People tend to focus on volatility decay and forget that major drawdowns are actually the bigger concern here. This is because simple math again tells us that it requires great gains to recover from great losses:

As a simplistic example using dollars, suppose your $100 portfolio drops by 10% ($10) to $90. You now require an 11% gain to get back to $100.

TQQQ Is TQQQ A Good Investment for a Long Term Hold Strategy?

Probably not, at least not with 100% TQQQ. But there may be hope; stay tuned.

The graph above illustrates in theory why a 100% TQQQ position is not a good investment for a long term hold strategy.

Many are jumping into TQQQ after seeing the last decade bull run of large cap growth stocks, as TQQQ has only been around since 2010 and is up over 5,000% from then through 2020:

Looks great, right? Not so fast. This is called recency bias – using recent behavior to assume the same behavior will continue into the future. As we know, past performance does not indicate future performance. Moreover, a decade – especially one without a major crash – is a terribly short amount of time in investing from which to draw any sort of meaningful conclusions.

TQQQ vs. QQQ

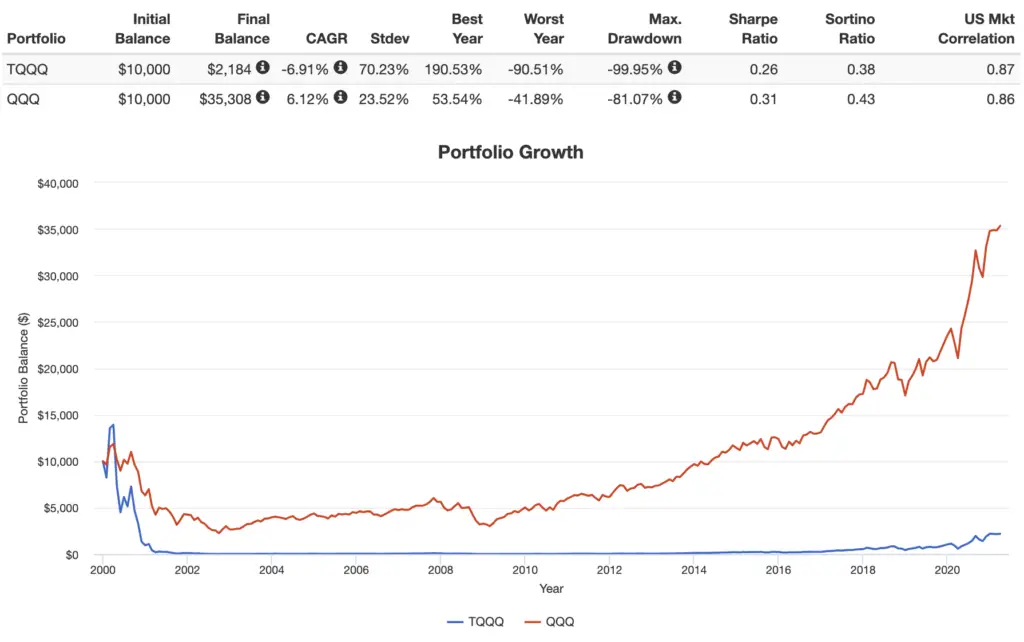

So we need to go back further to get a better idea of how TQQQ performs through major stock market crashes, which we can do by simulating returns going back further than the fund's inception. Going back to 1987 for TQQQ vs. QQQ tells a somewhat different story:

Notice how if you buy and hold TQQQ alone, it is basically a timing gamble that depends heavily on your entry and exit points. Basically, it can take too long for the leveraged ETF to recover after a major crash. After the Dotcom crash of 2000, TQQQ didn't catch up to QQQ until late 2007 right before it crashed again in the Global Financial Crisis of 2008. Had you bought in January 2000 right before the Dotcom crash, you'd still be in the red today:

So far I haven't even touched on the psychological aspects of this idea. Most investors severely overestimate their tolerance for risk and can't stomach a major crash with a 100% stocks position, much less a 300% stocks position. Holding TQQQ through the Dotcom crash would have seen a near-100% drawdown.

A Viable Strategy for Long Term TQQQ – Use Bonds with TMF

The above graphs tell us 100% TQQQ is only a viable strategy if we can perfectly predict and time the market, which we know is basically impossible.

So how can we make it work? By using a hedge to mitigate those harmful drawdowns. Diversification is your friend with leveraged ETFs. Treasury bonds offer the greatest degree of uncorrelation to stocks of any asset. I explained here why you shouldn't fear them.

TMF is a very popular leveraged ETF for long-term treasury bonds. This is the same basis of the famous Hedgefundie Strategy. This idea is also extended with other assets like gold in my leveraged All Weather Portfolio.

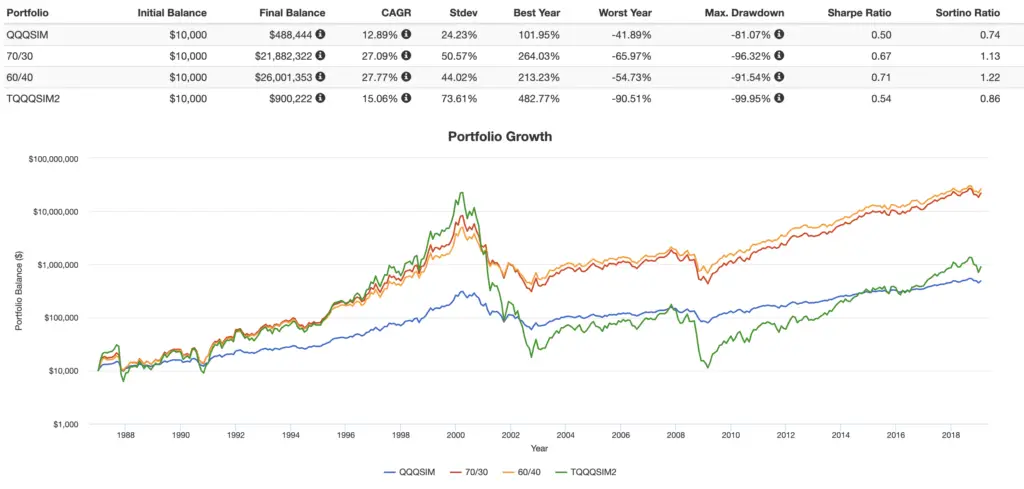

Once again, the beautiful 60/40 portfolio – in this case 3x for 180/120 exposure – emerges as the best option (at least historically) in terms of both general and risk-adjusted returns:

While we expect lower bond returns in the future, it doesn't mean TMF won't still do its job. Think of it as a parachute insurance policy that bails you out in stock crashes.

Also remember the NASDAQ 100 is basically a tech index at this point, posing a concentration risk, and growth stocks are looking extremely expensive in terms of current valuations, meaning they now have lower future expected returns. For these reasons, I'm a fan of using UPRO instead (the Hedgefundie strategy).

Addressing Concerns Over Bonds

I've gotten a lot of questions about – and a lot of the comments in discussions on TQQQ strategies focus on – the use, utility, and viability of long-term treasury bonds as a significant chunk of this strategy. I'll briefly address and hopefully quell these concerns below.

Again, by diversifying across uncorrelated assets, we mean holding different assets that will perform well at different times. For example, when stocks zig, bonds tend to zag. Those 2 assets are uncorrelated. Holding both provides a smoother ride, reducing portfolio volatility (variability of return) and risk.

Common comments nowadays about bonds include:

- “Bonds are useless at low yields!”

- “Bonds are for old people!”

- “Long bonds are too volatile and too susceptible to interest rate risk!”

- “Corporate bonds pay more!”

- “Interest rates can only go up from here! Bonds will be toast!”

- “Bonds return less than stocks!”

So why long term treasuries?

- It is fundamentally incorrect to say that bonds must necessarily lose money in a rising rate environment. Bonds only suffer from rising interest rates when those rates are rising faster than expected. Bonds handle low and slow rate increases just fine; look at the period of rising interest rates between 1940 and about 1975, where bonds kept rolling at their par and paid that sweet, steady coupon.

- Bond pricing does not happen in a vacuum. We've had several periods of rising interest rates where long bonds delivered a positive return:

- From 1992-2000, interest rates rose by about 3% and long treasury bonds returned about 9% annualized for the period.

- From 2003-2007, interest rates rose by about 4% and long treasury bonds returned about 5% annualized for the period.

- From 2015-2019, interest rates rose by about 2% and long treasury bonds returned about 5% annualized for the period.

- New bonds bought by a bond index fund in a rising rate environment will be bought at the higher rate, while old ones at the previous lower rate are sold off. You're not stuck with the same yield for your entire investing horizon.

- We know that treasury bonds are an objectively superior diversifier alongside stocks compared to corporate bonds. This is also why I don't use the popular total bond market fund BND. It has been noted that this greater degree of uncorrelation between treasury bonds and stocks is conveniently amplified during periods of market turmoil, which researchers referred to as crisis alpha.

- Again, remember we need and want the greater volatility of long-term bonds so that they can more effectively counteract the downward movement of stocks, which are riskier and more volatile than bonds. We're using them to reduce the portfolio's volatility and risk. More volatile assets make better diversifiers. Most of the portfolio's risk is still being contributed by stocks.

- This one's probably the most important. We're not talking about bonds held in isolation, which would probably be a bad investment right now. We're talking about them in the context of a diversified portfolio alongside stocks, for which they are still the usual flight-to-safety asset during stock downturns. Specifically, in this context, the purpose of the bonds side is purely as an insurance parachute to bail you out in a stock market crash. Though they provided a major boost to this strategy's returns over the last 40 years while interest rates were dropping, we're not really expecting any real returns from the bonds side going forward, and we're intrinsically assuming that the stocks side is the primary driver of the strategy's returns. Even if rising rates mean bonds are a comparatively worse diversifier (for stocks) in terms of future expected returns during that period does not mean they are not still the best diversifier to use.

- Similarly, short-term decreases in bond prices do not mean the bonds are not still doing their job of buffering stock downturns.

- Historically, when treasury bonds moved in the same direction as stocks, it was usually up.

- Interest rates are likely to stay low for a while. Also, there’s no reason to expect interest rates to rise just because they are low. People have been claiming “rates can only go up” for the past 20 years or so and they haven't. They have gradually declined for the last 700 years without reversion to the mean. Negative rates aren't out of the question, and we're seeing them used in some foreign countries.

- Bond convexity means their asymmetric risk/return profile favors the upside.

- Again, I acknowledge that post-Volcker monetary policy, resulting in falling interest rates, has driven the particularly stellar returns of the raging bond bull market since 1982, but I also think the Fed and U.S. monetary policy are fundamentally different since the Volcker era, likely allowing us to altogether avoid runaway inflation environments like the late 1970’s going forward. Bond prices already have expected inflation baked in.

David Swensen summed it up nicely in his book Unconventional Success:

“The purity of noncallable, long-term, default-free treasury bonds provides the most powerful diversification to investor portfolios.”

Ok, bonds rant over. If you still feel some dissonance, the next section may offer some solutions.

Reducing Volatility and Drawdowns and Hedging Against Inflation and Rising Rates

It's unlikely that any of the following will improve the total return of a strategy like this, and whether or not they'll improve risk-adjusted return is up for debate, but those concerned about inflation, rising rates, volatility, drawdowns, etc., and/or TMF's future ability to adequately serve as an insurance parachute, may want to diversify a bit with some of the following options:

- LTPZ – long term TIPS – inflation-linked bonds.

- FAS – 3x financials – banks tend to do well when interest rates rise.

- EDC – 3x emerging markets – diversify outside the U.S.

- UTSL – 3x utilities – lowest correlation to the market of any sector; tend to fare well during recessions and crashes.

- YINN – 3x China – lowly correlated to the U.S.

- UGL – 2x gold – usually lowly correlated to both stocks and bonds, but a long-term expected real return of zero; no 3x gold funds available.

- DRN – 3x REITs – arguable diversification benefit from “real assets.”

- EDV – U.S. Treasury STRIPS.

- TYD – 3x intermediate treasuries – less interest rate risk.

- TAIL – OTM put options ladder to hedge tail risk. Mostly intermediate treasury bonds and TIPS.

What About DCA / Regular Deposits Into TQQQ?

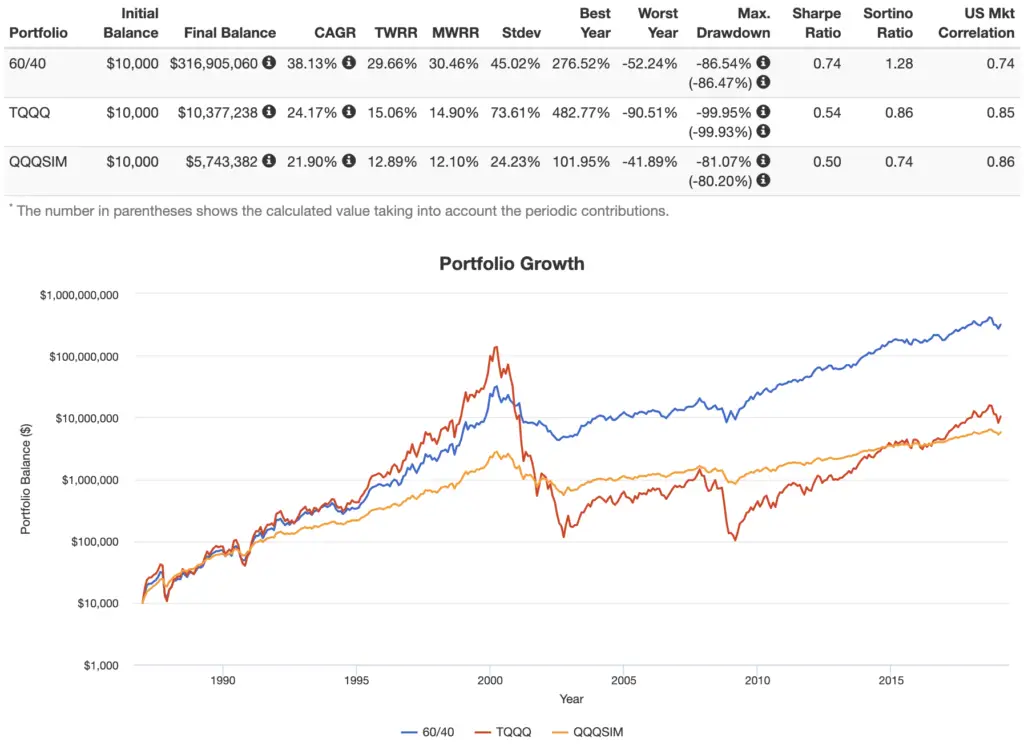

The backtests above buy and hold TQQQ with a starting balance of $10,000 and no additional deposits. Some will point out that an investor will usually be regularly depositing into the portfolio and that this would change the results. Since the market tends to go up and since major crashes are typically infrequent, regular deposits of $1,000/month into TQQQ actually doesn't change the end result:

TQQQ/TMF Pie for M1 Finance

You'll need to rebalance a strategy like this regularly, meaning getting allocations back into balance since these volatile assets may stray quickly from their target weights. I used quarterly rebalancing in the backtest above.

You might want to use M1 Finance to implement this type of strategy, as the broker makes rebalancing extremely easy with 1 click, and they even feature automatic rebalancing through which new deposits are directed to the underweight asset in the portfolio. I wrote a comprehensive review of M1 here.

Here's a link for the M1 pie for 60/40 TQQQ/TMF.

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use eToro or possibly Interactive Brokers.

Conclusion

Don't go all in and don't buy and hold TQQQ – or any leveraged stocks ETF – “naked” for the long term without a hedge of some sort, because sometimes they simply can't recover from major drawdowns. The last decade has looked great for TQQQ, but don't succumb to recency bias.

TMF is likely the most suitable hedge for funds like TQQQ and UPRO. For those with a weaker stomach who still want to use leverage, check out my discussion on levering up the All Weather Portfolio.

I also wouldn't bother with any kind of forecast or price prediction. Technical analysis on a normal broad index ETF is already pretty meaningless. Trying to forecast a 3x LETF is almost certainly a fool's errand.

Do you use TQQQ in your portfolio? Let me know in the comments.

Disclosure: I am long UPRO and TMF in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. All examples above are hypothetical, do not reflect any specific investments, are for informational purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Don't want to do all this investing stuff yourself or feel overwhelmed? Check out my flat-fee-only fiduciary friends over at Advisor.com.

You mentioned within the comments that you employ a modified hedgefundie strategy using UGL and UTSL. Are you using 55% UPRO or TQQQ then with the 45% are you using 35% TMF, 5% UGL and 5% UTSL? Or did you use a more similar approach to the All weather portfolio and do 25% TMF, 10% TYD, 5% UTSL and 5% UGL? Thank you. Great articles.

More like the first one.

I’m pretty new to this so bare with me, how can the max draw down % of the 60/40 and 70/30 portfolios exceed the percentage TQQQ in the portfolio, wouldn’t bonds be going up when TQQQ is tanking? Did they both drop together on these occasions?

A portfolio can drop by a percentage greater than that of one of its components.

You clearly are just making up information as you are going along.

1. First of all TQQQ has not gone up 5,000 % since it started trading in 2010.

It does average about 150 % a year which is good, but no where close to 5,000 %.

I know because I own it

2. You said that if you Bought TQQQ in 2000 , you would still be in the Red today ! What are you talking about ?

TQQQ was not even around in 2000 . Remember, it was created in 2010

3. And if you Bought TQQQ in 2000, and are still ion the Red, then how could it have gone up 5,000%

4. Why would you say that buying TQQQ is Risky ? I have owned TQQQ for 7 years and I have sold out of all my other stocks just to put money into TQQQ. Of course whern the Stock market goes down the TQQQ reflects that move. But when the stock market goes down with a correction, juast about all stocks go down.

And when the market goes back up like it has done everytime since the stock market was created, then the TQQQ goes up

I would never invest in any stock when I have the protection in the TQQQ index

The Best Long Term investment would be the TQQQ

You probably haven’t been in the stock market that long to know how it works

Thanks

Dave

Thanks for the comment, Dave. Definitely not making anything up. Can’t tell whether or not you’re just trolling here.

1. Yes, it has. This is easily proven true looking at a backtest. $10,000 invested in TQQQ at inception and held through 2020 was worth $591,455 for a total return of 5,815%. Average annual return is not the same as total return.

2. I clearly noted that I created synthetic simulation data to see how TQQQ would have behaved further in the past. Please re-read the post.

3. Different time periods.

4. Because it’s essentially a 300% tech fund. If you don’t understand why that’s risky, you shouldn’t own it. Period. It sounds like you clearly don’t understand the risks of these products. Also remember past performance does not indicate future performance; 7 years is a drop in the bucket. TQQQ does not offer any “protection.” Best of luck.

Regarding your 2nd point, am I missing something? (I’m looking at it from Tradingview): The price in 12 Feb 2010 (open price) was $0.84

And currently it is at $169.48 (close price of 30 Dec 2021). That would make the return to be 20076%, or in other words x202 the initial value.

Yours is correct also, Jason. PV here is using whole years, so Jan. 1, 2011 through Dec. 31, 2020. That’s the figure I was citing. Yours basically includes an extra year on either side.

Wow….

Hi John. Kudos for lots of interesting articles. I’m learning a lot by reading them (and reading them again). In this post, the focus has been 60/40 TQQQ/TMF vs. 100 TQQQ or 100 QQQ. How does it compare to some mixture of QQQ and treasury — potentially, at optimal weights, say, 80/20? This comparison (or an ablation study in some jargon) would isolate the effect of 3x leverage.

Thanks, Mike! Glad you’re finding them helpful. This post isn’t so much to suggest or assess a leveraged strategy using TQQQ; I wouldn’t buy it and don’t own it. It’s more just to show how holding a 3x LETF without a bond hedge is probably not a great idea. Check out the Hedgefundie post or the All Weather post for more details on the actual strategies.

With 6-7 rate hikes coming between now and 2024, would it be better to switch TMF for TYD? Or maybe something else? What if these rate hikes hammer both TQQQ and TMF?

Maybe. Maybe not. Can’t know the future. If rate hikes hammer both, then both go down.

Hey John, Recently discovered your blog and I’m impressed – very comprehensive. I’ve got some other 3x leveraged ETFs I am in (FNGO and TECL). Would it be fair to apply the 60/40 strategy with TMF to other leveraged ETFs? If not, why not? Thanks!

Thanks, Adam! Definitely. Always a fan of a bond hedge when levering up stocks.

In your examples, 100% TQQ, or 60/40 TQQQ/TMF, I understand the importance of using TMF for safety.

If an investor plans to put a RELATIVELY small % of their portfolio, say $1000 into TQQQ, would TMF really be necessary?

Percentages work the same for small amounts as they do for large amounts.

Great Read! Thanks for the info. If you started these graphs in the year 2000/2001 at the top of the market, would the 60/40 TQQQ with TMF still be a viable long term strategy?

Thanks, Josh. Yes, it would, but just to reiterate, I’m not a fan of the Nasdaq 100 index to begin with.

What is your personal favorite leverage strategy? UPRO/TMF 55/45? I am young, aggressive, have a great career and can stomach the dips. I have at least 30 years of investing ahead of me and planning to consistently add funds each month.

And, how much of your total portfolio do you allocate to a leveraged strategy? 25%? 50%?

Hey Josh, I personally like a modified Hedgefundie approach with dashes of those extra diversifiers I mentioned (UGL, UTSL, etc.) thrown in, just so I’m not fully relying on TMF for protection going forward. This mitigates the dissonance and emotional aspects of it, which is extremely important in my opinion. Taking that idea a bit further would basically be how I levered up the All Weather Portfolio. I’ve got about a 10% “lottery ticket” in HFEA, but the overall leverage ratio of my total portfolio is about 1.8.

Thanks. Great content! I think I have read about every blog you have on this website.

Just so I’m understanding you correctly, you basically have 10% of your portfolio in a version of HFEA and the other 90% in a leveraged All Weather Portfolio?

Thanks! Really glad you’ve found the content useful.

No, about 10% is in a modified HFEA as a “lottery ticket” with no new deposits, but most of my portfolio looks like this.

You said, “the overall leverage ratio of my total portfolio is about 1.8.” Are you leveraging your Ginger Ale Portfolio and if so, what does that look like?

NTSX, UPRO, TMF, PSLDX.

Hi John, love reading all your articles. Just a quick question regarding your statement re your portfolio being approximately 1.8 leveraged. Is that the Ginger Ale portfolio?

Thansk, Jason! Glad you’ve found them useful.

Sort of. I’ve got some lottery tickets in HFEA and PSLDX. 90/10 VOO/EDV is also roughly equal in exposure to 90/60 (1.5x 60/40) using interm. bonds.

John, what do you think about TQQQ/TMF/TYD? Would the latter help protect against unpredictable inflation?

No reason to use both TMF and TYD.

I love TQQQ I made $ with this LETF. Great Blog! The best Blog I’ve read about TQQQ!

You wrote… Once again, the beautiful 60/40 portfolio – in this case 3x for 180/120 exposure – emerges as the best option (at least historically) in terms of both general and risk-adjusted returns:

My question is: What exactly ETF’S did you use for this example? The graph shows that 60/40 made 26,001,353

Thanks!

Great Work!

Thanks! TQQQ and TMF.

Nice article, very impressive! One question, how do you simulate QQQ before 1999? Did you actually add all those 100 stocks?

Also TMF? which starts only 2010.

Thanks for instructions.

Thanks! As I noted, I created my own simulation data from the underlying indexes’ historical returns.

Would it be possible to know the max drawdown during the great financial crisis in 2008/9? The collapse around and after year 2000 is certainly what one wants to prepare for – but how would perfomance be during a more “normal” disaster period.

For 100% TQQQ? Basically went to zero. No such thing as a “normal” crash.

Sorry, I should have been clearer: Not for TQQQ; for your adjusted strategy as explained in the article.

Also apologies for posting basically the same comment a second time. For some reason I couldn’t see the comment above and thought there had been a technical glitch so that it hadn’t been posted.

Ah. About 65% for February, 2009.

How did you get TQQQ to backtest before its inception date? Would love to try this out. But TQQQ only goes back to late 2000s. How did you get it to show earlier years?

As I noted, I created my own simulation data from the underlying index’s historical returns.

Do you have an excel template where I can input the data into Portfolio Visualizer?

Specifically, the returns of the 2x and 3x funds pre-inception.

I have so many scenarios I want to run through.

Probably not going to be releasing that, at least not for free. I briefly delved into the reason why here. It’s a fair amount of work but is not necessarily difficult. Just download the historical index data from Yahoo Finance, create a column to calculate the leveraged daily return minus fees and borrowing costs, and upload that series to PV. That last one may require a paid membership at this point.

You can approximate doing 300% QQQ -200% CASHX etc In PV. This will perform better than TQQQ would’ve as there are less fees and TQQQ is rebalanced daily for leverage but it will give you a rough approximation. Similarily TMF approx is 300% TLT -200% CASHX, NTSX with 90% SPY 60% IEF -50% CASHX.

I know. I’d rather use accurate sim data whenever possible.

Hi John. Great analysis on LETF. The greatest thing is that you give solid pros and cons for readers to consider this product, instead of merely cherry picking.

Further, would you share the rolling return of TQQQ/TMF for references? Thanks.

Thanks, Kate! Yea I’ll see if I can dig up those rolling returns. Not sure why I didn’t include them the first time around. Thanks for the suggestion.

Hi John,

Great analysis. Would it be possible to share the rolling return figures in the portfolio visualizer? Thank you!

Thanks, Raymond! Yea I’ll see if I can dig up those rolling returns. Not sure why I didn’t include them the first time around. Thanks for the suggestion.

Great article. Did you backtest different revaluing periods and allocation amounts? Also is the majority of your portfolio in 60/40 UPRO and TMF?

I played around a bit but didn’t get too rigorous. 60/40 and quarterly rebalancing appeared best to me. No, I only have a small “lottery ticket” in UPRO/TMF.

Would it be smarter to use margin lending at a cost of 3-4% interest to buy ONEQ to hold in the long term?

Depends on what you’re going for. The NASDAQ Composite Index (ONEQ) is different from the NASDAQ 100 Index (QQQ, TQQQ).

True. I am more thinking of the concept of using leverage to buy an index vs using leveraged etf’s. I want the additional gains but for a long term hold situation, i am concerned about the bad year annhilating the investment.

Thanks. I am curious about the benefits of using levered etf’s vs buying a straight index using borrowed money. The interest rate seems to be greater than the expenses for the levered funds. However, you did talk about how long it took for the market to rebound from a 30% loss vs from the 90% hit that the triple levered etf took. I was considering if that makes it a better idea to go with using debt to buy straight index etf’s.

No easy answer, Evan.

Some investors just don’t want to deal with the possibility of margin calls. Period. So they use LETFs.

Looking at it rationally, the math still gets a little muddy because we can’t reliably predict the exact volatility decay we’ll see and its subsequent cost (or benefit). All things being equal, suppose I have $10,000 and I want 1.2x (120%) exposure to the S&P 500. I can do this a couple ways.

The first, using a LETF, is 90% VOO (Vanguard S&P 500) and 10% UPRO (3x S&P 500). Right now VOO has a fee of 0.03% and UPRO has a fee of 0.93%. So this costs me $12 annually.

The other way is using margin. Suppose a margin rate of 2%, which I get from M1 Finance. I have $10k in VOO and I’ll borrow $2k at 2% and also put that in VOO. This would incur a cost of about $43.60 annually. Just to be fair, let’s also just reduce that by 1/3 from the tax deductibility of margin interest, arriving at a cost of about $29.21.

Again, this is doing some hand waving with the napkin math and is also ignoring the fact that the LETF maintains your constant leverage ratio while margin does not (unless you borrow again every time the portfolio rises in value).

Another consideration is obviously what you want to buy. If I want to lever up something like AVUV (small cap value), I can only do that with margin, as there’s no LETF available.

Hope this helps!

Any idea if 30% UPRO 30% TQQQ and 40% TMF a good choice? Try not to heavily rely on NASDAQ since no one knows what the future will be like.

Again, market is already over 1/4 tech. I see no reason to overweight it further.

so the backtest you ran was assuming quarterly rebalancing. But what happens if I use M1 and deposit biweekly and M1 performs dynamic rebalancing? Won’t this cause the return to go down drastically?

Nah. Would just help keep things in balance, which is a good thing. See my post on the All Weather Portfolio where I compared rebalance interval at the end. Differences are minimal.

Hi John,

As for the TQQQ/TMF backtest, you have mentioned that 80/20 is one-size-fits-most allocation. Can you run a 80/20 TQQQ/TMF portfolio for me to see when this portfolio catch up to 60/40 one after a major crash? Thank you!

Hey Shawn, when we lever up 3x here, the traditional wisdom of that one-size-fits-most 80/20 sort of goes out the window. 60/40 is almost certainly the better choice for these leveraged funds. I don’t think 80/20 would provide enough protection.

What do you think about rebalancing at 5%, or some other? What were the differences between weekly, monthly, quarterly, and yearly distributions? Would you recommend this strategy with FNGU? Is there a way to further increase profits by selling options on the underlying assets? Thank you so much for this post. You are a star.

Rebalancing bands may be sensible. Not sure what you mean about different distributions. FNGU would be even more concentrated than the already-concentrated TQQQ, so no. If you mean covered calls, probably not.

Thank you. I should have rebalancing not distributions. I decided to make a pie with 50% TQQQ, 25% ARKG and 25% ARKQ and call it ‘LIFE’.

I had another crazy idea… I may be way out in India here. I was just recently indoctrinated by WallStreetBets, and I’m still holding the Banana Telephone. What about the VIX as a hedge?

I think it’s an insurance policy for which the premium paid isn’t worth the coverage. Basically, it’ll work when you need it to (a crash), but it’s too expensive to hold in “normal” conditions because it drags you down. This was discussed in the Hedgefundie thread on the Bogleheads forum.

By adding ARKW or another tech ETF to a TQQQ/TMF strategy, you could get great results with 2x leverage. I don’t know what NUSI is going to do, but perhaps even USD could complement TMF.

Gotcha. Monthly is probably too often in that you could be catching a falling knife. Semi-annually is probably too infrequent because we’re talking about 3x leverage that’s really moving. So quarterly is a happy medium. This was both the conclusion in the Hedgefundie thread on the Bogleheads forum as well as my empirical findings when I backtested my leveraged All Weather Portfolio.

What is your opinion on using stochastics vs. averaging in with a goal to invest 25% of my income in 55% TQQQ, 20% TMF, 12.5% ARKG, 12.5% ARKQ. I think this hits all the notes, and like Chris said in the comment below it’s 2.5x leveraged. I am still undecided about using bands vs quarterly rebalancing. Thank you guys.

I don’t try to time the market and I’m neither a fan of TQQQ nor ARK.

I threw everything I had a TQQQ when the market bottomed out at the beginning of the pandemic. I’m pretty happy since. Didn’t do anywhere near as well as my DOGE I bought at .003

Have you tried the 60/40 method with different periods of rebalancing? Since this is best suited for an IRA-type account, I’m curious if monthly, every other month, or every 6 months offers markedly better returns. If you rebalance too often, you’ll knee-cap your profits on the bull runs but if you balance too infrequently, you will get hammered by the drawdowns.

Indeed. Quarterly seems to be best for these LETF strategies, as was the case for both Hedgefundie and my leveraged All Weather Portfolio.

Hi John — I’m curious how you were able to get PortfolioVisualizer to simulate TQQQ performance from 1987 when, as you mention, the fund’s inception was 2010. Is there a previous post that walks through how to do that in PV? Thanks!

Hey Bill. Created my own sim data using the NASDAQ 100 index going back to its inception in 1987, and uploaded that to PV. There’s not a post that walks through that. Maybe I’ll write one up.

Would you mind sharing how you did the simulation? Thanks for the wonderful content.

Created my own sim data after downloading the index’s historical performance and just uploaded that to Portfolio Visualizer.

Anyone who is interested in leveraged investing needs to read any of the several books written by Ralph Vince. He is THE guru on the subject of leveraged investing. I read his first book when it came out in 1991 and it had a big influence on me. The math is a little thick, but if you passed middle-school math you’ll be fine and will be able to grasp the principles in his books.

The takeaway is that more leverage is not necessarily better. Too much leverage is actually counterproductive.

It is straightforward to simulate a leveraged ETF using daily historical data for the underlying index, so I did just that, inspired by Ralph Vince’s work. I found that 3x leverage works great in a bull market but suffers when a bear market is encountered. The sweet spot in my testing was 2.5x leverage. You can achieve this with a blend of 50% TQQQ and 50% QLD, the 2x LETF. That’s what I have as my long-term buy-and-hold core holdings and I’m pleased with it. My TQQQ dropped precipitously in March, 2020 but I held on tight and was ultimately well rewarded for my tenacity. You could try to time the market and switch in and out but that’s not always optimal and has tax consequences in a taxable account.

I’ve seen other studies which indicate that 2x is about the optimal amount of leverage. My cousin has been dabbling in the market and I put him in QLD as a long-term set-and-forget investment. I’m a big fan of LETF’s.

I’m sick of all the fear mongering surrounding LETF’s and all the dopey YouTube videos by people who have probably never owned a single share. There is one video where an hysterical guy compares LETF’s to crack cocaine. Yeah, whatever, dude.

Agree with all this. Thanks for the thoughtful comment, Chris.

Chris,

Your 50/50 split of TQQQ/QLD, is that the 60% part of your portfolio, assuming you’re doing 60/40? What are you hedging with? Thank you.

Chris, I happened to glance at this again and realized you can save a bit on fees by using 75% TQQQ and 25% QQQM.

I recently came across your page after a famous podcaster recommended it. I have learn a lot from all your articles. I love the way you explain your points in layman words. I had a few questions about M1 Finance. Do they offer back door roth IRA’S? Also is your TQQQ/TMF pie in a roth account or just tax brokerage? Just thinking in term of taxes?

Apart from this pie and the Ginger Ale pie, do you own any other pies?

Thank you in advance for providing all this knowledge to us.

Curious, what podcast?

Glad you’ve found the content useful.

M1 does indeed offer backdoor Roth IRA’s.

I don’t own TQQQ. But you’d definitely want leveraged funds in a tax-advantaged account.

My total portfolio is spread across several accounts with different brokers, so the Ginger Ale for example is not an actual pie I own. It’s just what most of my portfolio looks like.

Hi John,

Great blog overall. I really enjoy digging into your articles.

In relation to this specific post, just a few questions:

1)

You write that: “…since 2010 and is up over 500% from then through 2020”. As I can see from your calculations from PortfolioVisualizer, it has actually increased more than 5,500% (increase from $10.000 to $591.455). Is 500% just a typo? Or am I looking at some different numbers than what you looked at when you calculated it to be “only” 500%?

2)

You write that: “regular deposits of $1,000/month actually doesn’t change the end result”.

Again, as I can see from you calculations from PortfolioVisualizer, the end result has indeed changed. The portfolio has increased from $10.000 to $316,905,000 (with the 60/40 portfolio) compared to an increase to “only” 26,000,000 without the deposits. So as I see it, there’s a big difference between $316,905,000 and $26,000,000.

Also the GAGR is much better in your calculations based on deposits (38.13%) vs not depositing (27.77%).

So my question is how you came to the conclusion that “regular deposits of $1,000/month actually doesn’t change the end result”?

PS:

I am not saying in any way that you are wrong. Just trying to fully understand and get clarification on your calculations and what you wrote 🙂

Keep up the great work. You make investing interesting and straightforward for many people.

Thanks for the kind words, Jake!

1) You’re right. Typo.

2) By “end result,” I’m referring to the idea that 100% TQQQ is still likely not the optimal strategy even if you’re depositing regularly, and that something like 60/40 seems objectively superior.

You are welcome. With all the work you put into all your posts, you deserve to know this 🙂

1) All good.

2) OK, got it. That clarified what you really meant.

Many thanks for your answers. Looking forward to continue reading more of your articles. Many already bookmarked 🙂

Hi John,

Great work., did you incorporate the TQQQ splits since 2010 into your calculation.

Best

Raul

Thanks. Splits don’t affect market cap or shareholders’ value.