RSP is an interesting and extremely popular ETF that equally weights stocks in the S&P 500. Is it a good investment? I review it here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

RSP ETF Video

Prefer video? Watch it below. If not, keep scrolling to keep reading.

RSP ETF – What, Why, and How

RSP is the Invesco S&P 500 Equal Weight ETF. It launched in early 2003. As the name suggests, the fund simply takes all the stocks in the S&P 500 Index and weights them equally, as opposed to the index's inherent market cap weighting scheme in which larger companies get more representation.

Why would we want that?

Well, market cap weighting typically results in a fund being concentrated in a handful of companies and/or sectors. For example, at the time of writing, the technology sector comprises more than 1/4 of the S&P 500, and just Apple and Microsoft make up more than 12% of the index! For the market cap index investor investor buying a plain ol' S&P 500 index fund, just one of these companies suddenly going under would spell disaster, at least temporarily. We call this single company risk.

An equal weighting scheme, on the other hand, gives more agnostic, equal representation to all companies. It solves our aforementioned single company risk problem, as here each stock comprises an equal percentage of the fund. In this case specifically, each of the 500 stocks – including Apple and Microsoft – should make up around 1/500th (or 0.2%) of the total fund.

Note that in order to maintain these weights, RSP is constantly taking a contrarian approach compared to a cap-weighted index by selling winners instead of letting them climb and buying losers instead of letting them fall. It rebalances once per quarter. In doing so, it is purposefully trading against Momentum.

This special weighting scheme means RSP costs a bit more than the typical S&P 500 ETF at 0.20%, whereas something like VOO from Vanguard has a fee of only 0.03%. Many are happy to pay this higher fee; RSP boasts over $50 billion in assets.

Is RSP a Good Investment?

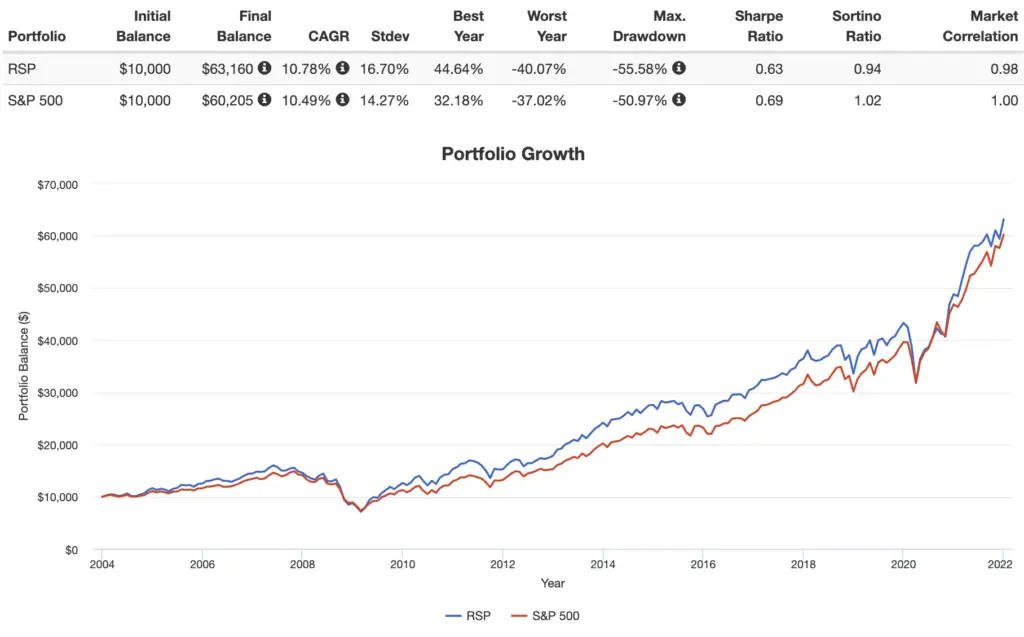

So is RSP a good investment? Technically RSP has indeed been a good investment for investors who stuck with the ETF since its inception in 2003 due to its higher returns compared to its cap-weighted cousin, though it's worth noting that it has come with greater volatility and larger drawdowns, as we'd expect from its higher beta, so the cap-weighted S&P 500 index has still delivered a greater risk-adjusted return historically:

RSP had more notable outperformance in its early years when smaller stocks were doing well, thereby compensating investors for its greater fee. In recent years, the story has been a bit different, with large cap tech stocks dominating the U.S. stock market.

And there's sort of the rub. At the end of the day, an equal weighting scheme on an otherwise cap weighted index is effectively just an indirect way to slide one's exposure down the market cap scale toward smaller stocks. Specifically, RSP avoids the concentration in mega caps in the S&P 500 and provides more exposure to smaller large caps within it, which we would technically consider mid cap stocks. RSP's weighted average market cap is roughly $75 billion, compared to $550 billion for the S&P 500. In short, as we would expect, RSP effectively behaves like a mid-cap fund.

This fact is illustrated in its factor exposure, with small positive loadings on both Size and Value, due again to its avoiding the concentration in large cap growth stocks.

This corroborates RSP's historical performance, as we expect these equity risk factors to pay a premium over the long term, and a higher beta just means more market risk.

Is your small cap value spidey sense tingling yet? The takeaway here that you may have realized already in all this is that we can achieve the same exposure RSP provides in a much more efficient and direct manner by simply deploying a dedicated small cap value fund alongside an otherwise cap weighted core holding in a well-diversified portfolio. I do precisely that in my own portfolio. Put another way, RSP is a naive, inefficient way to gain exposure to the factors responsible for its returns.

I'll explain what I mean.

Suppose the investor decides to use the equally-weighted RSP to replace the cap-weighted VOO in the portfolio, effectively getting more exposure to smaller stocks and value stocks as we've discussed. We can show theoretically and empirically that she would almost certainly be better off simply lowering the allocation to VOO and then filling that empty space with a dedicated fund for small cap value stocks such as VIOV from Vanguard.

That is, for any given target exposure, we should prefer to get it with the lowest fees and trading costs.

Specifically, we can replicate RSP's factor exposure with roughly 71% VOO and 29% VIOV. This combo conveniently has much lower turnover and costs about 0.06% in fees, compared to 0.20% for RSP. If you happen to use M1 Finance, that pie can be found here.

It's important to note here that I'm not bashing an equal weighting scheme per se. Equally weighting holdings can be perfectly sensible, such as within a small cap value fund. It's just that it doesn't make too much sense on a broad large cap index like the S&P 500, which is the case here in the context of RSP.

You may also still be wondering about the single company risk we touched on earlier. While it sounds like a bad thing, it ends up helping quite a bit when stocks soar inside a cap-weighted index fund because we get exposure to that success. Most stocks underperform the market; only a select few drive massive returns. Specifically, for U.S. stocks from 1926 through 2017, in terms of lifetime dollar wealth creation, only 4% of stocks accounted for the net gain above T Bills.

In conclusion, in investigating the merits of RSP, we find yet another popular, well-marketed fund that sounds nice on the surface but that probably isn't worth its fee and greater trading costs. Upon looking under the hood, we see an engine that we can build more efficiently and more effectively with parts sourced elsewhere.

RSP should be available at any major broker, including M1 Finance, which is the one I'm usually suggesting around here.

What do you think of RSP? Do you own it in your portfolio? Let me know in the comments.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply