The Bogleheads 4 Fund Portfolio is globally diversified across stocks and bonds. Here we’ll investigate its components, historical performance, and the best ETF’s to use in its implementation.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Video

Prefer video? Watch it here:

What is the Bogleheads 4 Fund Portfolio?

The Bogleheads 4 Fund Portfolio is simply the Bogleheads 3 Fund Portfolio with the addition of international bonds. The theory and mechanics underlying the composition of the 4 Fund Portfolio is the same as that of the 3 Fund Portfolio. For the sake of brevity in this post, I won't be repeating it here. I would strongly encourage you to go read the post on the 3 Fund Portfolio first and then come back here where I'm simply discussing the addition of the international bonds component.

The Bogleheads 4 Fund Portfolio, as the name suggests, is comprised of 4 funds capturing U.S. stocks, U.S. bonds, international stocks, and international bonds. This gets you fully diversified globally across all styles and cap sizes for stocks and bonds. Let's look at the specific assets.

Stocks

At global market weights, U.S. stocks only comprise about 50% of the global market. International stocks don't move in perfect lockstep with U.S. stocks, offering a diversification benefit. If U.S. stocks are declining, international stocks may be doing well, and vice versa.

No single country consistently outperforms all the others in the world. If one did, that outperformance would also lead to relative overvaluation and a subsequent reversal. Meb Faber found that if you look at the past 70 years, the U.S. stock market has outperformed foreign stocks by 1% per year, but all of that outperformance has come after 2009.

Excluding stocks outside the U.S. means you're missing out on leading companies that happen to be based elsewhere. Similarly, there have been periods where a global portfolio outperformed a U.S. portfolio. During the period 1970 to 2008, an equity portfolio of 80% U.S. stocks and 20% international stocks had higher general and risk-adjusted returns than a 100% U.S. stock portfolio. Specifically, international stocks outperformed the U.S. in the years 1986-1988, 1993, 1999, 2002-2007, 2012, and 2017.

Emerging Markets and international small cap stocks have crushed the U.S. market historically, for example, as they're considered riskier, and investors are compensated for that greater risk. And this is just talking about performance. The volatility and risk reduction benefits are another conversation entirely, which is of huge significance for a retiree.

Dalio and Bridgewater maintain that global diversification in equities is going to become increasingly important given the geopolitical climate, trade and capital dynamics, and differences in monetary policy. They suggest that it is now even less prudent to assume a preconceived bet that any single country will be the clear winner in terms of stock market returns.

In short, geographic diversification in equities has huge potential upside and little downside for investors.

I went into the merits of international diversification in even more detail in a separate post here if you're interested.

Just as in the 3 Fund Portfolio, here I've set both international stocks and international bonds at 1/3 the allocations of their domestic counterparts.

Bonds

The inclusion of international bonds in diversified portfolios and target date funds is a fairly recent occurrence. Until recently, costs of international bond fund products were prohibitive for retail investors, and international assets of all kinds were viewed with skepticism until about the 1990's. Vanguard didn't begin including international bonds in their target date funds until 2013.

The evidence seems to show that international bonds may offer a small diversification benefit in terms of credit risk on the fixed income side due to their low correlation with both U.S. stocks and U.S. bonds, but there’s no compelling reason to think it's any significant benefit. This potential diversification benefit is even less convincing for a portfolio that is not bond-heavy.

Larry Swedroe suggests, based on a 2014 Vanguard paper, that investing in foreign bonds may be prudent for reducing portfolio volatility if and only if the investor can do so with low fees and with currency hedging to eliminate currency risk. Without currency hedging, it's basically FOREX trading. Luckily, Vanguard's Total International Bond ETF (BNDX) satisfies those requirements.

Vanguard published another paper in 2018, proposing that “various local market risk factors (such as interest rates, inflation, and yield curves) have resulted in relatively low correlations of government bond yields across markets over the past 50 years, suggesting a diversification benefit to increasing the number of global markets in a fixed income allocation.” While the research is comprehensive, the tiny diversification benefit they illustrate is negligible in my opinion. Specifically, they showed that for a 60/40 portfolio during the period 1985-2013, diversifying internationally with fixed income resulted in a reduction of volatility as measured by standard deviation from 9.5 to 9.4, a reduction of 1%.

In short, there's no good reason to consciously avoid international bonds, but there's also no good reason to embrace them either; it's unlikely to help your portfolio, and it's unlikely to hurt it.

Allocations

Assuming a retirement age of 60, my general rule of thumb is to use [age-20] for bond allocation, obviously titrating up or down based on risk tolerance. Vanguard has a useful tool here to help you choose. You can also view how different allocations have performed historically.

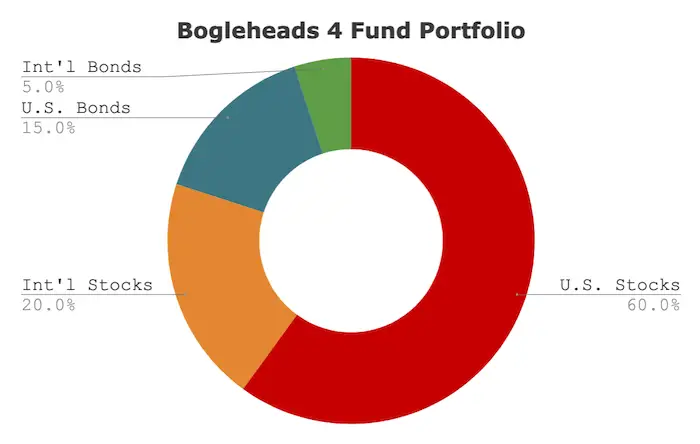

Given that, for the sake of simplicity in this post, let's assume a starting age of 20 and a retirement age of 60, yielding an average investor age of 40. Based on that, a one-size-fits-most 80/20 allocation for the Bogleheads 4 Fund Portfolio is:

- 60% U.S. Stocks

- 20% International Stocks

- 15% U.S. Bonds

- 5% International Bonds

Bogleheads 4 Fund Portfolio Historical Performance

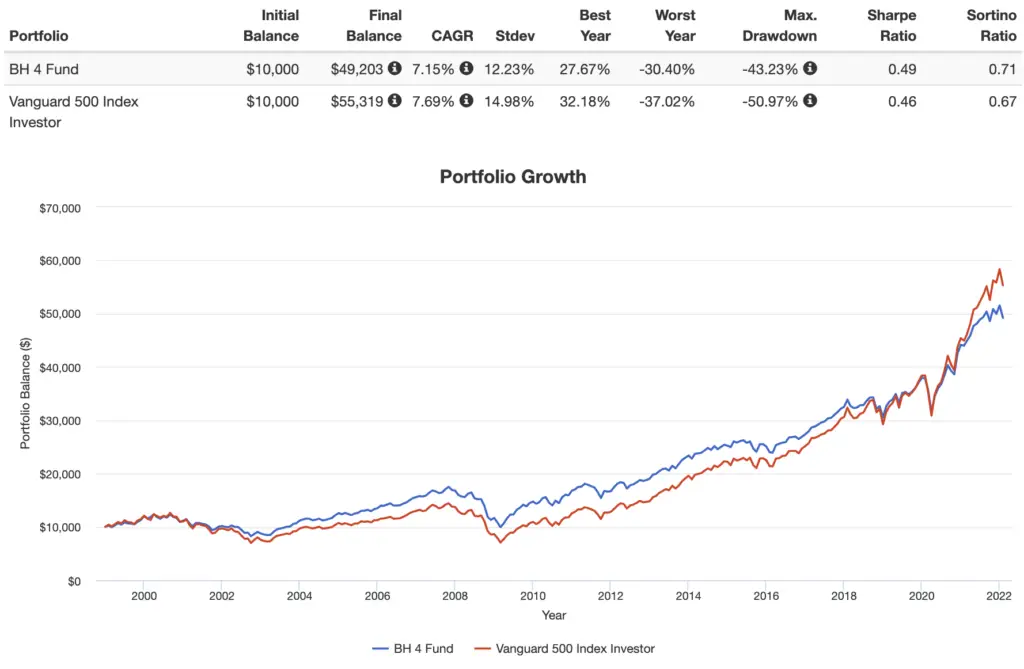

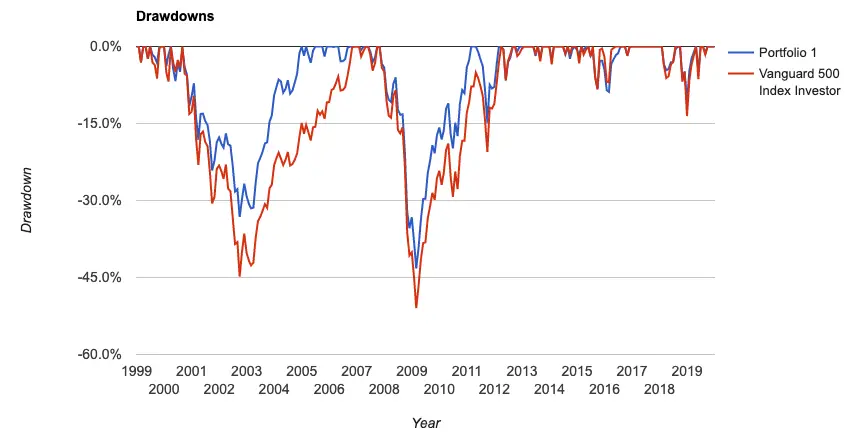

My data for the total international bond market only goes back to 1999, so the backtest below is for the period 1999 through 2021, comparing an 80/20 Bogleheads 4 Fund Portfolio to the S&P 500 index.

Given the short time period, CAGR's are pretty close, with the 4 Fund Portfolio having a higher risk-adjusted return from lower volatility and smaller drawdowns:

Bogleheads 4 Fund Portfolio ETF Pie for M1 Finance

M1 Finance is a great choice of broker to implement the Bogleheads 4 Fund Portfolio because it makes regular rebalancing seamless and easy, has zero transaction fees, allows fractional shares, and incorporates dynamic rebalancing for new deposits.

Using entirely low-cost Vanguard funds, we can construct an 80/20 allocation of the Bogleheads 4 Fund Portfolio pie like this:

- VTI – 60%

- VXUS – 20%

- BND – 15%

- BNDX – 5%

You can add the this pie to your portfolio on M1 Finance by clicking this link and then clicking “Save to my account.”

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Disclosure: I am long VTI and VXUS.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Why can’t this be simplified even more: VT and BNDW? Can you drop VT in your tax advantaged accounts, prioritizing tax free growth, and hold BNDW in taxable?

It can. That’s the Bogleheads 2 Fund Portfolio. 🙂

Hello, John.

I know this is a late post, but I only now found this article. I’m curious as to why you use allocations that are so different than those for the 80/20 on the the Bogleheads site. https://www.bogleheads.org/wiki/Vanguard_four_fund_portfolio

You mention the need the general theory of the need for more international exposure, but this version of the 4 fund portfolio has less. I am just wanting to understand your thinking on this. Maybe you just went with what was already in the M1 Pie?

Thanks,

Daniel

I just put an example of what I see most people using because many US investors prefer home country bias, for better or for worse. Investors are free to choose their own US/int’l allocation.

Following some of your thoughts regarding the superiority of government bonds to corporate you’ve written about elsewhere, and a preference for long term at that – what would you think of replacing BND with GOVT, or EDV, or SPIP, or LTPZ? And is there one you’d personally prefer? I think there’s an argument for the beauty of simplicity with GOVT, but SPIP or LTPZ would be better as inflation hedges.

I like GOVT over BND. EDV would be for a time horizon of 25+ years. TIPS are likely only needed at or near retirement.

Does FBIIX have currency hedging like BNDX?

Yes

Thanks! I’ve been following this portfolio with Fidelity funds for couple of years now, but want to do some tilts without adopting a whole new portfolio. For example, keeping my FSKAX (60%) and FTIHX (40%) but moving to adding some small or mid cap tilts and what that could look like. I’ve often been annoyed with the the top heavy exposure in total market funds, but don’t want to move to a 8+ fund portfolio either. Would love to see a post on this in the future.

How often should we adjust bonds to match our age -20? Every year, every 5 years, every 10 years?

Great question, Keith. I’d say in between 1 and 5 years. No more than 5.

I like the idea underlying this portfolio, and I’m considering deploying it in a taxable brokerage account.

However, I wonder if replacing the US Bonds portion with NTSX would make a measure of sense to increase returns. Since it is effectively a 90/60 in a single fund, it seems to me that I could match the contribution of BND with NTSX at 25%, then decrease VTI to make it fit. Thoughts?

I don’t see how replacing bonds with NTSX makes any sense, as then your allocation to stocks would be higher, e.g. 80/20 VTI/BND turns into 98/12 stocks/bonds if you replace BND with NTSX. Maybe decide on a target asset allocation and then choose funds to fit that. Or use the diversification use case for NTSX that I outlined here.

Can I change the international bond fund

For emerging markets bond funds?

Sure, just know those are two very different investments.