Two popular dividend-focused ETFs are the Schwab U.S. Dividend Equity ETF (SCHD) and the Vanguard High Dividend Yield ETF (VYM). Let's compare them.

First, note that I don't chase dividends. But I recognize that many investors use dividends to supplement their current income, particularly in retirement. Others just irrationally prefer dividend-paying stocks. I even designed a dividend-focused portfolio for income investors. In any case, these two high-yield funds are very popular and take a somewhat different approach. Here we'll review these dividend ETFs and explore the differences between them.

In a hurry? Here are the highlights:

- SCHD and VYM are two popular dividend-yield-focused ETFs from Schwab and Vanguard, respectively.

- SCHD launched in 2011 and VYM launched in 2006.

- Both are very affordable with the same fee of 0.06%.

- Both are very popular and have significant AUM, but VYM is slightly more popular than SCHD.

- SCHD looks for high-quality companies with a sustainable dividend via profitability screens.

- VYM is comprised of higher-than-average-dividend-yield stocks, excluding REITs. It doesn't care too much about quality.

- Since SCHD's inception in 2011, it has delivered a higher return than VYM with roughly the same volatility.

- As we'd probably expect, SCHD tends to deliver much more exposure to the Profitability risk factor.

- Dividend investing is largely rooted in the Value, Profitability, and Investment factors, with somewhat naive exposure to them.

- I created a dividend-focused portfolio that incorporates both of these funds that can be found here.

Contents

Video

Prefer video? Watch it here:

SCHD vs. VYM – Methodology

SCHD is the Schwab U.S. Dividend Equity ETF. It tracks the Dow Jones U.S. Dividend 100™ Index. This index is comprised of 100 stocks with at least 10 consecutive years of dividend payments and a minimum market cap of $500 million. Stocks are then selected for the index by screening for high yield, profitability metrics, and 5-year dividend growth, excluding REITs. Individual companies are capped at 4% and sectors at 25%.

The Vanguard High Dividend Yield ETF (VYM) seeks to track the FTSE® High Dividend Yield Index. Its process is pretty simple. Constituent stocks are taken from the FTSE® All-World Index, excluding REITs, and ranked by forecasted dividend yield, after which the top half are selected for inclusion. As such, VYM's selection methodology is much more “loose” than SCHD; SCHD is much more stringent in buying what it believes to be high-quality companies with robust profitability and a sustainable dividend. Because of this, note that SCHD only has about 100 holdings while VYM has a little over 400.

Because of this, as we'd probably expect, VYM has slightly more loading on Value but much lower exposure to Profitability. Essentially, SCHD is capturing more profitable companies, but VYM is capturing comparatively cheaper companies. Average market cap (Size factor) and exposure to the Investment factor are roughly equal.

As we'd also probably expect, SCHD has higher ESG/SRI scores, if you care about that sort of thing.

Dividend yield is similar between these two funds, with SCHD's being slightly higher by about 0.25% at the time of writing.

SCHD vs. VYM – Composition

| SCHD | VYM | |

| Basic Materials | 4.10% | 4.90% |

| Consumer Staples | 14.10% | 13.70% |

| Consumer Discretionary | 9.30% | 8.70% |

| Financials | 22.20% | 23.00% |

| Healthcare | 11.50% | 12.60% |

| Industrials | 14.50% | 9.20% |

| Energy | 1.90% | 7.00% |

| Technology | 18.90% | 10.00% |

| Telecommmunications | 0.00% | 3.30% |

| Utilities | 0.00% | 7.30% |

Notice how SCHD has zero or low exposure to Utilities, Telecom, and Energy. These sectors are notorious for high dividends but relatively weak profitability, which is why SCHD's screens exclude them but VYM still holds them.

SCHD vs. VYM – Performance Backtest

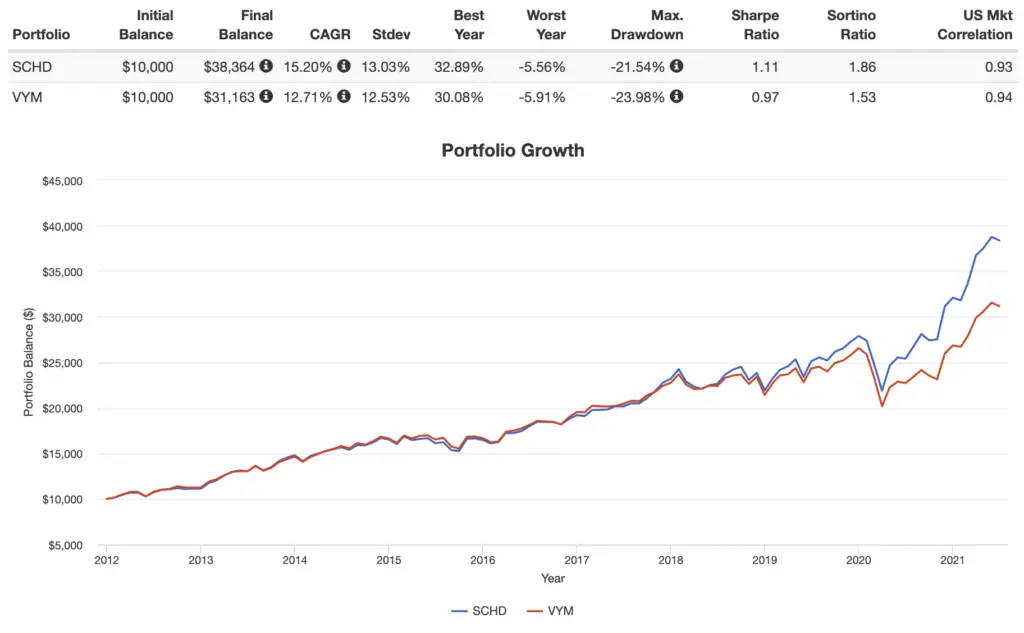

Both SCHD and VYM are highly liquid and have the same low expense ratio of 0.06%. Here's a performance backtest of these two funds going back to SCHD's inception in 2011:

SCHD has delivered substantially greater returns than VYM over this relatively short time period with roughly the same volatility and a slightly smaller max drawdown. Consequently, SCHD delivered a much higher risk-adjusted return. In fairness, the Value factor has suffered greatly over precisely the backtested time period, but the small difference in Value loading between these funds wouldn't fully explain the difference in CAGR.

That max drawdown was the March 2020 crash, from which SCHD shot out of the hole much faster than VYM. SCHD's recovery time was roughly half that of VYM's.

SCHD vs. VYM – Conclusion

I created a dividend-focused portfolio that incorporates both of these funds that can be found here.

But remember what I noted in my comparison of VIG and VYM: Vanguard themselves investigated the strategies of funds like these and concluded that their constituent stocks’ performance was fully explained by their exposure to known equity factors like Value, Profitability, etc., so if you don't care about using dividends as income, you may be better off – in terms of total return – by simply investing in products that specifically target those factors, like a small cap value fund.

Conveniently, both of these funds should be available at any major broker, including M1 Finance, which is the one I'm usually suggesting around here.

Do you hold any of these ETFs in your portfolio? Let me know in the comments.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

I own SCHD, 100% of my portfolio. Why? I ran an analysis and came to a startling conclusion. In a spreadsheet, one column is the quarterly dividend, the next column is the 12 month trailing dividend, another column is the stock price on the close before the ex-div date. When graphed with a best fit exponential, the dividend growth rate comes in at 11.31% per year with an R-squared of 0.9723. The mean and median yield on the dividend dates are 2.909% and 2.879% respectively. VYM comes in at a much lower growth rate and a lower R-squared.

I almost fell out of my chair when the results came up in the spreadsheet. I dumped my entire portfolio into SCHD and now I sleep well at night without caring what the stock market is doing from day to day. I can predict where my portfolio will be 5 years from now, account value and dividend rate.

Sounds like literal overfitting, along with a misunderstanding of how dividends work.

I used to buy only VYM for last many years, then I found SCHD. Now I only buy SCHD but I did not sell VYM. Gradually plan to sell my oher equities and buy SCHD from the proceeds. I am retired.

I prefer schd, has a sort of quality component to it. Vym is a great diversified dividend fund as well. I don’t think you’d go wrong with either.

And no harm in using both.

I own both vym and schd, and my experience is schd has preformed better over the years. And schd raises it’s dividend more on average. Thanks for the article.

VYM has more on Value, and Value has suffered in recent years.

Doesn’t mean it will continue to. I prefer schd but can imagine a time when value will trounc pe growth and give vym the lead in total return