DFSV and AVUV are two relatively new, ultra-targeted factor ETFs from Dimensional (DFA) and Avantis respectively for U.S. small cap value stocks. I compare them here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Video

Prefer video? Watch it here:

Brief Recap on Factors

Before diving into the details on DFSV and AVUV, let's first briefly review factor investing. If you've landed here, you're probably already pretty familiar with them. If not, I've got a separate post on factors here. You might even already own AVUV and are wondering whether you should switch to DFSV.

Basically, financial academia – ironically mostly from Dimensional themselves – has identified independent sources of portfolio risk that we call factors. These sources of return are responsible for the differences in performance between diversified portfolios.

Two of those that are especially relevant to this discussion are Size and Value (i.e. small and underpriced stocks). We expect these factors to pay a premium over the long term and thus overweight them in the portfolio relative to the market.

Dimensional Fund Advisors (DFA) and Avantis

For the longest time, Dimensional Fund Advisors (DFA for short) were the gold standard for funds that deliver exposure to these risk factors most effectively. DFA was actually founded in 1981 on this specific idea.

DFA themselves set out to research this idea of independent sources of risk and then implemented their findings in live funds. Founder David Booth has explicitly said that DFA is all about the implementation of those great ideas, and this has proved fruitful for the firm's clients.

In fact, the researchers who have long been the foremost experts of factor research, Eugene Fama and Kenneth French, as well as other big names in financial academia such as Merton Miller and Myron Scholes, were on the board of DFA to help guide this evidence-based investing philosophy.

Dimensional has been making headlines in recent years because their funds weren't available to retail investors until just a few years ago when they began converting their mutual funds to ETFs. But not all of their mutual funds have an ETF equivalent.

Around the same time, some people left DFA to start their own fund house called Avantis, continuing the scientific approach drawing on Dimensional DNA combined with some new ideas. Avantis have quickly proven themselves with some impressive factor funds at relatively low fees.

The Case for DFSV and AVUV

DFSV from Dimensional, which launched in early 2022, is the new ETF counterpart for their mutual fund DFSVX that was established in 1993. AVUV from Avantis launched in late 2019, with DFSVX arguably being the inspiration.

So why would we be interested in either of these funds in the first place?

In case you didn't pick up on it already, we're interested in getting the most factor exposure bang for our buck, and funds from the folks who quite literally wrote the book on factors are probably the best way to do that. There are a multitude of small cap value funds available nowadays; I compared a handful of the best and most popular ones in a separate post here.

In short, we can show empirically that funds like DFSV and AVUV provide superior exposure to their index-based competitors such as VBR and VIOV from Vanguard, and they seem to be able to easily overcome their greater fees. That is, DFSV and AVUV are probably the most efficient and most effective targeting we can hope for as retail investors with long-only portfolios.

So now let's look at some numbers to specifically compare DFSV and AVUV.

DFSV vs. AVUV – Factor Loadings

Here are the factor loadings for DFSV and AVUV. As you can see, these two funds are very close. AVUV appears to slightly win out on most dimensions.

| DFSV | AVUV | |

|---|---|---|

| Beta | 1.00 | 1.09 |

| Size | 0.74 | 0.82 |

| Value | 0.56 | 0.59 |

| Profitability | 0.11 | 0.15 |

| Investment | -0.03 | -0.07 |

| Alpha | 0.10% | 0.17% |

| R2 | 99.3% | 98.4% |

These slight differences also show up with AVUV having a lower average market cap by about 10% and a lower P/E ratio by about 25% compared to DFSV.

Next we'll look at the performance of DFSV versus AVUV.

DFSV vs. AVUV – Performance

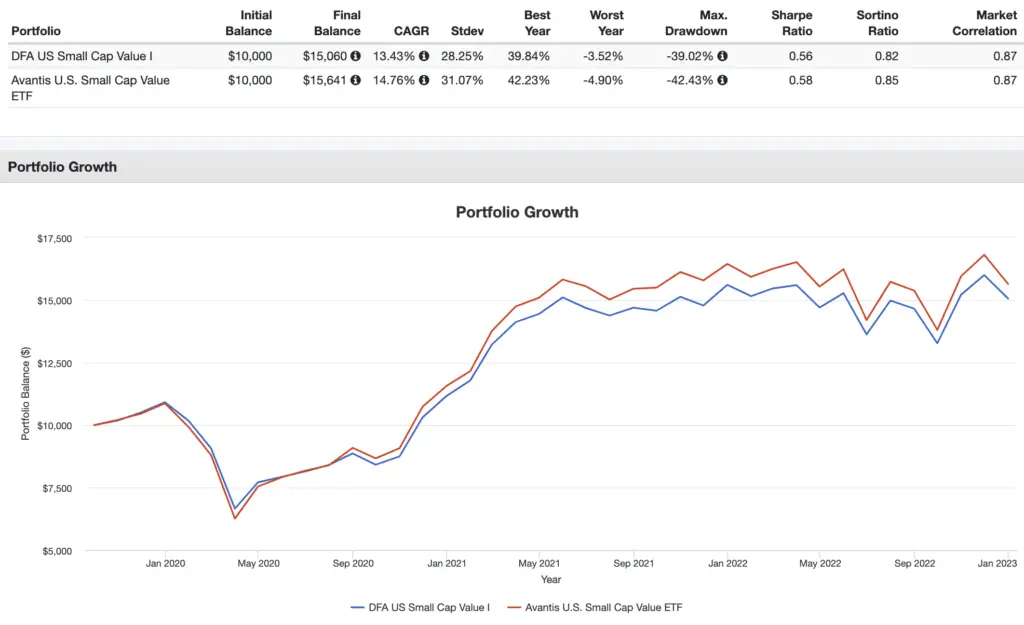

Using DFSV's mutual fund equivalent DFSVX to extend the backtest by a couple years, here's that versus AVUV for the period October 2019 through 2022:

While it's a very short time period, AVUV has beaten DFSV on a general and risk-adjusted basis.

Conclusion – DFSV or AVUV?

So should you go with DFSV or AVUV?

I think the primary takeaway here is that these are very similar funds with similar methodologies so you can't really go wrong either way, and both would be a fine choice for targeted factor exposure in U.S. small cap value stocks. In a taxable account, these would also be a good pair for tax loss harvesting.

I personally already owned AVUV when DFSV came out, and I see no compelling reason to switch. If it ain't broke, don't fix it.

Conveniently, AVUV is also slightly cheaper with a fee of 0.25% compared to 0.31% for DFSV.

I would feel perfectly comfortable owning either, and it is not obvious that one is objectively “better” than the other. A choice between them may simply come down to personal, intangible preference of provider.

If you're indecisive, you could always go 50/50 with both. In the scope of portfolio management, this decision should be pretty low on your priority list.

Conveniently, DFSV and AVUV should be available at any major broker, including M1 Finance, which is the one I'm usually suggesting around here.

What do you think of DFSV and AVUV? Do you own either? Let me know in the comments.

Disclosure: I am long AVUV in my own portfolio.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

John: Thanks for all the work you do here.

Question for you: which website do you get the Factor Loading table you posted in this article?

PortfolioVisualizer

I have AVUV already and this seems like the best option for TLH as far as I can see. But, do you ever worry about the staying power of some of these newer funds? SCV isn’t super niche, but maybe some of these funds won’t last. For example, I have AVUV, AVDV, AVES and might buy into some dimensional funds. I am commited to the theoretical basis for the tilt, but using year old funds is new for me because I am mostly a vanguard guy. I worry about piling a bunch of money into funds that might not catch on and will be liquidated. Do you ever worry about this?

Also, thank you for the work you do. I only recently started learning about investing and your site/posts/youtube channel have helped a lot.

No. AVUV already has over $5 billion in assets. $100M is usually the safe threshold. I don’t buy funds below that.

Thanks for a terrific site John. I really like the Avantis product. What’s holding me back is the concern that it is owned by American Century which is a private company (so it’s hard to assess it financial position). Do you have any sense of what would happen to Avantis ETFs if AC went out of business?

American Century is one of the oldest, most reliable asset managers out there. The fact that they back Avantis makes me more confident. I’d assume Avantis would still exist independently in that scenario if AC went out of business, but worst case, an ETF is liquidated at its fair market price and you get cash.