The Sandwich Portfolio is a 55/45 portfolio from Bob Clyatt. Here we’ll take a look at its components, performance, and the best ETF’s to use in its execution.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

What is the Sandwich Portfolio?

The Sandwich Portfolio is a lazy portfolio created by Bob Clyatt. He and the portfolio are famous online with the FIRE (Financial Independence, Retire Early) crowd, specifically with those looking to “semi-retire.” Clyatt authored the book Work Less, Live More: The Way to Semi-Retirement. Check out the website here.

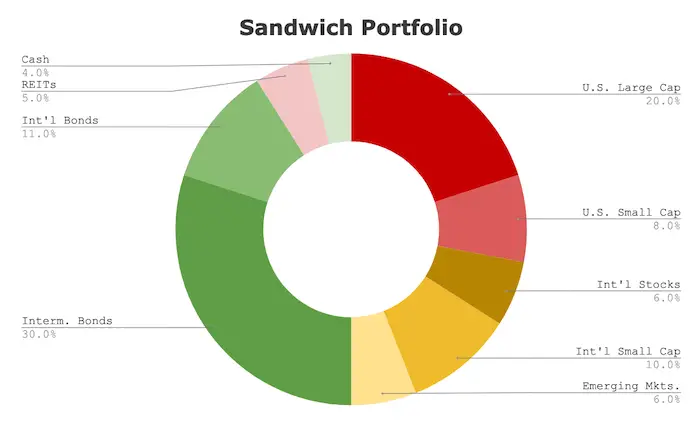

The Sandwich Portfolio is as follows:

- 20% U.S. Large Cap Stocks

- 8% U.S. Small Cap Stocks

- 6% International Stocks

- 10% International Small Cap Stocks

- 6% Emerging Markets

- 30% Intermediate-Term Bonds

- 11% International Bonds

- 5% REITs

- 4% Cash

Sandwich Portfolio Performance Backtest vs. the S&P 500

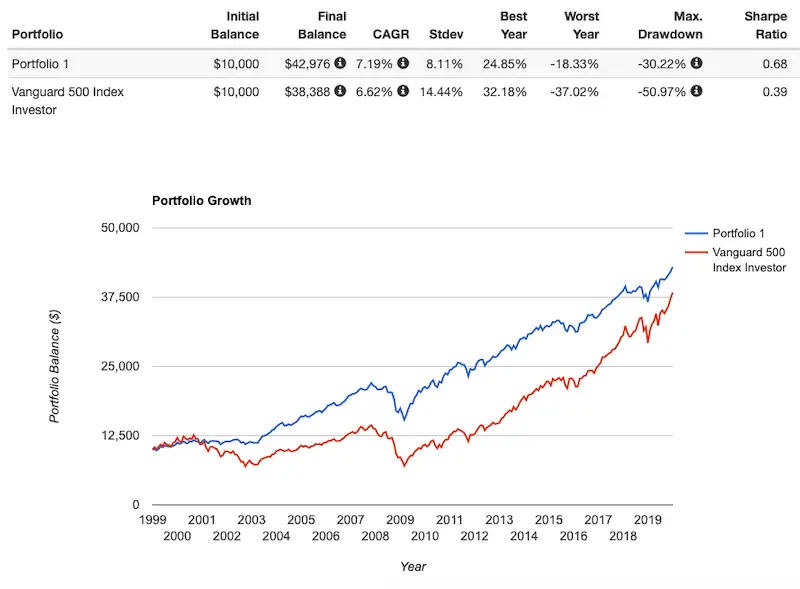

Going back to 1999, here's the Sandwich Portfolio's performance vs. an S&P 500 index fund through 2019:

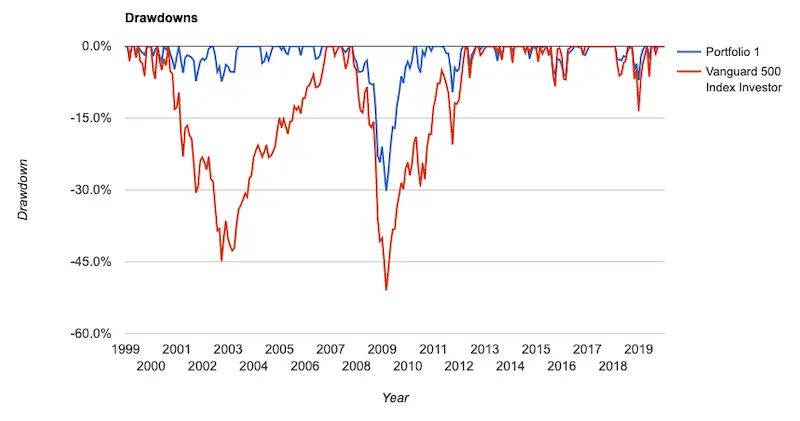

Compared to the S&P 500 index, the Sandwich Portfolio has delivered higher general and risk-adjusted returns (Sharpe), with a little more than half the volatility of the S&P 500, due to its healthy allocation to fixed income. This behavior is largely explained by its considerably smaller drawdowns through both the Dotcom Crash and the Subprime Mortgage Crisis:

I like the Sandwich Portfolio's allocation to fixed income, international stocks, international bonds, and emerging markets. I can also appreciate its Size tilt to small-caps, though that also happens to be where I specifically diverge. Small-caps have indeed beaten large-caps historically, but only because of small-cap value stocks. Small-cap growth stocks have been abysmal historically, seeming to not pay a risk premium, and are referred to as a “black hole” of investing. For that reason, I choose to avoid small-cap growth stocks altogether and tilt small-cap value.

A young investor with a long investing horizon can also likely afford to utilize a bond allocation with a longer average duration than that of intermediate-term bonds. Holding at least some allocation to long-term treasury bonds would probably be prudent.

Sandwich Portfolio ETF Pie for M1 Finance

M1 Finance is a great choice of broker to implement the Sandwich Portfolio because it makes regular rebalancing seamless and easy, has zero transaction fees, and incorporates dynamic rebalancing for new deposits. I wrote a comprehensive review of M1 Finance here.

Using almost entirely low-cost Vanguard funds, we can construct the Sandwich Portfolio like this:

- VOO – 20%

- VB – 8%

- VXUS – 6%

- VSS – 10%

- VWO – 6%

- VGIT – 30%

- BNDX – 11%

- VNQ – 5%

- BIL – 4%

You can add the Sandwich Portfolio pie to your portfolio on M1 Finance by clicking this link and then clicking “Save to my account.”

Disclosure: I am long VXUS.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply