Three of the most popular Vanguard international ETFs are VWO, VEA, and VXUS. Is there one that reigns supreme to hold alongside U.S. stocks?

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Video

Prefer video? Watch it here:

Diversifying with International Stocks

Index investors in the U.S. usually know it's a good idea to diversify in equities outside the United States. At global market weights, U.S. stocks only comprise about half of the global market. International stocks don’t move in perfect lockstep with U.S. stocks, offering a diversification benefit. If U.S. stocks are declining, international stocks may be doing well, and vice versa.

The U.S. is a single country. No single country consistently outperforms all the others in the world. If one did, that outperformance would also lead to relative overvaluation and a subsequent reversal. Meb Faber found that if you look at the past 70 years, the U.S. stock market has outperformed foreign stocks by 1% per year, but all of that outperformance has come after 2009.

During the period 1970 to 2008, for example, an equity portfolio of 80% U.S. stocks and 20% international stocks had higher general and risk-adjusted returns than a 100% U.S. stock portfolio. Specifically, international stocks outperformed the U.S. in the years 1986-1988, 1993, 1999, 2002-2007, 2012, and 2017.

In short, geographic diversification in equities has huge potential upside and little downside for investors.

I went into the merits of international diversification in even more detail in a separate post here if you're interested.

VEA, VWO, and VXUS from Vanguard

What is perhaps less clear is how exactly one should go about implementing that diversification in ex-US stocks. The most popular choice by far is VXUS, Vanguard's total international stock market fund. This fund is a crucial component of both the Bogleheads 3-Fund and 4-Fund portfolios.

Investors may not realize what the underlying components of a broad index fund like VXUS are, though, and how those components behave relative to U.S. stocks. VXUS is roughly 75% Developed Markets and 25% Emerging Markets. But as we would expect, Developed Markets are highly correlated with the U.S. market, and thus don't offer much of a diversification benefit. Emerging Markets offer a consistently lower correlation to the U.S. market and are thus the superior diversifier.

Of course, we would expect this, too, as these developing countries have unique risks – regulatory, liquidity, political, financial transparency, currency, etc. – that do not affect developed countries, or at least not the same extent. As an added bonus, Emerging Markets tend to compensate investors for taking on these extra risks in the form of higher returns compared to Developed Markets.

For example, consider the decade 2000-2009. While this famous “lost decade” delivered a negative 10% (-10%) return for the S&P 500, Developed Markets returned a positive 13%, and Emerging Markets stocks returned a positive 155%. This sort of massive performance difference between Emerging Markets and the U.S. has been fairly consistent throughout history. When Emerging Markets outperform the U.S., they tend to outperform by a wide margin. And when they underperform the U.S., they tend to underperform by a wide margin. This is actually a good thing for diversification.

VEA is Vanguard's broad index fund for Developed Markets. Its mutual fund equivalent is VTMGX. VWO is the one for Emerging Markets. Its mutual fund equivalent is VEMAX. Thus VXUS (mutual fund equivalent VTIAX) is roughly 75/25 VEA/VWO. So for a realistic example where the portfolio has home country bias (most people do), a 100% equities portfolio of 80% VTI (total U.S. stock market) and 20% VXUS unfortunately only has about 5% exposure to Emerging Markets.

To remedy this, we have to forego the use of VXUS and use its components VEA and VWO to get more granular. I personally choose to equally weight Developed Markets and Emerging Markets in international stocks in my own portfolio to take advantage of this superior diversification and greater expected returns while still including the many countries in Developed Markets that may outperform the U.S. during certain periods.

Let's look at some historical performance of this idea by switching the example to a 100% stocks portfolio of 50% U.S. stocks and 50% international stocks to keep things simple. Let's assume the use of VTI (total U.S. stock market) for the U.S. side. Here are a few options I'll propose for the international side:

- 100% VXUS (again, we know this is about a 3:1 ratio of Developed Markets to Emerging Markets)

- 50% VEA, 50% VWO (half Developed Markets, half Emerging Markets)

- 100% VWO (all Emerging Markets; no Developed Markets)

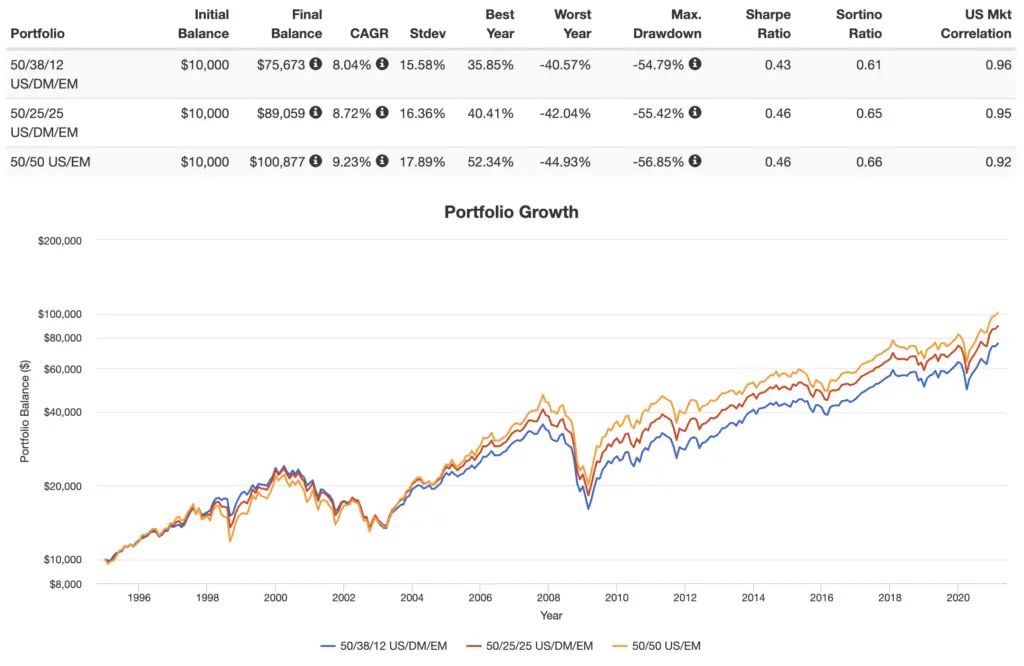

Here's how these three options worked out historically from 1995 through February, 2021:

As we'd expect based on the aforementioned geographical correlations and risk premium of Emerging Markets, we can see that overweighting Emerging Markets relative to their global market weight has resulted in greater general returns and risk-adjusted returns historically.

Conclusion

Does this mean investors should use Emerging Markets for their entire ex-US stocks position? Probably not. Again, we wouldn't want to miss out on all the developed countries around the world. That said, it shows we can probably reliably expect a greater diversification benefit and higher returns over the long term by giving a little more weight to Emerging Markets. I keep it pretty simple and just give equal weight to Developed Markets and Emerging Markets, i.e. a 1:1 ratio instead of VXUS's 3:1.

Conveniently, all these funds should be available at any major broker, including M1 Finance, which is the one I'm usually suggesting around here.

How do you weight Developed Markets and Emerging Markets in your portfolio? Let me know in the comments.

Disclosure: I am long VEA and VWO in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

The Bogleheads wiki states:

> …if an emerging market is reclassified as developed, an emerging-markets index fund will have to sell all its stock in that country, infrequently generating a large capital gain. A fund including both developed and emerging markets such as Vanguard FTSE All-World ex-US Index Fund or Vanguard Total International Index Fund avoids this risk.

To minimize this risk, it seems like you should buy VXUS+VWO in a 2:1 ratio (if you want a 1:1 EM:DM). I assume that VXUS avoids this risk. You could eliminate this risk by holding international ETFs in a tax-advantaged account, but then you’d miss out on the foreign tax credit.

An interesting fact I came across is the fact VXUS does not contain China A-shares (to my knowledge), while VWO does contain China A-shares. Including these companies have been shown to reduce correlation even further with US stock market and developed countries. So, in actuality, a 75/25 split of VEA/VWO is different than VXUS. Looks like it’s closer to “buying the haystack” than VXUS. Of course if you tilt towards VWO, it’ll reduce correlation with US stocks even further than what most people might realize. Any thoughts on China A-shares considering possible China state control? Is there more risk in China A-shares?

Haven’t thought too much about it honestly, Jimmy. I’ve seen a lot of people wanting to allocate less to China in general.

China should not be considered an EM. I would imagine that label is rather insulting to China. They have the second largest GDP behind US. Their GDP is more than double number three which is Japan. Whoever runs the EM indexes really to adjust the definition. And… if they removed China, the negative impact on $VWO would be massive.

Emerging markets are by definition countries experiencing rapid economic growth and that lack mature regulatory bodies and high per capita income. This perfectly describes China.

What are your thoughts on the rising very high correlation of us to international stocks over the past 10 ish years described here: https://www.google.com/amp/s/www.forbes.com/sites/nicksargen/2021/03/18/does-international-diversification-still-work/amp/

Is international diversification much less useful now due to globalization?

Perhaps less useful, but it still doesn’t mean we’d want to go all in on a single country. Correlations also ignore expected returns; currently, the U.S. looks very expensive compared to the rest of the world. Correlations can also change quickly. In summary, an increasing correlation doesn’t at all change the course of action in terms of portfolio construction.

Thank you very much, it helped me to see VEA and VWO together in another way.

Newbie here. Wouldn’t a 75/25 split between VXUS and WWO get basically the same result (about 50/50 emerging and developed)?

Yes, but you’d save a bit on fees going with VEA and VWO.

Does VEA and VWO qualify for the Foreign Tax Credit? What percentage, if any, of VEA/VWO are qualified dividends?

Yes: https://advisors.vanguard.com/iwe/pdf/taxcenter/FASFTCWS_012021.pdf