The 7Twelve Portfolio is equally-weighted diversification. Here we’ll review its components, performance, and the best ETFs to use in its implementation.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Video

Prefer video? Watch it here:

Who Is Craig Israelsen?

Craig L. Israelsen, Ph.D. designed the 7Twelve Portfolio. He is an Executive-in-Residence in the Financial Planning Program at Utah Valley University (UVU). His most popular book is 7Twelve: A Diversified Investment Portfolio with a Plan.

What Is the 7Twelve Portfolio?

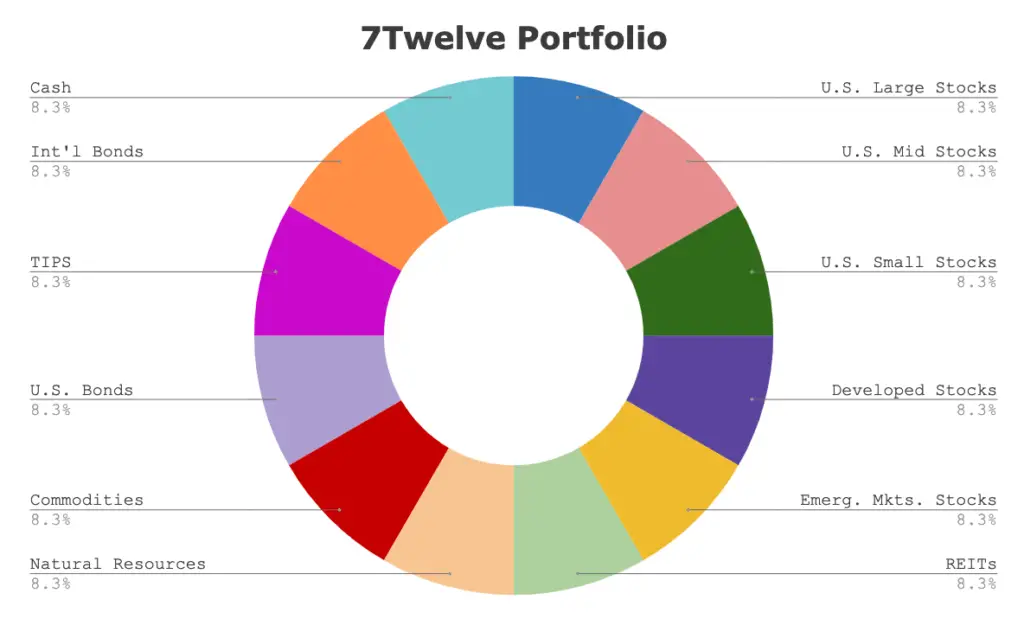

The 7Twelve Portfolio is a lazy portfolio that takes diversification to the max, utilizing 12 different funds, equally weighted, across 7 asset “groups.”

Israelsen maintains that “the performance of a diversified portfolio is more important than the performance of any individual fund.” I completely agree. This is basically the foundation of modern portfolio theory.

Israelsen uses food analogies, suggesting that “great salsa is all about diversification,” and that “investment portfolios should include a wide variety of diverse ingredients.”

The 7Twelve Portfolio uses 12 funds, each comprising 1/12 (8.3%) of the portfolio, across these 7 asset “groups”:

- U.S. Stocks

- International Stocks

- REITs

- Resources/Materials

- U.S. Bonds

- International Bonds

- Cash

I put “groups” in quotation marks because the above assets only span 4 asset classes: stocks, bonds, real assets, and cash.

By my calculation, the asset allocation comes out to roughly 59% stocks, 33% bonds, and 8% commodities. Specifically, the portfolio is constructed as follows:

- 8.3% U.S. Large-Cap Stocks

- 8.3% U.S. Mid-Cap Stocks

- 8.3% U.S. Small-Cap Stocks

- 8.3% Ex-US Developed Stocks

- 8.3% Ex-US Emerging Markets Stocks

- 8.3% REITs

- 8.3% “Natural Resources”

- 8.3% Commodities

- 8.3% U.S. Bonds

- 8.3% Inflation-Protected Bonds (TIPS)

- 8.3% International Bonds

- 8.3% Cash

7Twelve Portfolio Performance

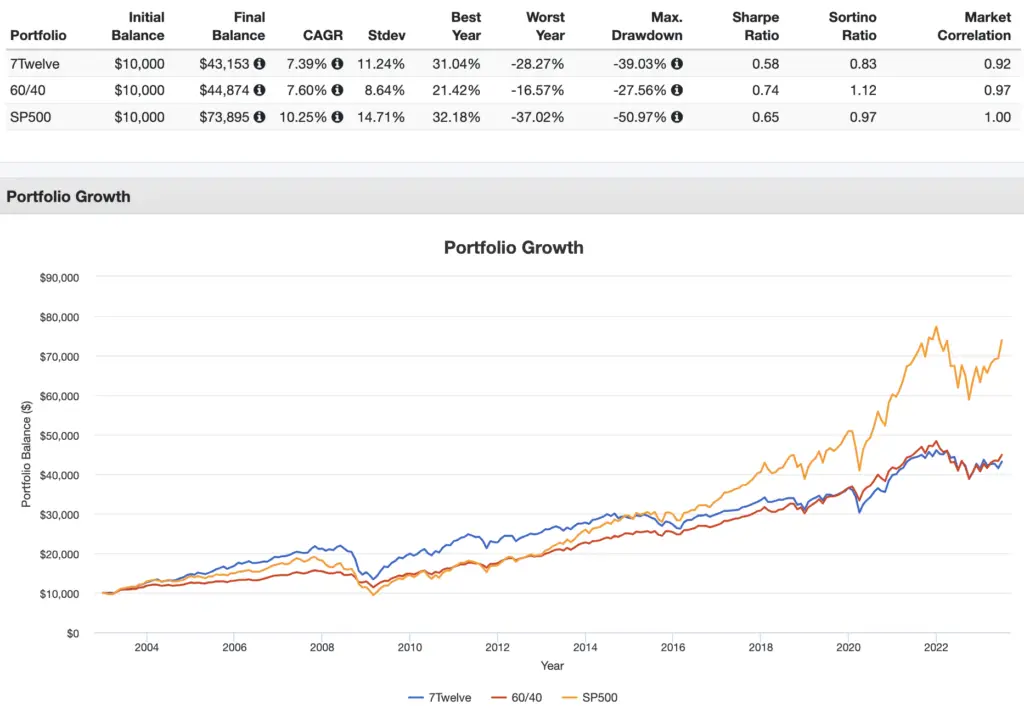

Here's the 7Twelve Portfolio's performance vs. an S&P 500 index fund and a classic 60/40 Portfolio from 2003 through June, 2023:

Granted, this only goes back about 2 decades, small-caps and international stocks have suffered in recent years, and past performance doesn't indicate future results, but the S&P 500 and a 60/40 portfolio beat the 7Twelve on both a general and risk-adjusted basis.

The whole point of diversification is to reduce volatility and drawdowns and thereby improve risk-adjusted return. Notice that the 60/40 portfolio has a risk-adjusted return, as measured by Sharpe, about 1/3 higher than that of the 7Twelve Portfolio, and with significantly lower volatility and smaller max drawdown. Volatility and max drawdown of the 7Twelve Portfolio were actually not too far off from those of the S&P 500 index, which even delivered a higher risk-adjusted return despite greater volatility.

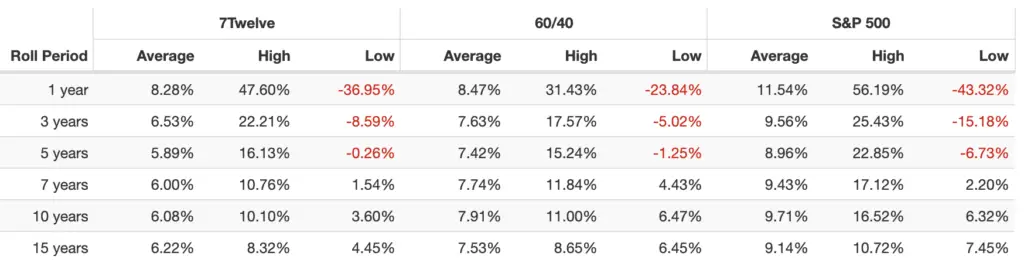

Here are the rolling returns:

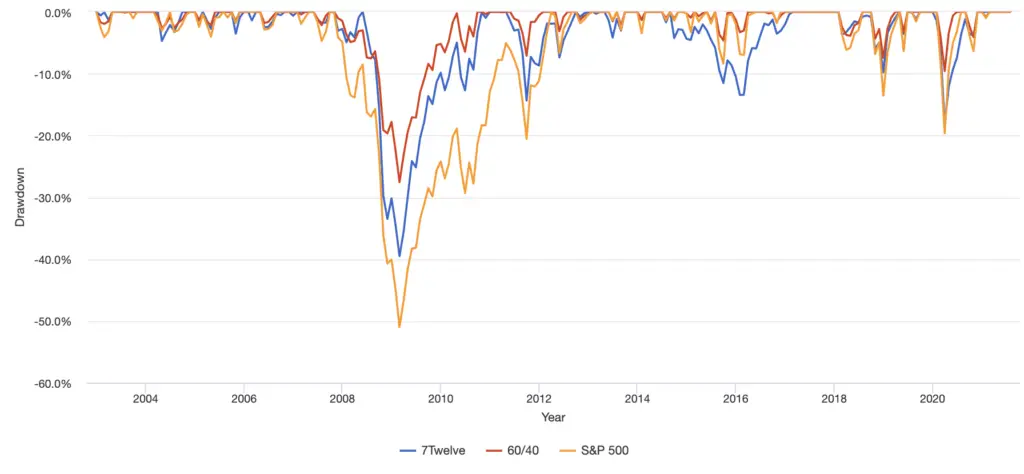

Drawdowns over that time period are illustrated below. Notice how in some cases, the drawdown of the 7Twelve Portfolio was actually greater than that of the 60/40 and the S&P 500:

7Twelve Portfolio Review

Being a Boglehead myself, my knee jerk reaction to the 7Twelve Portfolio is that it is somewhat antithetical to Jack Bogle's proposition of the “majesty of the simplicity.” Obviously one could construct a more complicated portfolio, but 12 different funds just seems unnecessarily complicated. In fairness, the portfolio is specifically overweighting classes like small-caps, mid-caps, and emerging markets relative to their market weights, so separate funds become necessary up to a point.

The naive equal weighting seems arbitrary and is almost certainly suboptimal, given the assets we're buying. I would submit that an allocation using risk parity (even if it's just a starting point) or simply market cap weighting would likely yield a more robust long-term portfolio. I'm all for not relying on overfitting or a mean-variance optimization output to dictate allocations, but the equal weighting here seems more haphazard and less of a thoughtful “plan,” as the book title suggests. In complete fairness to Israelsen, I haven't read the book.

I'm generally not a big fan of Commodities. They have largely fallen out of favor, as their long-term returns have been dismal, which we would expect. We want diversifiers to have positive expected returns. Commodities have had negative real returns over the past century. I explored potentially using the Utilities sector as an alternative diversifier here.

The prescribed “Natural Resources” is something I've never actually encountered in a lazy portfolio, which is why I put it in quotes. There are only several funds available – all with relatively high expense ratios – for this asset category. The heavy allocation to Commodities and Resources will likely just drag down returns over the long-term. Funds for these assets also have much higher fees. At the end of the day, though, these are just commodity producers (gold miners, etc.). These companies are more correlated with the stock market than with commodities themselves, which sort of defeats the intended purpose of their inclusion. In holding them, the investor is also taking on the business risks of these companies that may be unrelated to commodities. Lastly, commodity producers tend to sell commodity futures to hedge their price risk, which basically cancels out the precise hedge we’re looking for.

Similarly, with 16.6% in U.S. and international bonds, I question the need for an additional 16.6% dedicated to cash and TIPS. These, too, while providing a mild inflation hedge, are going to drag down long-term total return. That would be totally acceptable for the investor with a short time horizon or a significant aversion to risk, but then that investor should almost certainly be interested in a greater allocation to fixed income. In other words, the investor who would be interested in the sales pitch for this portfolio would want less stocks and more bonds.

We also know that small-cap growth stocks don't tend to pay a risk premium. Israelsen has written about the Value premium in the past, so it seems strange that he didn't specifically target small cap value here over small cap blend. As is the case with some other portfolios I've discussed, if one knows about and believes in the Size factor premium enough to overweight those stocks, they should also know about and believe in the Value factor premium just as much, if not more. The tilt toward smaller stocks here also only applies to U.S. stocks and not the international stocks.

I also think the 7Twelve Portfolio looks more diversified than it really is. For example, we could achieve the same global equities diversification across all cap sizes and all markets with Vanguard's Total World Stock Market Fund (VT). But here we're using 5 funds to replicate that exposure. Despite what many beginner investors think, simply buying more funds does not always mean greater diversification of the portfolio.

While the 7Twelve seems to be an interesting thought experiment and is certainly a very colorful lazy portfolio, it's definitely not for me. It certainly doesn't match the needs of the young investor with a long time horizon, for whom assets like cash, TIPS, and commodities make little sense. But then it also doesn't seem conservative enough for the retiree looking to get a similar risk profile to a classic 60/40 allocation. So it's hard to pinpoint the exact audience for whom this portfolio would be suitable.

I'm always supportive of any portfolio that steers investors away from stock picking, but I see no compelling reason or research-based justification to adopt the 7Twelve Portfolio over, say, much simpler options like a 60/40 Portfolio, a 3-Fund Portfolio, or other lazy portfolios, including other slice-and-dice ones, all of which should have the added benefit of lower fees.

I would also argue the latter options are much easier for a DIY retail investor to understand due to their greater simplicity, which may allow the investor to stay the course more easily than with the more complex 7Twelve Portfolio. Tracking error regret – giving up on a strategy after consistent underperformance – is a real concern. Simplicity in investing is vastly under-appreciated.

And there's the rub. The 7Twelve Portfolio seems better suited for a seasoned, semi-active investor who is going to take the time to research the potential merits of the assets and their allocations, not for an armchair retail investor who needs to simply take it as face value and trust in its ability to generate long-term returns and mitigate risk. Again, I would submit that a simpler portfolio would be easier for that investor to grasp and get behind without wavering. Ironically, those simpler options may also yield similar returns with lower risk, as we saw with the backtest earlier.

Next we'll look at how to construct the 7Twelve Portfolio using ETFs.

7Twelve Portfolio ETFs and Pie for M1 Finance

If you comb through the 7Twelve Portfolio website looking for specific funds to use in its implementation, you won't find them. Israelsen wants to charge you $350 for that information. Below are my suggestions based on sufficient AUM and volume, and low fees whenever possible.

M1 Finance is a great choice of broker to implement the 7Twelve Portfolio because it makes regular rebalancing seamless and easy, has zero transaction fees, and incorporates dynamic rebalancing for new deposits. I wrote a comprehensive review of M1 Finance here.

Using mostly low-cost Vanguard funds, we can construct the 7Twelve Portfolio like this:

- VOO – 8%

- IJH – 8%

- SPSM – 8%

- VEA – 8%

- VWO – 8%

- FREL – 4%

- VNQI – 4%

- GNR – 8%

- BCI – 8%

- BND – 9%

- SCHP – 9%

- BNDX – 9%

- SGOV – 9%

You can add the 7Twelve Portfolio pie to your portfolio on M1 Finance by clicking this link and then clicking “Save to my account.”

What do you think of the 7Twelve Portfolio? Let me know in the comments.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Disclosure: I am long VOO, VEA, and VWO in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

I read the 7T book and I’ve used the 7T philosophy for ~4 yrs, from age 62 (retirement) to 66. Your review is mostly fair, but I think you missed a few things. I invest through Fidelity, and I pay $75/yr for the Fidelity fund picks (Israelson does Vanguard, too). You mention $350, but that must be for some other bundle of products from CI. Compared to most wealth managers that want ~1%/yr of an entire nest egg, $75 is an excellent deal to self-manage a portfolio. As detailed in CI’s book and in the annual reports he writes, the recommended approaches adjust risk profile by age. What CI recommends for someone at 45yr is not the same as for 55yrs and it changes about every 5 yrs. The primary move is that 7T increases the amount in fixed income with age, a pretty standard approach. The risk adjustment is explicit in 7T and I think you missed this by not reading the book. Seems you have a liking for Vanguard, so maybe you should check out the Vanguard 7T. One more thing. After many calculations, CI demonstrates that either annual or bi-annual rebalancing is sufficient to maximize returns (no need to birddog every day), therefore the 7T approach is low maintenance.

I had the same reservations about 8% commodities when I began using the 7twelve strategy 6 years ago. Commodities have been dead money for some time. It turns out they do have a nice place in the portfolio when inflation hits. I use COMT to get exposure. I looked at the 7twelve back test and there have been periods when the commodities carry the portfolio. We may be in that environment now.

I think I’d rather use TIPS and short bonds for inflation “protection.” Ultimately though, I’m also of the mind that periods of high, unexpected inflation are likely to be infrequent and short-lived nowadays, so any allocation to such an asset is probably just an opportunity cost that drags down the portfolio’s total return over the long term. Commodities have had negative real returns over the last 100 years.

Do you still hold this perspective on inflation?

Yes