Financially reviewed by Patrick Flood, CFA.

The oft-cited advice is to put your emergency fund in a safe, high-liquidity savings account or money market fund, but there may be a better way if you're willing to take on some additional risk. Here we explore how you can invest your emergency fund to beat a high-yield savings account and inflation.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Introduction – Why Invest Your Emergency Fund?

An emergency fund is exactly what the name suggests – an amount of money, usually in a separate account, saved for a rainy day in case of emergencies in the form of unexpected expenses, e.g. car repairs, loss of job, medical bills, etc. Professionals recommend having 3-6 months' expenses in an emergency fund. Even having one month of expenses saved up puts you ahead of most people in the world.

The advice usually heard is to put this emergency fund in a safe, low-risk, highly-liquid account like a savings account or money market fund, so that you can access it immediately when needed and not worry about it dropping in value. That is, safety and liquidity over returns. This is solid advice and obviously makes great sense. But there may be a better way.

High-yield savings accounts typically max out around 2% APY during relatively “normal” economic environments. With inflation at around 3% annually on average historically, you're still losing to inflation with a high-yield savings account or money market account. This has caused many to begin rethinking the common advice of not investing one's emergency fund in recent years with high inflation.

Those willing to assume a marginal amount of extra risk can invest the emergency fund in a well-diversified portfolio that can be expected to grow over time instead of staying flat or diminishing due to inflation. This is obviously a highly personal situation. Those with a low tolerance for risk may very well be perfectly happy losing money to inflation and keeping their emergency fund in a safe savings account, and that's totally fine. The emotional aspect of investing is very real. Peace of mind can absolutely be worth the expense of lost value to inflation and opportunity cost.

Similarly, if any of the following apply to you, investing your emergency fund is probably not a good idea:

- High-interest debt

- An unstable job

- Just starting an emergency fund

- Greater risk factors for emergencies (kids, commute, etc.)

But for others, investing your emergency fund can make sense in the right circumstances. Let's assume you have an emergency fund of 6 months' expenses saved and sitting in a savings account right now. Let's also suppose this amount you need – the value of the account – is $10,000. Consider these facts:

- It's unlikely that you'll need the entire emergency fund – all $10,000 – on a single day all at once.

- In the modern era of credit cards, you can use a credit card to cover any emergency expenses and pay off the balance within 30 days without incurring interest charges, meaning immediate liquidity/availability of cash at the time of the expense is not supremely important.

- As mentioned above, any savings account is still going to be losing to inflation, meaning the account value is slowly dwindling over time in terms of real dollars and actual purchasing power. Diligent savers will need to continually top off the account for this reason.

- Time that passes without needing to access the emergency fund is an opportunity cost where that money could have been invested to achieve a compound growth rate that beats inflation, allowing the account to grow over time instead of shrink or stay flat.

- Significant market downturns and black swan events are inherently rare. Diversifying the investment account mitigates volatility and the degree of drawdowns (risk).

- Traditional brick-and-mortar banks are unlikely to offer a competitive high-yield savings account, meaning you'd have to go with an online bank where transfer times to get liquid cash are likely similar to that of a brokerage account anyway.

Investing your emergency fund becomes particularly appropriate and attractive if you have:

- A large emergency fund saved, e.g. 6-12 months' expenses.

- High-limit credit cards.

- More than one stream of income or more than one person earning in the household.

- A stable job.

- Good health insurance.

- An HSA.

Of course the main criticism of investing one's emergency fund is the fact that a market correction can result in the account dropping in value at the precise time you need that money. Thankfully, there's a way to mitigate or even eliminate that risk.

How To Invest Your Emergency Fund

There's a simple yet beautiful way to ensure a market correction doesn't affect your ability to use the money in your emergency fund: overfund the account.

Specifically, we want to attempt to estimate the maximum degree (value) by which the account can drop from the initial value and then simply overfund the account by that amount. For example, if we estimate the max drawdown of the investment portfolio to be 10% and we need $10,000 in the emergency fund for 6 months' expenses, we would want to put an additional $1,000 in the emergency fund for a total of $11,000.

This maximum drawdown – and subsequently, the amount by which to overfund – correlates with the riskiness (and likely the expected return) of the investment portfolio in which you place your emergency fund. If the portfolio is low-risk, we may estimate the max drawdown to be 10%, as in the example above. A riskier portfolio may have an estimated potential drawdown of 30%, in which case you'd want to overfund by 30%. Keep in mind future drawdowns may be worse than the worst ones shown in the past on a backtest.

This concept becomes less important as time passes without using the emergency fund. The longer you go without using it, the more time the investments have to grow, making drawdowns less impactful. For example, if your investments appreciate and the emergency fund grows from $10,000 to $15,000 after 5 years without needing to access it, a market downturn of 10% still leaves you with $13,500 in the account.

Account Type

In terms of account type to invest your emergency fund, you can use a taxable brokerage account or a Roth IRA. For the former, depending on when you sell your investments, you'll incur short- or long-term capital gains taxes. For the latter, you can withdraw contributions from a Roth IRA tax- and penalty-free anytime, but the paperwork may be a bit more cumbersome. Also keep in mind IRA's have annual contribution limits which may be lower than the amount you need in your emergency fund.

Time Horizon and Asset Allocation

Consider the fact that the time horizon for your emergency fund is technically continuous and limitless, as unexpected emergencies are, by definition, unpredictable. You may never need to access your emergency fund, which would be a good problem to have. Conversely, you may need to access it within a year. As such, asset allocation must be set initially to be quite conservative and can later be made more risky as the account grows if you prefer.

For example, when starting out, we want a very conservative allocation with something like 10/90 stocks/bonds, but after 20 years, this may slide to 40/60 or even 60/40 stocks/bonds if you want.

Asset Selection

Remember, in investing the emergency fund, we want to minimize volatility and risk, at least when starting out. This means maximizing diversification across uncorrelated asset types, as well as diversifying risk factor exposure. This also means using broader, less volatile asset classes and styles, such as index funds over stock picking, treasury bonds instead of corporate bonds, and short-term bonds instead of long-term bonds.

Below are some ETF portfolios to consider for investing your emergency fund that check these boxes.

“What's the Best ETF for an Emergency Fund?”

I get a lot of questions asking what the “best ETF for an emergency fund” would be. Well, I'd argue that's sort of the wrong way to think about it.

In my opinion, there's no single fund that can adequately serve that purpose. Remember, for an emergency fund, we want to minimize volatility (the swinging movement of the portfolio) and risk (permanent loss of capital, in this case), because the money has to be there when we need it. To do that, we want to diversify broadly across different assets. And in order to do that, we need multiple ETFs; there's really no getting around it, at least with the current availability of financial products.

I've also heard the phrase “emergency fund in bonds” thrown around a fair amount. First, that phrase is too reductive. There are quite a few different types of bonds and different durations out there to choose from. Here we want to primarily make use of short-term treasury bonds. Secondly, while I'd argue we do still want mostly bonds here, bonds alone still don't get the job done. Bonds mitigate the risk of stocks, but stocks also mitigate the risk of bonds. Again, diversification.

I designed a pretty low-risk portfolio to invest one's emergency fund. Past iterations of this idea got a little more granular (and thus more complicated) with more funds. Einstein suggested to “make everything as simple as possible, but not simpler.” I've tried to do that here. It looks like this:

5% Total U.S Stock Market

5% Total ex-US International Stock Market

90% Short-Term U.S. Treasury Bonds

I've split up U.S. and international stocks purely so U.S. investors can get the foreign tax credit, which would not be available with the total world stock market fund VT in years in which the U.S. market comprises greater than 50%.

Why do we want stocks in there at all? Just like bonds reduce the risk of holding stocks, so too do stocks reduce the risk of holding bonds. We're basically holding stocks and short treasury bonds at roughly risk parity weights of 10/90.

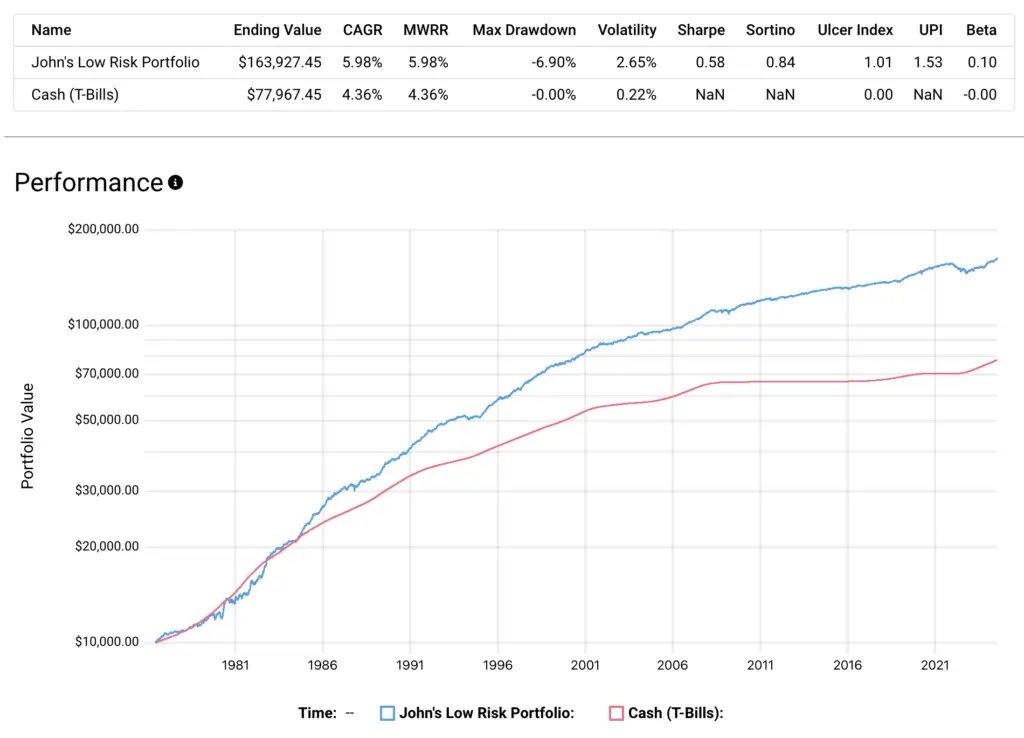

Below is a backtest for the period 1974 through mid-2024 comparing it to “cash,” which is really T-Bills:

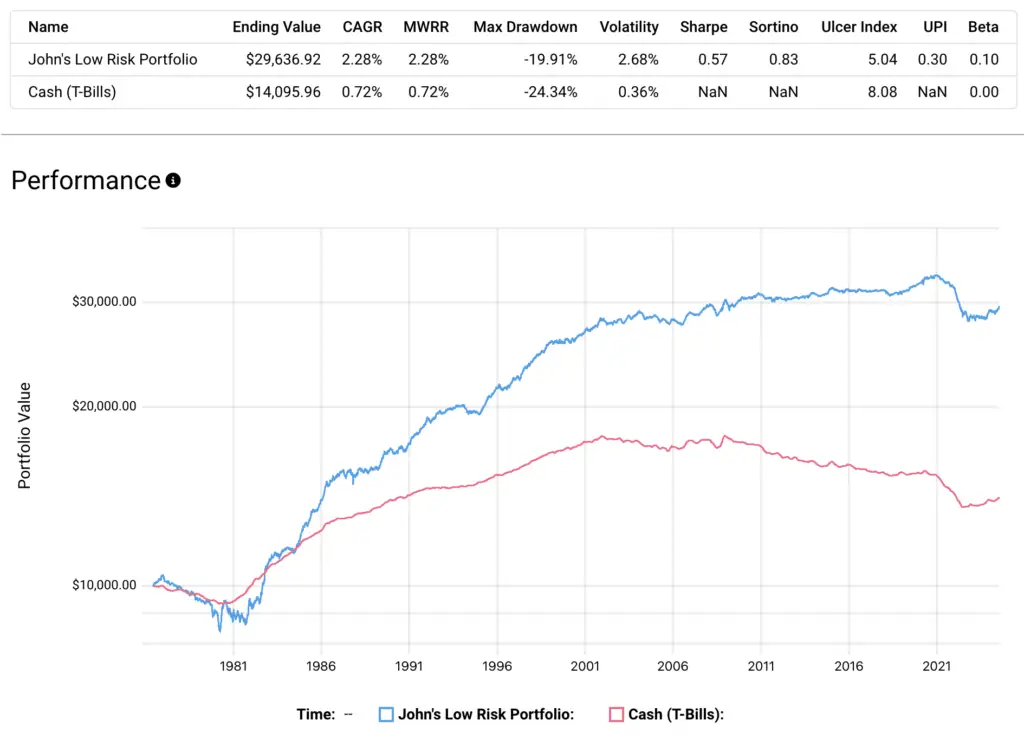

That doesn't look too exciting. But that's sort of the point. We're trying to take on a small amount of risk to edge out above inflation. Look at how the picture changes when we adjust for inflation:

In both scenarios, even though the CAGR's aren't too different, my suggested allocation resulted in more than double the final value over about 50 years due to the power of compounding over long periods. Basically, small differences add up.

Using mostly low-cost Vanguard funds, my low-risk emergency fund portfolio can be constructed using the following ETFs:

VTI – 5%

VXUS – 5%

SCHO – 90%

To add this custom low-risk emergency fund portfolio to your M1 Finance account, click this link.

Remember that if you want to use this idea, I would highly suggest overfunding you're emergency fund by 10%.

Again, I've split up U.S. and international stocks here using VTI and VXUS purely so U.S. investors can get the foreign tax credit with VXUS, which would not be available with the total world stock market fund VT in years in which the U.S. market comprises greater than 50%, which is currently the case at the time of writing in 2024.

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

As an aside, I would suggest using M1 Finance if you don't already have an investment broker, because it has zero transaction fees, automatic rebalancing for new deposits, and a user-friendly interface, among other things. I wrote a comprehensive review of M1 Finance here.

Again, after your emergency fund grows and you can sustain a larger drawdown, you can explore riskier but still-well-diversified options like the All Weather Portfolio. This is essentially sliding further down the scale of risk and expected return. Earlier I said there's no single “best” ETF for an emergency fund. If I had to pick one, it would just be a plain ol' low-cost short-term treasury bond fund or T-Bills fund (or BOXX for those more savvy investors). Those are about as far down on the safe end of that aforementioned scale as you can get.

But that's obviously the boring answer that people aren't really looking for. And I'd argue that's appropriate, as emergency funds are supposed to be pretty boring out of necessity. But I'll oblige. So again, later on, provided the account value is sufficiently large, one could get away with something a bit more exotic. Risk and return tend to be inextricably linked.

Where To Invest Your Emergency Fund

Again, I think M1 Finance is an ideal platform to use to invest your emergency fund. The modern broker offers retirement accounts, taxable brokerage accounts, high-yield savings, and more. This allows you to house multiple accounts under one roof and seamlessly transfer between them. M1 features fractional shares, automatic rebalancing, a sleek mobile app, zero account fees, zero transaction fees, and some of the cheapest margin around.

M1 also has a premium account option called M1 Plus that gets you access to their new Smart Transfers, allowing users to set up chains of automatic transfers between accounts based on specified dollar amount thresholds, e.g. investing any excess cash above $1,000.

Right now M1 is offering a transfer promotion of a 0.50% payout on settled transfers over $10,000 into Invest accounts before January 31 with a max payout of $25,000. Terms for this promotion are here.

Conclusion

I fully support investing your emergency fund to avoid the opportunity cost of missed growth, provided it fits your personal situation and risk tolerance described above. But in doing so, make sure you're investing it in a relatively low-risk, well-diversified portfolio, especially when initially accumulating your savings. Look at historical risk metrics and overfund your invested emergency fund accordingly.

If you're still indecisive, you can always simply split the difference. Put 3 months' expenses in a highly-liquid savings account, and the other 3 months' expenses in an investment account. This allows you to cover short-term, immediate expenses with liquid cash while also allowing money in the investment account to grow, and allows you to potentially avoid capital gains taxes from selling investments to cash.

Do you invest your emergency fund? Do low interest rates have you rethinking the traditional advice of a plain ol' savings account? Let me know in the comments.

Disclosures: None.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Hi John,

Enjoy your prose and opinions. I’ve seen you offer several Gold ETF’s. What’s the uses of SGOL compared to PHYS? Where is one better used than the other and why?

Thanks! PHYS is more tax-efficient so it’s better for taxable space.

This is great stuff, John! I have been squirrelling away a ton of money for a lumpsum expense which has now been deferred indefinitely. I have been in a fix as to how to invest it for the long term. Pretty nervous about going all in now. These funds have holding it in savings as I am figuring things out. This is such a great solution to park these funds and hedge against the darn inflation. Thanks again, John!

P.S. Shamelessly copied your ginger ale portfolio for my monthly DCA in taxable account. This is going to be my retirement nest egg. Started only a few months ago but I am sure it’s going to be the best decision in my investing life. Maybe second best, after deciding against active management.

BTW, would love to get your view from a macro standpoint. How would this portfolio do in a year like this where the FED rates are going to increase at least 4 times?

Impossible to say. Probably not great.

Thanks, Sean! Glad you’ve found some of my stuff useful. Definitely check out I bonds if you haven’t, too. Best thing for savings for 1+ years right now.

I have been holding off getting back into stock market past 9 years expecting a big correction. In spite of reading Intelligent Investor long before!

Anyway, I am even more worried now(with all predictions of big correction past few years!) to get back via either lump sum or DCA. Still waiting for blood in the market!

Any suggestion for 10 year investment period(hoping to retire), medium risk tolerance, objective is to grow the portfolio as much given I missed longest bull run in front of my own eyes and saga continues.

Hi John,

Great post! I’ve been searching for something like this for a while. So far, I’ve come across your portfolio and Chris Kawaja’s “Ultimate Liquidity Portfolio” which is 25 short term treasury, 57 intermediate treasury, 18 total stock market. If M1 wasn’t available I’d probably go with the “ULP” due to its simplicity when it comes to rebalancing, etc. but since we have M1, this seems much better.

Would you recommend this as an “Opportunity Fund”? I want to move money out of a HYSA into something like this to hold larger amounts of cash that could be used anytime between 6 months – 2 years. My concern would be the taxes on this vs. just holding gov bonds and equities since I’d have it in a taxable account. Thoughts?

Thanks, Drew. Not sure what you mean by “opportunity fund.” Would prob want to hold for at least 1 year to avoid short term cap gains.

By “opportunity fund” I’m referring to needing cash for an opportunity in 1-3 years (i.e. for downpayment of a house). My sense is that you could use this portfolio for the same purpose. Would you recommend this portfolio for that purpose? Or would you point to a different portfolio?

Yes. This one.

Hi John,

Thank you for all of the time and energy you put into this site. I’ve learned a lot reading through your insights.

Question: What do you think about this as an emergency fund: SPTL: 50%, MGC: 50%

Historically it seems low risk/high reward. But I would love your insight before I start funding it.

Thank you!

Thanks! Moderately risky but nothing like an emergency fund. YTD you’d be down about 9%. In my mind, an emergency fund ideally shouldn’t have volatility greater than about 3%, but of course this varies based on how much you overfund it initially and how much it grows.

Hello John,

Great site.. A lot of useful information.

I was wondering if you had a ‘RISK OFF’ M1 portfolio ?

Thanks! No. Not sure what that means.

Hey John,

Thanks so much for all of this information. I just came across your website, and the content is truly top notch!

I had a question regarding setting up an emergency fund portfolio for a beginner Canadian investor. I’m looking to invest my emergency fund, while keeping things as simple, and low-risk as possible.

I was considering doing a 10/90 allocation for the portfolio – 10% VFV (Canadian ETF that tracks the S&P) and 90% VSB (Canadian short-term bond ETF). I’d like to avoid any kind of currency risk, and currency exchange fees for this portfolio.

My question is, generally, would you think this is a sound approach for an emergency fund that’s around $15K in size, and do you think selecting Canadian over US short-term bonds would yield a similar outcome (for the purposes of this portfolio – beating inflation, low volatility, etc.)? Or would it worthwhile trying to get my hands on US bonds?

I completely appreciate that any info you provide wouldn’t be specific specific investment advice 🙂 but any insight would be greatly appreciated!

Thanks,

Andrew

Sounds reasonable to me. Admittedly don’t know much about the creditworthiness of Canada vs. the U.S. but I’d guess it’s similar. Also not sure if you have access to a TIPS equivalent; may be a sensible addition.

So your Ginger Ale plan is what you use for non-taxable accounts if you use NTSX for your taxable?

Are there any bond ETFs available that are better for a taxable account? For instance any that don’t pay out the dividends to the owner but perhaps internalize it by just raising the ETF price (so the owner doesn’t incur it as a gain)?

No. We even have to pay imputed phantom interest on zero-coupon bonds. Munis are the most tax efficient, but they don’t offer the protection we want, and then treasuries are comparatively more tax efficient than corporate bonds and total bond market.

Ahh thanks for clarifying that information about muni bonds!

John – Your website is awesome. I have learned and gained so much knowledge from it. Please keep posting more stuff

Thanks! Glad you’ve found it useful.

What’s your thoughts about the betterment safety net?

Do you think is a good idea using minimum volatility ETFs for the international and usa stocks?

Haven’t heard of it.

Maybe. Depends on the context.

Thank you so much for putting this website together. It is well laid out and provides insightful information. Much appreciated. It has helped me a lot in putting together a portfolio that I can have confidence in for the long run.

I just had a simple question. I think your original mix on the emergency fund had 60% in ST treasuries and 5% in ST Tips but now I see 45% on the ST treasuries and 20% on the ST Tips. What prompted the adjustment and why?

Thanks again.

Thanks, RJ! Glad you’ve found it useful. Just thought it made sense to add more direct short-term inflation protection.

Hi John – super interesting summary, as always! (1) Curious about your choice of PHYS for the Gold allocation. Do you have a preference for this fund over funds like SGOL or GLD? (2) Also, I realize that you cannot give financial advise, but perhaps there might be away to answer this next question. I am very close to retirement and do not hold a position in Gold. My thinking is that long term, it could be smart to have a gold allocation. At this moment in time, given where pricing is, I am hesitant to jump in. Instead, I am thinking of slowly building up the position over a pd of time, say 12-24 months (which of course could work for or against me). Any thoughts you can share?

Thanks! Just recently discovered PHYS, actually. It’s more tax efficient than other gold funds. Impossible to predict the future. Like I’ve noted in reference to broad commodities, gold is probably not useful as a long term holding, but may be beneficial over the short term to reduce portfolio volatility and risk.

If I put some money in SWAN for my emergency fund won’t the turnover of it hit me as taxable?

Continued:

Is the turnover in SWAN a lot and concerning in a taxable brokerage account?

Not ideal but not horrible.

Yes

Great info on this site, John! I am grateful to you! And with your article and all our other research we have decided to place 50k into SWAN for our emergency fund. Our income is very stable and it hits on every point you stated but we also need to try to keep up with inflation and the 7% dividend will do that. Also if the US government defaults on their bills no fund will be safe! Thanks for all the help on your site!

Thanks for the kind words, Rex! Glad you’ve found the information useful.

Been looking for pragmatic advice on emergency fund investing for people who are table to tolerate a bit more risk than a mere savings account and your article hit the nail on the head! Thank you for sharing your knowledge.

Great writeup! I really like you way you lay out the information, very clear and concise. Would it be possible to see the actual links to the portfolio optimizer to allow us to play with some of the percentages?

I was looking for it on one of your other articles, I’ll message you there as well.. I think that would be a great benefit to include in all of them.

Thanks!

Thanks, Dan!

My thought process has been that listing out fund equivalents for the sake of backtesting or posting the PV links just invites more nitpicking, questions, and discussion over those funds (their fees, methodology, etc.) and the backtests per se, which I don’t want. I’m of the mind that backtests usually don’t mean much at all in terms of informing decisions about the future, especially when we’re looking at terribly short periods like 10-20 years. The only time I think they’re useful is if one is interested in seeing how asset types behaved relative to each other over the long term. And at the end of the day, people are free to use the funds I’ve listed and play with backtests themselves.

Basically I don’t want to lend any credence to the idea of using backtesting as a means of picking what appears to be an optimal portfolio for the future. My readership is overwhelmingly newbies, not seasoned investors, though I do have some of the latter obviously. So I try to keep the former group in mind – and speak more to them – when considering what I include/exclude; it’s sort of a fine line.

Of course seasoned investors would know how to interpret a backtest and what to take from it (and more importantly, what not to take from it), and would take anything with a handful of salt. If my readership were all advanced, I’d probably include every little tidbit of everything. Young, new investors, however, love recency bias and will invariably simply look at a backtest over the past 5-10 years and pick whatever had the highest CAGR and declare it optimal. I can see people saying things like “I got a higher return using 9% instead of 10%!” Talk about overfitting…

I’d rather not even include backtests, but if I did that, I’d immediately get a flood of comments saying “Where’s the backtest?!” So I feel like there’s no easy solution that pleases everyone, and I completely realize I may be making the “wrong” choice whenever I choose to include or exclude some particular piece of information.

Great article, I myself still keep 6 months of expenses in a high yield savings account. I like to view it like insurance. It’s almost an expense in itself since inflation can get to it. But it gives me peace of mind and it’s there if I need it immediately. I did however decide to use my taxable account as a place to store some cash I have saved up for larger purchases. Down payment on a car etc. that sort of thing. Went with the pie you laid out here actually.

Thanks, Henry! Sounds great! Glad you found it useful.

Hi John, Love the stuff on this page.

This sort of strays from exchange-traded stocks and bonds, per se, but I was wondering your thoughts on using Series I U.S. Saving Bonds ( https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds.htm ) as an “emergency fund.” You have to hold it for at least a year, but after that, you can withdraw at any time (penalty of 3 months interests if between 1 – 5 years). It’s better than losing money to inflation in a checking account, as the interest rate is tied to inflation (and the rate is currently at 3.5% until October 21). Sorry for the long paragraph, but wondering your thoughts on savings bonds (even series EE as well) in an optimized portfolio.

They’re looking attractive right now. Actually planning on doing a post on them at some point.

Hi John

Another great article. When you say your entire taxable accounts is NTSX, does that mean you don’t hold anything else in that account? So basically is your emergency fund held in NTSX?

Thanks in advance Pat.

Indeed. Account value is high enough where I don’t really have to worry about putting it in safer assets.

Thank you for taking your time to educate us. Highly appreciated. Keep up the good work,

I recently decided to put 10% of my 6 month emergency fund in VDIGX to combat at least some inflation. Should I push this to 15% or 20%? I suspect the answer is whatever my risk tolerance is, but I thought I would ask none the less.

For reference, I’m the sole income provider for a family of four.

No reason to use a dividend fund for that; just a greater tax drag. I can’t provide personalized advice. Allocations depend on risk tolerance and value of the emergency fund, i.e. how much drawdown can you survive? An emergency fund should ideally be low volatility and low risk.

How about using Vanguard’s Wesley fund with 35% stocks, 65% bonds.

I appreciate the time you’ve spent putting these articles together, particularly your review of various lazy funds. So far, I haven’t seen where you mention your views of some of the laziest–ones like Vanguard’s Target Retirement funds. Thoughts on those generally, other than that they’re clearly a modification of 60/40 portfolios?

Thanks Leo! Technically we wouldn’t call target date funds “lazy portfolios,” as their asset allocation changes as time goes on. Target date funds are great if the investor wants to be truly hands-off and doesn’t care to know or learn anything about investing, which is perfectly sensible for some people. I prefer to retain control over my asset allocation and selection of assets. There’s a sliding scale for the tradeoff between simplicity and control/optimization. Target date funds are as simple as it gets.

Would there be much difference in tax liability created between using the Permanent Portfolio approach vs John’s Low Risk Portfolio in a taxable account of $40,000 with re-balancing at M1?

Hey Ralph. The Permanent Portfolio would probably incur a larger tax burden since gold is taxed as a collectible at 28%. Try to avoid rebalancing in a taxable account if you can, at least for a year.

Thanks John. I find your site very helpful. I can search for hours online and not find as clear and straight-forward information. Keep up the good work.

Wow, thanks so much for the kind words. That’s always been the goal, and it’s comments like yours that keep me going! Really glad you’ve found the content helpful.

I have $700 saved so far in my emergency fund. It’s in an Ally account with a low-interest rate due to the current circumstances. Would it be wiser to open a Roth and invest in one of the above-mentioned portfolios?

Thanks for the resources. I’ve been reading through your posts and the information has been helpful as I’m learning how to invest and improve my financial situation.

Lee, I’m really glad the info has been helpful!

It’s a little more cumbersome to withdraw Roth contributions than to realize gains in a taxable brokerage account. I’d build up the emergency fund first, put it in a low-risk portfolio if you want to hopefully beat inflation, and then start funding an IRA. Also, if you withdraw from a Roth IRA, you can only redeposit up to the annual contribution maximum.

Why do you choose VGLT over the EDV fund that you recommend in other portfolios across the website?

No real reason I guess other than lower fees and long-term bonds being more “familiar” than STRIPS. I think I’ve only mentioned EDV a couple times elsewhere IIRC. Just depends on one’s desired weighted average bond maturity.

What are your current thoughts on this portfolio given the focus on Bonds at a time when we have news article after news article questioning the reasoning behind Bonds at a time when rates are at an all-time low? Is there a less bond-focused alternative you’d consider and do you invest your own emergency fund in this manner?

1. Short-term treasuries are considered a cash equivalent and don’t carry the interest rate risk of longer bonds.

2. We’re not buying bonds here for their yield, but rather for their uncorrelation to stocks. Bonds remain the best diversifier alongside stocks.

3. No reason to expect interest rates to rise just because they are low. They have gradually declined for the last 700 years without reversion to the mean.

4. No reason to fear bonds at low, zero, or negative rates.

On the whole, I’m also not sure I’d call them “news articles.” They’re usually sensationalized fearmongering, similar to all the articles that have been written for years parroting that “the 60/40 portfolio is dead” or that “leveraged ETFs should never be held for more than a day.”

Keep in mind too this is also why we’re diversifying with other assets like gold, TIPS, REITs, international stocks, etc. While it’s technically bond-heavy, the stocks positions still likely contribute more volatility to the portfolio.

Alternatives would be volatility-minimizing portfolios like the Permanent Portfolio mentioned or the All Weather Portfolio.

Thankfully the value of my taxable account is high enough to where I don’t have to care too much about drawdowns. It’s entirely NTSX which is basically 90/60 exposure to a traditional 60/40 portfolio using the S&P 500 and intermediate treasuries.