The Paul Merriman 4 Fund Portfolio is a simple, equal-weighted equities portfolio that tilts toward small caps and Value stocks. Here we’ll take a look at its components, performance, and the best ETFs to use in its implementation.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Paul Merriman 4 Fund Portfolio Video

Prefer video? Watch it here:

Who Is Paul Merriman?

Paul Merriman is a financial advisor and educator who is referenced often in the financial blogosphere for his impactful and approachable analyses on index investing and asset allocation in relation to long-term buy-and-hold investing strategies.

Merriman founded an investment advisory firm in Seattle in 1983, from which he has since retired. He is regularly published on MarketWatch.com, and offers free podcasts, articles, newsletters, and more on his website PaulMerriman.com.

Merriman has written a number of highly-rated books that you can find on Amazon here. His newest one from November, 2020 is We're Talking Millions!: 12 Simple Ways to Supercharge Your Retirement. You can read more about him on his website here.

What Is the Paul Merriman 4 Fund Portfolio?

The Paul Merriman 4 Fund Portfolio, as the name suggests, is a lazy portfolio designed by Paul Merriman that utilizes equal weightings of 4 assets. The portfolio is 100% stocks and is thus considered more risky than his Ultimate Buy and Hold Portfolio.

To design the portfolio, Merriman looked within stocks at the styles and cap sizes that have paid a risk premium historically. Basically, the portfolio places large bets on the well-established Size and Value factor premia, tilting heavily to small cap stocks and Value stocks, to hopefully deliver market outperformance over the long term. The research is sound and the concept is simple.

Unfortunately the Size and Value factors suffered for the decade 2010-2020, lagging the market. I don't employ or advise market timing, but AQR maintains that Value is basically the cheapest it's ever been right now relative to history, suggesting that now may actually be the worst time to give up on the factor, and that it's due for a comeback. We would also expect factors to have negative premiums from time to time, even for extended time periods. Value stocks beat Growth stocks and small stocks beat large stocks in 2021 and 2022, so that comeback may be happening.

Merriman suggests that this 4 fund portfolio can indeed provide a “comeback” after all the recent market volatility. Note again though that this is a high-risk portfolio that is likely better suited for investors with a high risk tolerance and a long time horizon.

The Paul Merriman 4 Fund Portfolio looks like this:

25% S&P 500

25% Large Cap Value

25% Small Cap Blend

25% Small Cap Value

Just as with his Ultimate Buy and Hold Portfolio, Merriman walks us through each “building block” of the portfolio.

- The S&P 500 is considered to be a sufficient proxy for the U.S. stock market and is a good, diversified “work horse.” It provides a solid foundation for the portfolio across large-cap Growth and Value stocks.

- Large cap Value stocks have beaten large cap Growth stocks historically, so the 2nd building block is to tilt large-cap Value with 25%. This is again known as the Value factor premium.

- Small stocks have beaten large stocks historically, presumably because investors demand higher returns for riskier, more volatile small-cap stocks compared to large-cap stocks. This is known as the Size factor premium.

- Small cap Value stocks have beaten small cap Growth stocks historically, so we're tilting small cap Value with 25%. This enhances exposure to both the Size and Value factor premia.

My own personal portfolio tilts toward both of these factors.

Paul Merriman 4 Fund Portfolio Performance vs. the S&P 500

Going back to 1928, the S&P 500 index (U.S. large cap blend) has had a compound annualized return of 10.2% through 2022.

Large cap Value: 11.2%

Small cap stocks: 12.1%

Small cap Value: 13.4%

These 4 combined: 11.9%.

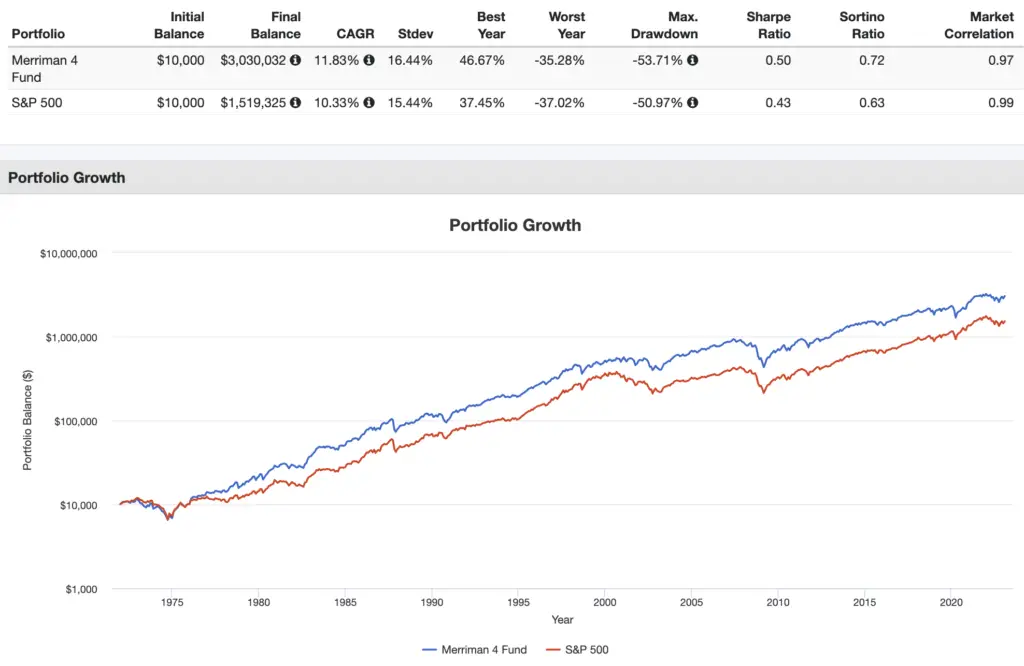

Here's a performance backtest of the Merriman 4 Fund Portfolio from 1972 through 2022:

It has smoked the S&P 500 historically, which again we would expect over the long term, even on a risk-adjusted basis despite its greater volatility.

Paul Merriman 4 Fund Portfolio ETF Pie for M1 Finance

M1 Finance is a great choice of broker to implement the Paul Merriman 4 Fund Portfolio because it makes regular rebalancing seamless and easy, has zero transaction fees, and incorporates dynamic rebalancing for new deposits. I wrote a comprehensive review of M1 Finance here.

Using Merriman's “best-in-class” ETFs, we can construct the Paul Merriman 4 Fund Portfolio like this:

- VOO – 25%

- RPV – 25%

- IJR – 25%

- AVUV – 25%

You can add the Paul Merriman 4 Fund Portfolio pie to your portfolio on M1 Finance by clicking this link and then clicking “Save to my account.”

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

Disclosure: I am long VOO and AVUV in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Hi John,

In your above review of the Merriman 4 Fund Portfolio you note that it is 100 percent domestic equity in its construction. That noted, the relative performance over a lengthy period seems to compare favorably with the S&P 500 Index. In other reviews you have published I have seen where you make adjustments to the creator’s portfolios which you contend might increase reward and possibly reduce risk; doing both at the same time. You also speak to the benefits of having a foreign component(s) as part of an effort to reduce the correlation which exists in a 100 percent domestic portfolio. Can you share an idea based on your analysis about what foreign equity EFT(s), and what allocation, might compliment the Merriman 4 Fund Portfolio?

Best to you, great web site.

John,

Just Portfolio Visualized Paul Merriman’s 4 Fund portfolio using the funds you suggest. It only went back to 2019 for AVUV so I substituted IJS which is also a small cap value. Then because VOO’s inception date is more recent than VFINX, I used VFINX to represent the S&P 500.

Well, significantly different results if the start date is Jan 2007 rather than the “way back” you used. CAGR for S&P 500: 10.00 %; Merriman’s 4 fund portfolio: 9.28.

Value funds haven’t outperformed growth and the S&P since 2004. I think the bloom is off the rose.

AND, while I’m at it, you have the wrong definition of risk. Who cares how volatile a portfolio is during the accumulation phase so long as it’s final value is greater at the end of the accumulation phase. In this regard, merely investing in the S&P in the long run will always give superior results. I can prove this using Portfolio Visualizer.

Tom, I’ve noted many times that Size and Value have both suffered recently, that we would expect extended periods of factor underperformance, and that volatility per se is not risk. I delved into those ideas here and here.

Hello! Since this includes Small Cap Blend, which includes Small Cap Growth, is that a problem per your reference here?

Thanks.

Impossible to know the future. I wouldn’t call it a “problem” but it is arguably suboptimal, though we can’t say for sure. SCG has done pretty well in recent years.