ETF. ETN. ETP. So many initialisms. Here we'll explore what these things are and what differences exist among them. Video Prefer video? Watch it here: ETF vs. ETN vs. ETP - What Do the Letters Mean? First, here's what these initialisms stand for: ETF - Exchange Traded FundETN - Exchange Traded NoteETP - Exchange Traded Product Secondly, I created … [Read more...] about ETF vs. ETN vs. ETP – Differences, Similarities, Risks, Etc.

Funds

QYLD – Avoid This ETF as a Long-Term Investment (A Review)

QYLD has been gaining popularity among income investors as a bullish-yet-defensive play on the NASDAQ 100. Here we'll review it and look at why it's probably not a great choice for a long-term buy-and-hold portfolio. Video Prefer video? Watch it here: Introduction - What Is QYLD and How Does It Work? QYLD is an ETF from Global X that holds the NASDAQ 100 … [Read more...] about QYLD – Avoid This ETF as a Long-Term Investment (A Review)

The 7 Best Inflation Hedge Assets and ETFs for 2025

Inflation fears are always lingering. Here we'll look at what inflation is, why it occurs, how it's measured, and the best assets to hedge against it with their corresponding ETFs for . Video Prefer video? Watch it here: Introduction - What Is Inflation? Simply put, inflation refers to an aggregate increase in prices, commonly measured by the Consumer … [Read more...] about The 7 Best Inflation Hedge Assets and ETFs for 2025

TQQQ – Is It A Good Investment for a Long Term Hold Strategy?

TQQQ has grown in popularity after a decade-long raging bull market for large cap growth stocks and specifically Big Tech. But is it a good investment for a long term hold strategy? Let's dive in. Video - TQQQ ETF Strategy Review Prefer video? Watch it here: What Is TQQQ? TQQQ is a 3x leveraged ETF from ProShares that aims to deliver 3x the daily returns … [Read more...] about TQQQ – Is It A Good Investment for a Long Term Hold Strategy?

VEA vs. VWO vs. VXUS – Which Vanguard International ETF?

Three of the most popular Vanguard international ETFs are VWO, VEA, and VXUS. Is there one that reigns supreme to hold alongside U.S. stocks? Video Prefer video? Watch it here: Diversifying with International Stocks Index investors in the U.S. usually know it's a good idea to diversify in equities outside the United States. At global market weights, U.S. … [Read more...] about VEA vs. VWO vs. VXUS – Which Vanguard International ETF?

The 3 Best Commodities ETFs To Invest in Commodities in 2025

Commodities offer a diversification benefit in a long-term investment portfolio. Here we look at how to invest in commodities broadly with the best commodities ETFs. Video Prefer video? Watch it here: Introduction - Why Commodities ETFs? Commodities - metals, energy, livestock, and agriculture - offer what's called an uncorrelation to the stock market, … [Read more...] about The 3 Best Commodities ETFs To Invest in Commodities in 2025

3 Best Convertible Bond Funds & Why You Shouldn’t Buy Them (2025)

Convertible bonds are a somewhat rare but interesting asset type. Here we'll explore what they are, how to buy them using the best convertible bond funds, and why you might (not) want them. Convertible Bond Funds Video Prefer video? Watch it here: What Are Convertible Bonds? As the name suggests, convertible bonds are corporate bonds issued by companies … [Read more...] about 3 Best Convertible Bond Funds & Why You Shouldn’t Buy Them (2025)

The Momentum Factor – Do Momentum ETFs Deliver the Premium?

The Momentum factor is one of the most studied - and simultaneously perhaps the most misunderstood - elements in finance. Here we discuss the Momentum factor, how one might access it with so-called "momentum ETFs," and whether or not investors can expect a premium. What Is the Momentum Factor? A few years after the Fama French 3 Factor Model emerged, Mark … [Read more...] about The Momentum Factor – Do Momentum ETFs Deliver the Premium?

The 3 Best Materials ETFs To Buy in 2025

The materials sector refers to the basic materials used in production. Here we'll check out the 3 best materials ETFs for . Video Prefer video? Watch it here: Introduction - Why Basic Materials ETFs? As the name suggests, "basic materials" refers to raw materials used in production and construction. Specifically, we're talking about companies involved … [Read more...] about The 3 Best Materials ETFs To Buy in 2025

5 Nuveen Funds for Targeted ESG Exposure in 2025

Nuveen funds provide targeted style and cap size exposure through an ESG lens. Here we'll check out 5 of them. Introduction - Nuveen Funds Nuveen is a subsidiary of TIAA providing funds for specific styles, cap sizes, and geographies with an ESG filter overlaid. Nuveen aims to invest "to make an enduring impact on our world." Nuveen claim to not avoid … [Read more...] about 5 Nuveen Funds for Targeted ESG Exposure in 2025

The 3 Best Transportation ETFs To Watch in 2025

The transportation sub-sector may be due for a rebound as we come out of the pandemic. Here are the 3 best transportation ETFs to capture that exposure in . Introduction - Why Transportation ETFs? The transportation industry has been one of the hardest hit by the pandemic, as travel was suspended and people have been staying at home and not traveling. This is … [Read more...] about The 3 Best Transportation ETFs To Watch in 2025

The Best (And Only) Airlines ETF for 2025

Interested in betting on (or shorting) the airlines industry? Capture the narrow transportation segment with the JETS ETF in . Introduction - Why Airlines ETFs? Airlines are a narrow play that may not move in the same direction as the much broader transportation segment of the market. As we come out of the pandemic, airline stocks are looking attractive for a … [Read more...] about The Best (And Only) Airlines ETF for 2025

5 Marijuana ETFs To Bet on Cannabis / Weed / CBD in 2025

Want to enhance your exposure to the myriad of cannabis and CBD applications? Here we'll check out 5 of the best marijuana ETFs for . Introduction - Why Marijuana / Cannabis / Weed / CBD ETFs? In the context of ETFs, all these terms are pretty interchangeable, even though they sometimes mean different things. CBD contains no THC, meaning it's not psychoactive. … [Read more...] about 5 Marijuana ETFs To Bet on Cannabis / Weed / CBD in 2025

The 4 Best Fintech ETFs for 2025 (Financial Technology)

Fintech ETFs capture stocks involved in financial technology, a fast-growing segment of the banking system. Here we'll check out the best fintech ETFs for . Video Prefer video? Watch it here: Introduction - Why Fintech ETFs? Fintech is shorthand for "financial technology." It refers to technology companies involved in mobile payments, e-commerce, … [Read more...] about The 4 Best Fintech ETFs for 2025 (Financial Technology)

The 5 Best Industrials ETFs for 2025

Sector ETFs are cheap and highly liquid now. Industrials broadly covers many sub-sectors. Let's check out the best industrials ETFs for . Introduction - Why Industrials ETFs? The industrials sector refers to companies involved in supplies and equipment used in manufacturing and construction. Sub-sectors include aerospace and defense, transportation, professional … [Read more...] about The 5 Best Industrials ETFs for 2025

The 8 Best Bitcoin ETFs and Cryptocurrency ETFs for 2025

Bitcoin and cryptocurrency in general have been surging in popularity in recent years. Here we'll check out the best Bitcoin ETFs and cryptocurrency ETFs for . Video Prefer video? Watch it here Introduction - Why Bitcoin ETFs and Cryptocurrency ETFs? There are thousands of different cryptocurrencies that have emerged - Bitcoin, Ethereum, Litecoin, … [Read more...] about The 8 Best Bitcoin ETFs and Cryptocurrency ETFs for 2025

The 4 Best Blockchain ETFS for 2025

Blockchain is heavily associated with cryptocurrency but is also used in investing, banking, and more. Here we'll check out the best blockchain ETFs for . Introduction - Why Blockchain ETFs? Blockchain is a relatively new technology used not only for cryptocurrencies but also in investing, banking, supply chain management, and more. Blockchain just refers to a … [Read more...] about The 4 Best Blockchain ETFS for 2025

The 4 Best Gaming ETFs for eSports Exposure in 2025

Interest in gaming and eSports is soaring, especially since more people are staying at home. Here we'll check out the best gaming ETFs to get in on the action. Introduction - Why Gaming ETFs? The gaming industry within the Consumer Discretionary and Communications sectors have outperformed the broader market over the past year. Interest in gaming and eSports has … [Read more...] about The 4 Best Gaming ETFs for eSports Exposure in 2025

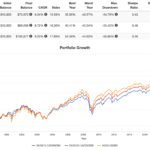

VYM vs. VOO & VTI from Vanguard – Dividends vs. Broad Market

VYM is Vanguard's dividend-yield-oriented ETF. VOO and VTI are their broad market index funds for the S&P 500 and total U.S. stock market. Let's compare them. In a hurry? Here are the highlights: VYM, VOO, and VTI are all very popular U.S. stock funds from Vanguard.VYM tracks the FTSE High Dividend Yield Index. VOO tracks the S&P 500 Index. VTI tracks the CRSP US … [Read more...] about VYM vs. VOO & VTI from Vanguard – Dividends vs. Broad Market

The 5 Best EV ETFs – Electric Vehicles ETFs for 2025

Electric vehicles (EV's) are here to stay and are surging in popularity, so EV ETFs are also emerging to fill that thematic fund demand. Below we'll explore the best electric vehicles ETFs to capture this narrow group of stocks in . Video Prefer video? Watch it here: Introduction - Why Electric Vehicles ETFs? With electric car sales skyrocketing, … [Read more...] about The 5 Best EV ETFs – Electric Vehicles ETFs for 2025