NTSX from WisdomTree is a relatively new ETF designed to provide access to asset class diversification without sacrificing returns in order to free up space in diversified portfolios. I think the fund is pretty clever, simple, elegant, and useful. Here's my summary and review.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

NTSX ETF Review Video

Prefer video? Watch it here:

NTSX – The What, Why, and How

NTSX is a relatively new ETF from WisdomTree that launched in late 2018. Its name is the WisdomTree U.S. Efficient Core Fund (formerly WisdomTree 90/60 U.S. Balanced Fund). It holds entirely U.S. securities, investing in 90% straight S&P 500 stocks (think 90% VOO or SPY, for example) and 10% 6x treasury bond futures using a bond ladder of different durations, providing effective exposure of 90/60 stocks/bonds, which is essentially 1.5x leverage on a traditional 60/40 portfolio, considered to be a near-perfect balance of risk and expected return.

Hopefully you didn't exit out of the page after you read the word “leverage.” Leverage per se gets a bad rap from survivorship bias and confirmation bias, because you only hear about the extreme cases, which are usually disastrous. In the right circumstances, I think it can be particularly useful and can even decrease risk, such as with the idea of Lifecycle Investing, applying leverage while young and deleveraging as you get older in order to diversify across time.

I'm always talking about how young investors with a long time horizon can reasonably expect to boost returns and possibly beat the market by using a “modest” amount of leverage applied to a broad index (or preferably, multiple indexes), and that this is statistically a far better bet than stock picking. “Modest” is admittedly subjective, but I'd say it's anything between 1 and 1.5.

I think NTSX perfectly embodies that idea. It's effectively applying 1.5x leverage but doing so with a diversified allocation of stocks and bonds (technically, bond futures), which are uncorrelated to each other, meaning when stocks zig, bonds tend to zag. This reduces the portfolio's volatility and risk. The traditional belief is that bonds – and more specifically, treasury bonds – are inherently less risky that stocks and provide downside protection during stock market crashes. Historically, this has been true. Diversifiers like bonds become more important as we increase portfolio leverage, as drawdowns become more damaging.

The idea is that levering up a balanced 60/40 exposure to 90/60 should provide roughly stock market returns with lower volatility and risk, and indeed this has been the case historically, which I'll illustrate below. Think similar returns to the S&P 500 with smaller drawdowns. We can say that over the long term, on average, compared to 100% stocks, we would expect NTSX to outperform during bear markets unless interest rates are rising faster than expected. I think this makes it a perfect investment for the moderate-risk-tolerance investor who wants returns similar to that of 100% stocks but who can’t stomach the volatility and drawdowns.

This enhanced exposure also makes something like NTSX a particularly attractive investment in the face of lower expected returns for both stocks and bonds in the near future. Rodrigo Gordillo of ReSolve Asset Management coined the term “return stacking,” suggesting that leverage in this context can be an “ally” for those with a long term view. I delved into the concept of return stacking here.

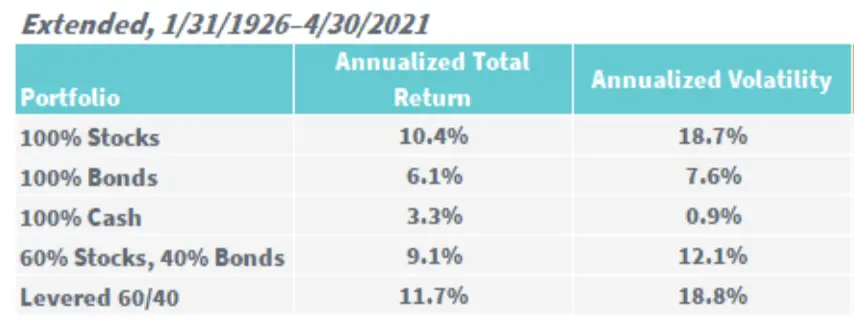

Of course, this idea isn't really new. We know from Markowitz's Modern Portfolio Theory from the 50s that we can allocate assets based on their relative “risk” – not dollar amount – to construct a more efficient portfolio than one of a single asset, and then we can lever up to increase exposure and subsequent expected returns. Cliff Asness showed that a 60/40 portfolio levered up to match the volatility of 100% equities has delivered higher returns historically. This is exactly what NTSX does. Here's how that would have worked out historically, from 1926 to 2021:

NTSX is an “Efficient Core” indeed. The fund only uses leverage on the bonds side in the form of futures contracts on treasury bonds, so no credit risk. The stocks side is unleveraged – just roughly 500 U.S. large cap stocks similar to the S&P 500. This is a simple yet elegant way in which NTSX was specifically built with tax-efficiency in mind, making it one of the few (if not the only) leveraged funds appropriate for a taxable account. Futures are taxed as 60% long term capital gains and 40% short term capital gains, as opposed to traditional bond interest being taxed as ordinary income. In fact, NTSX even has a lower tax cost than VTI!

It’s also cheaper to lever up bonds than stocks, and by using futures on a bond ladder, they’re not using daily-reset leverage usually seen with leveraged ETFs, so no volatility decay to worry about, and we're also largely avoiding counterparty risk, as bond futures markets are highly liquid. Even Bogleheads seem to like it for all these reasons.

All this comes at what I think is a low cost of only 0.20% for a packaged solution that novice investors would likely not be able to implement on their own. It's also been speculated that this is precisely the reason why the fund hasn't soared in popularity among portfolio managers. The theory is that ETFs that combine asset classes for you aren’t popular among advisors because they’re doing the work of the advisor. The aforementioned negative perception of the word “leverage” may also have something to do with it.

Those wanting a DIY version of this fund with ETFs can achieve roughly the same exposure with 90% VOO (S&P 500) and 10% TMF (3x long treasuries), rebalanced monthly, but it would be pretty tax-inefficient. You’d also still have an overall fee of roughly 0.13%, not to mention all the unwanted things like volatility decay, counterparty risk, greater borrowing costs, etc. A DIY version just doesn’t seem worth it in my opinion when NTSX itself is already sufficiently liquid, simple, elegant, relatively low-cost, and incredibly tax-efficient. You could also just buy treasury futures yourself, but that doesn't really seem worth the hassle either.

NTSX can be thought of as essentially a milder, cheaper version of the famous Hedgefundie Adventure.

NTSX vs. SWAN

NTSX is not unlike SWAN, though SWAN is designed more specifically for downside protection to hedge against black swan events, as the name suggests, aiming for 70/90 stocks/bonds exposure through options contracts on the stocks side. SWAN also commands a much larger fee and would be comparatively less tax-efficient than NTSX. Also keep in mind that WisdomTree's stated use case for NTSX is to use it to make room for other assets.

That said, these funds are pretty similar. In terms of exposure, NTSX is 1.5x 60/40 for effective 90/60, and SWAN is roughly 1.6x 44/56 for effective 70/90. Note that NTSX's treasury bond futures ladder has an effective average duration of about 7 years, while SWAN's treasury bond ladder aims to match the duration of the U.S. 10-Year Treasury Note.

NTSX Performance vs. the S&P 500 (SPY, VOO, etc.)

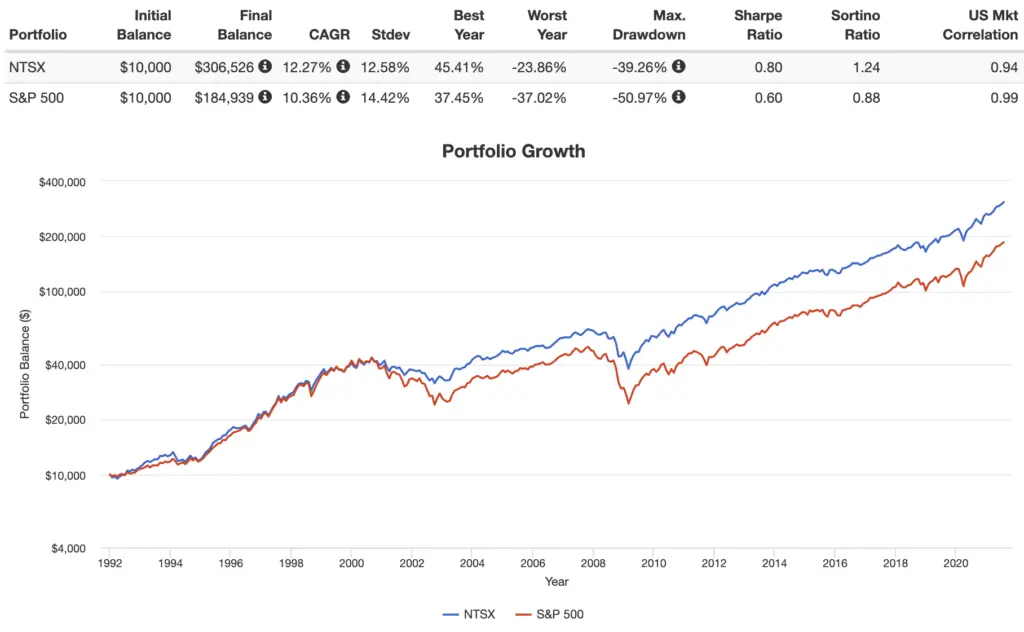

Remember, NTSX was designed to roughly deliver stock market returns but with lower risk. Conveniently, the bond bull market over the last 40 years or so has allowed a 90/60 portfolio to deliver above-market returns with lower risk. Here's a simulated approximation of NTSX vs. the S&P 500 from 1991 through July, 2021:

Use Cases for NTSX

Interestingly, NTSX is suitable for different investors with different goals depending on how it's used. For a young investor in the accumulation phase, 100% NTSX wouldn’t be a bad idea. You’d basically be treating it like a less volatile S&P 500 fund. This use case is illustrated in the backtest above. This would again simply be a 90/60 portfolio in a single fund, though note that your equities exposure would be entirely U.S. large caps.

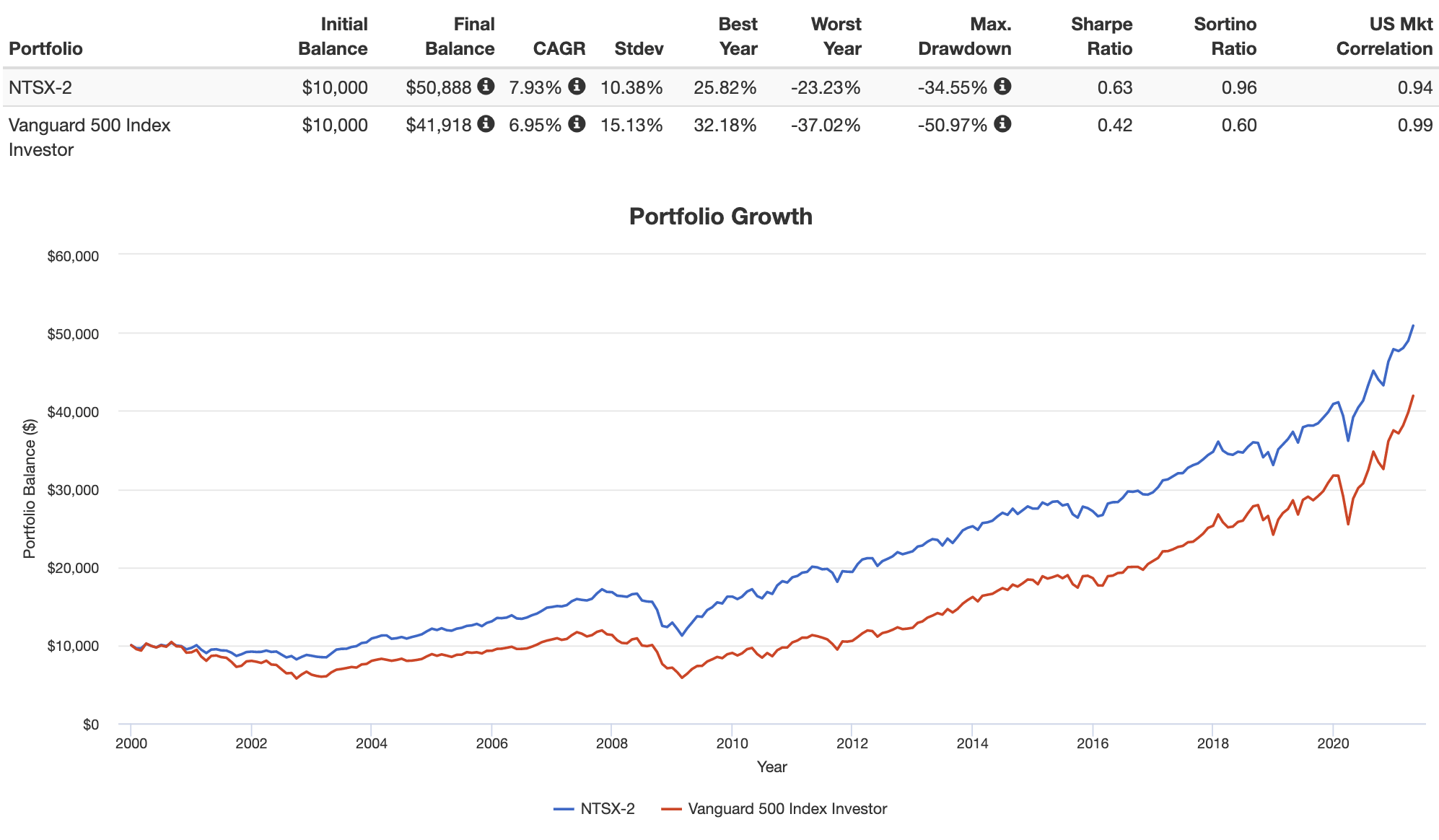

The primary use case suggested by WisdomTree themselves, on the other hand, suitable for older investors, even retirees, or anyone wanting more diversification, would be to use this fund at around 67% and diversify with that other 33% across other assets to further reduce the volatility and risk of the portfolio. The possibilities here are endless: international stocks, TIPS, factor tilts, gold, etc. Ideally, this would mean adding assets that aim to address a risk that both stocks and bonds suffer, such as TIPS for inflation risk. This could also mean simply adding assets that tend to be lowly correlated to both stocks and bonds, such as gold.

In this sense, NTSX basically provides a way to hold a traditional 60/40 portfolio – considered a near-perfect balance of risk and return – and still have room to diversify further. WisdomTree themselves state they aim to “boost the capital efficiency in the core to allow investors more flexibility” with these products.

A reasonable portfolio for this diversification use case in my mind, if one’s desire is to reduce volatility and risk, would be something like this:

- 60% NTSX

- 10% Small Cap Value

- 10% Emerging Markets

- 5% Developed Markets

- 10% TIPS

- 5% Gold

Here's a backtest of this use case vs. the S&P 500 from 2000 through April, 2021:

This portfolio would provide effective exposure of 79/46/5 stocks/bonds/gold.

Here's a link for that pie for M1 Finance if you're interested. I wrote a comprehensive review of the M1 platform here if you're interested.

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

Risks for NTSX

Originally, fundamental risks of liquidity and fund closure were concerns. I got into NTSX when its AUM was a little under $100M, with the cautious expectation that it may close within the year. Thankfully, AUM has now grown to around 6X that, approaching $600M. Again, it seems that it hasn't taken off with retail investors perhaps because it seems like a sophisticated product (with no marketing behind it), and it hasn't taken off with advisors/managers because it potentially puts them out of a job.

An obvious shortcoming of this fund – solved somewhat by the above proposed use case – is the lack of geographical diversification in equities. WisdomTree may have heard that complaint from investors; they recently filed for 2 new products like NTSX using Developed Markets and Emerging Markets. Whether or not those will materialize into viable ETFs is another story yet to be seen.

Update – May 20, 2021: Today, those two ETFs – NTSI and NTSE – launched for Developed Markets and Emerging Markets, respectively. I'm curious to see if they attract assets.

Update – August 9, 2021: A little less than 3 months later, NTSI and NTSE still have concerningly-low AUM of about $16 million and $2 million respectively. I'm hopeful they'll grow and stick around, but only time will tell. I still don't own them.

Update – January 3, 2022: NTSI and NTSE have attracted more assets and now have about $86M and $36M respectively. Industry rule of thumb says a “safe” minimum is $50M, after which fund closure becomes much less likely. So these two newer funds are now more attractive and viable in my opinion. I'm hoping the trend continues upward. I still don't own them at this time. Volume and spread still appear to be worse for NTSE, as we'd expect.

Update – February 18, 2022: Time flies. A year later, NTSI and NTSE have now attracted assets of about $217M and $50M respectively.

Update – June 2024: Time flies. NTSX, NTSI, and NTSE now have assets of $1B, $330M, and $27M respectively. NTSX and NTSI are now far away from the chopping block, though weirdly NTSE went in the opposite direction and pales in comparison to its older sister funds. I'd like to think that the success of NTSX and NTSI would help ensure the continued viability of NTSE.

The downfall of NTSX would be what I would argue is a rare simultaneous combination of economic factors: rapidly rising interest rates, runaway inflation, and slow economic growth. But this scenario would also wreak havoc on virtually any diversified portfolio that holds mostly stocks and bonds. This concern can also be mitigated with an allocation to things like TIPS, international stocks, managed futures, and gold, as I suggested above.

I actually think that’s why it’s also important to note that the effective duration of the bond allocation is intermediate (about 7 years), not long-term, posing less interest rate risk. This is why NTSX still outperformed the S&P 500 during periods where interest rates rose slowly. There also tends to be more roll yield to be captured in the middle of the yield curve.

Is NTSX a Good Investment?

So it NTSX a good investment? Maybe.

I think NTSX is an extremely interesting, useful, and clever product that can be inserted into different strategies, risk tolerances, and time horizons. The fund is incredibly tax-efficient, and it provides a packaged solution for retail investors who want the long-term returns of 100% stocks without the associated volatility and risk, all at what I consider to be a pretty low fee. The fund's risks are easily mitigated by diversifying across other assets and geographies, and its intermediate effective bond duration should bode well for future performance even in a rising rate environment.

What do you think of NTSX? Let me know in the comments.

Disclosures: I am long NTSX in my own portfolio. It comprises most of my taxable account. I know it sounds like I'm selling this fund pretty hard, but note that I am not affiliated with WisdomTree at all and I get no sort of kickback or compensation from them if you decide to buy NTSX (or any of the other funds listed here). I've also received no form of compensation from WisdomTree for the words I've written on this page. My discussion and appreciation of NTSX are simply the result of my own independent research and analysis.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Hey John, first of all wanted to say thanks for the amazing content — I’ve learned a ton about leveraged funds and factor investing because of you.

I’ve chosen NTSX as the main fund in my taxable account because of a lot of the points mentioned in this article, but recently noticed something interesting you said in your Ginger Ale Portfolio article: “In other words, going 6x on intermediate treasury bonds (what the WisdomTree funds do) is nearly the same exposure as what EDV provides.”

If this is true, what are the benefits of going with NTSX (90/60) as opposed to 90/10 with EDV? In theory, the latter portfolio should be simpler because it avoids any leverage complications. And looking back historically these portfolios perform basically identically (https://www.portfoliovisualizer.com/backtest-portfolio?s=y&sl=RzVMq9fWWG0GHn76drkzu). So I’m curious if there are factors still pulling you to NTSX here and why this situation would be different than the Ginger Ale one where you find introducing those intermediate term treasuries unnecessary.

Great question. Not too different. Like you noted, simplicity is a big factor, and with that, mental accounting – some would see EDV down and stocks up or vice versa and feel bad about one component dropping. Note that EDV’s phantom interest would be taxed as ordinary income in taxable space. Could even use the two ideas as a tax loss harvesting pair. I also somewhat irrationally like to have “skin in the game” – if I praise the merits of a fund like I did with NTSX, I should probably own some so that readers see that I eat my own cooking.

First of all, thanks a lot for the amazing content! I’ve based my entire investing on the learnings from this website.

I just wanted to tell you and that this ETF is finally available for EU investors! It’s been really frustrating the low availability of factor and other non-broad indexes, so this is good news.

Thanks!

Thanks! Glad it has been helpful! Thanks for sharing that info.

Hello John,

Is the cost of leverage taken into account in the backtest?

After searching on the internet, it seems that the cost of leverage is equal to the fed funds rate which would currently be 5.33% per year.

Can we consider that the coupon on US Treasury Bond Futures is also 5.33% per year?

In this case, 90% stocks and 10% unlevered bonds are free = 100%.

There remains the 50% leveraged bonds, 50 * 5.33% = 2.665%

If I bring back to 100/150 * 2.665% = 1.78%

But if we consider that the US Treasury Bond Futures coupon neutralizes the cost of leverage of 5.33% per year, would the 1.78% per year be free?

I’m a little lost in understanding what to pay in addition to the TER at 0.20%.

And in addition to the leverage costs, knowing that I use the WisdomTree US Efficient Core UCITS ETF USD Unhedged Acc ( Ticket : WTEF, ISIN : IE000KF370H3 ) because I am a European investor and it only has 6 million outstanding, does it there would not be more other costs?

Good write-up – been using NTSX myself as part of a capital efficient strategy. 50% NTSX, 30% AVUV, 20% DBMF. Net exposure is 45% U.S. large cap, 30% U.S. SCV, 30% Treasurys, 20% trend-following, or 75%/30%/20% stocks/bonds/alts (1.25x leverage). Thoughts?

Now if they’d just do a Global (VT) version… wouldn’t a 90/60 where the 90 is VT be something many folks would go for? You could practically VT and Chill with one tax efficient fund.

Indeed, Jeff. Would love that. Someone on Reddit mentioned the same thing.

Thoughts, anyone, on the effects of yield curve inversion on NTSX? Seems like you would have negative carry on the Treasury futures.

Would a three fund solution work?

55% NTSX

15% AVUV

30% VXUS

I would like to circle back around and present a new portfolio. I’m calling it the Diet Ginger Ale. Similar taste with half the ingredients.

30% NTSX

30% AVUV

40% DFAX

John can I get your thoughts on combing NTSX with managed futures etf? For example 67 NTSX/33 DBMF. Managed futures are uncorrelated with Stocks and Bond leading to more diversification. The issue with managed futures is that it depends on the active manager. Which is bad however DBMF is diversified by replicating 20 ctas so you get an index of multiple active managers

I would be curious to hear about John’s opinion on this too.

Admittedly I’m not super well versed on managed futures.

Must have missed this originally. Admittedly I’m not super well versed on managed futures.

What’s the exact link to wisdomtree’s 1926 backtest?

It’s in the fund literature.

Hi John,

I’ve been reading through a lot of your articles over the past year and plan on implementing the Ginger Ale portfolio. I was originally going to include VOO, but after stumbling on this article, I liked some of the benefits that NTSX provides. I was wondering if the below asset allocation is redundant or too conservative based on my investing horizon? (30 years – moderate to high risk tolerance). I would like to get some tilts for small cap value (AVUV, AVDV, DGS) and geography (VWO, VEA) as well. I know you mentioned that NTSX is essentially 90/10 VOO/EDV and that you are worried about NTSE and NTSI having low AUM/volume. I know this isn’t financial advice, but any recommendations to tailor this better for my investing horizon would be greatly appreciated. Thanks for all your hard work!

25% NTSX

25% AVUV

10% VEA

10% AVDV

10% VWO

10% DGS

10% EDV

I can’t provide personalized advice. I don’t think replacing VOO with NTSX is unreasonable, but make sure that bond exposure combined with EDV satisfies your goals.

Hi, John! Optimizedportfolio is definitely fun and useful site.

In my Taxable account, I am interested in getting 50% NTSX along with 50% International etf (via Developed Market ex US + Emerging Market, or Total international).

Contrary to NTSX, are NTSI and NTSE tax-efficient enough to be in a taxable account? I see that at the end of the year, NTSI distributed some capital gains, while NTSE distributed a lot of short-term capital gain (which I learned is not tax-friendly.)

If NTSI/NTSE are not tax-efficient, what international ETF would you recommend for taxable account to pair with NTSX (VXUS, VEA)?

Just note that your portfolio would be 45% US 50% int’l. The rest (effectively 30%) would be bonds.

Hi John,

Would this be a reasonable alternative to your emergency fund portfolio, in a taxable account?

I’m new here and have a dumb question – how did you backtest NTSX so far when it’s only been around a short time? I can’t get Portfolio Visualizer to do that. Did you use a “leverage” option on a regular 60/40 fund?

Yes, rough approximation using mutual funds – 90% S&P 500 and 60% intermediate treasury bonds.

Have you given much thought to USMV vs NTSX as the basis of your core position. As you noted over long periods of time USMV will outperform S&P500. It has similar total risk and market beta to NTSX. Let me know your thoughts. Thanks.

Also there are widely available international min vol equity ETFs as well for global diversification (although this strat doesn’t work well in EM).

Fine for someone who wants to target low vol, which essentially just ends up being stocks with large loadings on Profitability and Investment. Its overlap with the broader market is only about 33% so you’d be comparatively less diversified. I wouldn’t compare it to NTSX because they are 2 completely different products.

Hi John,

What are your thoughts on the recent underperformance of NTSX vs the S&P500? I’m concerned about the rising interest rate environment with the hawkish fed having an excessive negative impact on NTSX and therefore wonder if I truly can use NTSX as a set and forget ETF in my taxable account.

I’d appreciate any insight you have!

Why would I be concerned with recent performance? As always, stay the course and ignore the short-term noise. I’m in it for the long-term. I don’t try to time the stock market or interest rate changes. All else equal, the investor whose time horizon is greater than their effective bond duration should be indifferent to interest rate changes. It sounds like these funds may not fit your risk tolerance.

Is there a good explanation to read up on how rolling futures over an X-duration time period is independent of interest rates?

That comment was based on the idea that a bond fund would be expected to have a positive return – returning its par value plus interest – at maturity, and on the fact that duration is the point at which a bond’s price risk and reinvestment risk “cancel” out, not on anything to do with rolling futures contracts. Vanguard’s BND, for example, has never had a 7-year period with a negative return. NTSX’s treasury futures are replicating a bond fund with an effective duration of about 7 years. I touched on some of these concepts here.

Thanks for your insightful posts.

I am trying to figure out what advantage NSTX with diversification confers over the All-Weather Portfolio. Is there an angle I am missing?

Just different weights and slightly different assets. NTSX is 90/60 so you’d be getting leveraged exposure.

interesting nice fund for a taxable account, while offering a little better downside protection than vanilla S&P500. I haven’t heard of anything similar for NDX. It would be nice if they offered something like this too, for QQQ too. I don’t know enough to get into treasury futures myself,

along the same lines, i’m curious if I 90/10 QQQ/treasury futures alongside some money in NTSX, if that would be considered a diversified entry level portfolio. I’m just starting out.

No need. NDX is already inside SPX.

Thank you for the great post. Just to update this, NTSX now has AUM of $927mm, and NTSI has AUM of $109mm. I am currently 100% NTSX in my IRAs and am considering going 75% NTSX and 25% NTSI now that the AUM on the NTSI is above $100mm.

Would you plan to deleverage later on? I’m curious if you’d feel comfortable holding and adding to this 100% for the long haul and if not, what would you do later on to deleverage (retiring and slowly selling, paying tax, and converting?). Thanks!

Yes. I’d feel comfortable using NTSX to make room for other diversifiers like I noted, but not 100% NTSX.

“The downfall of NTSX would be what I would argue is a rare simultaneous combination of economic factors: rising interest rates, runaway inflation, and slow economic growth. But this scenario would also wreak havoc on virtually any diversified portfolio that holds mostly stocks and bonds. This concern can also be mitigated with an allocation to TIPS, international stocks, and gold, as I suggested above.”

With the fed going hawkish and end of QE, potentially QT and rate hikes, coupled with the slowing growth of the economy, this seems like especially adverse conditions using leverage.

Have you or do you anticipate adjusting your allocations any? I have a somewhat similar Ginger Ale portfolio, but with increased Real Estate, Energy, Healthcare exposure, but I have been slowly reducing my NTSX, I am curious if you have taken any actions and if so or if not, I’d love to hear your reasoning.

Thanks!

Thanks for the comment, Jim. I don’t try to time the market so I have not taken any actions or made any adjustments. I did buy $20k worth of I Bonds, though.

How do you backtest so far back? This goes back before the ETF even existed

Mutual funds to match target exposure.

Hi John, did you notice that NTSI AUM increased to USD 86MM and NTSE to USD 31MM? Do you think the AUMs are still concerningly low? Thanks, Simon

Hi John,

Huge fan of your website, which I’ve recommended to numerous friends in my crusade against financial advisors…

One question, I’m having a hard time squaring your comments about your Ginger Ale portfolio being your portfolio, with your comment here that NTSX constitutes almost of all your taxable account. Are you 70% NTSX /30% Ginger Ale? I don’t think you are, but just wondering if you don’t mind sharing.

I’m thinking of going 70% of my taxable in NTSX and am still trying to figure what to do with the remaining 30%.

Thanks! Taxable account is small. 90/10 VOO/EDV is roughly NTSX.

Hi John,

There are many thanks for you and not without reason. I really appreciate your work.

One question popped to my mind and I couldnt find any answers for that.

In the brochure WisdomTree writes “Should the Funds deviate from the targeted 90% equity and 60% U.S. Treasury allocations by 5%, the

fund will be rebalanced back to target allocations.” https://www.wisdomtree.com/-/media/us-media-files/documents/resource-library/investment-case/the-case-for-the-efficient-core-fund-family.pdf.

So I think that should mean that if stocks drop eg 10%, they rebalance it right away and if we get a bounce back, the rise should be faster than index because we have invested more on stocks during that downturn. I can not see this kind of effect in the NTSX chart. And this leads to other question: if we get a long bear market, eg few years, NTSX will be rebalanced at least every 3 months. Then we take a good hit from that bear market because we have invested more in the downtrend and when we finally see the turnaround, our overall portfolio is so much smaller that the next allocation will not help a lot to keep in run with the index.

Sorry my bad english. I hope that I have understood something wrong because I really like the idea 90/60. I just dont like current valuations.

Thank you, a lot..

Toni

PS. Somebody asked if this can be bought outside US. At least from Finland it is possible.

Thanks for the comment, Toni. I wouldn’t overthink it. A 5% rebalancing band is pretty common practice and is probably a sensible approach. It wouldn’t be easy to spot the rebalancing effect in a performance chart.

Thanks John! Once again, you’ve thoroughly covered a fascinating sensibly leveraged fund that is now totally on my radar. I don’t think I could ever personally commit to an all-equity 2X to 3X fund even with a barbell strategy of putting it together in tandem with a 2x to 3X bond fund. However, this offering from WisdomTree is a fascinating middle ground with less leverage and a more conservative 90/60 ratio.

One question I’ve been wondering is whether you’d at some point consider a triple allocation of NTSX/NTSI/NTSE in the 50-60% range allowing you 40-50% to add some of your staple holdings in your Ginger Ale portfolio. Small cap value (domestic, international, emerging) and possibly some combination of alternatives other than stocks/bonds considering you get substantial coverage with the WisdomTree trio along with global diversification. Would the bond portion of your NTS series funds encourage you to be more aggressive with additional equities or stock/bond alternatives or would you still want to keep the STRIPS component?

Thanks! NTSX is my taxable account. I wish NTSI and NTSE would attract assets; still very low AUM. NTSX is close in effective exposure to 90/10 VOO/EDV.

Thanks John! Yeah, it is frustrating how sometimes the INT DEV and EM market version of a great fund/strategy doesn’t attract the assets of the US version. I can think of a number of examples of this. One that comes to mind is MOAT.

Thanks again for the great posts on leverage. Do you anticipate an all in one asset allocation leveraged ETF being launched in the future similar to PSLDX? It is fascinating that only component leveraged ETFs exist (stocks, bond, commodities) at the moment with no asset allocation ones available.

SEC said no more 3x ETFs so I’d bet they’ve gotten tighter on restrictions. But I think the makers of RPAR are launching a more leveraged version.

John,

I’ve become a huge fan of your site over the last few weeks; you’re doing yeoman’s work for the level-headed investing community at a time when there’s so much noise and speculation – thank you.

I’m in the process of committing to Boglehead principles in all of my tax-advantaged accounts, but still have some individual stocks and complicated and/or high-ER ETFs gathering dust in taxable brokerages (some money in Betterment and in TD Ameritrade). My main taxable account is at Fidelity, and it is almost entirely NTSX as I believe (as you articulated) that it is the ideal merging of Boglehead and Lifecycle investing philosophy. Knowing that you’re 100% NTSX in your taxable account, 1) did you exit other positions, and 2) how did you do this in the most tax-efficient way?

Best,

Dylan

Thanks for the kind words, Dylan! Glad you’ve found the content useful. I didn’t have much in a taxable account until recently so I just started making new, large deposits into NTSX. Most tax efficient way would be to harvest any losses, don’t sell anything with large gains, and just start buying NTSX. Basically what I did.

Hello!

Thank you for all of your time and effort on these posts. I appreciate how much is drawn from letting the data speak for itself.

Any plans on doing an article for NTSI and NTSE?

I would be curious to see your take on these.

Thanks again!

Thanks Alex! I probably won’t just because they’re the same thing as NTSX but for Developed and Emerging markets respectively, so I’d be writing the same things. They also still have concerningly low AUM.

How many millions under aum do you think is reasonable? Ntsi seems to suggest 86 million right now.

It just updated this week. I’d say $50M minimum for me personally. That’s the threshold where closure becomes much less likely.

If I wanted NTSX with some international exposure and a small cap value tilt, what would you think of the following?

60% NTSX

15% NTSI

5% NTSE

20% AVUV

If I wanted to add some margin in a taxable account, taking a page out of lifecycle investing to diverse across time, how would you consider 20-30% purchased on margin of the same securities keeping the same allocation?

Hey John and Alex,

Just FYI, I recently checked and there seems to have been a significant inflow to both NTSI and NTSE recently when analyzing the funds on Morningstar. They’re at 86 and 36 million respectively now. When I checked a few weeks ago they were a tiny fraction of this.

Thanks!