Here we dive into the famous “Excellent Adventure” from Hedgefundie and how to implement it.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

In a hurry? Here are the highlights:

- Hedgefundie

iswas a member of the Bogleheads forum. - Hedgefundie created a thread in February 2019 proposing a 3x leveraged ETF investing strategy based on risk parity using the S&P 500 index (UPRO) and long-term treasury bonds (TMF) held in a 40/60 allocation. The thread later expanded into a Part 2.

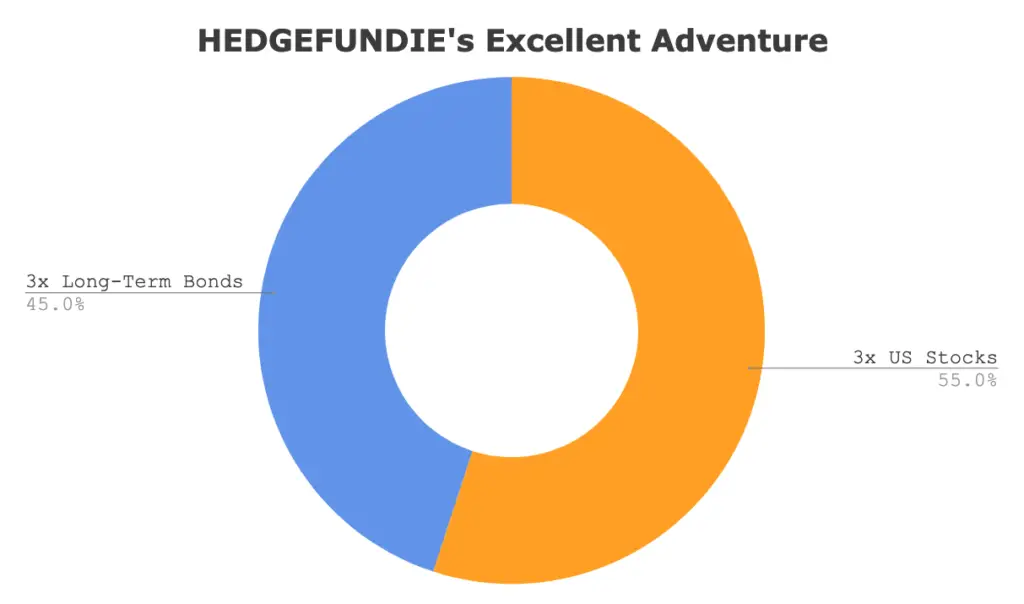

- Hedgefundie later updated the strategy's asset allocation in August 2019 to 55/45 UPRO/TMF.

- Extensive backtesting, discussion, and analysis within the thread by members of the Bogleheads forum supports the validity and potential market outperformance of the strategy.

- The proposed strategy calls for quarterly rebalancing.

- Several different protocols/variations of the strategy emerged in the Excellent Adventure thread, including monthly rebalancing, rebalancing bands, and volatility targeting with various lookback periods.

- Some users have added a dash of TQQQ (3x the NASDAQ 100 index) for a minor tech tilt, as Big Tech has had a stellar run recently.

- It is recommended to implement the strategy within a Roth IRA on M1 Finance, to avoid tax implications and to make regular rebalancing seamless and easy.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Contents

Video

Prefer video? Watch it here:

Who Is Hedgefundie?

Hedgefundie is was a member of the Bogleheads forum who created a now-famous thread on the forum proposing a 3x leveraged ETF strategy.

What Is the Hedgefundie Strategy?

The Hedgefundie strategy – the wild ride of which is known as “Hedgefundie's Excellent Adventure” – is based on a risk parity allocation of leveraged stocks (3x the S&P 500 index via UPRO) and leveraged long-term treasury bonds (3x the ICE U.S. Treasury 20+ Year Bond Index via TMF). Note that “HFEA” is the shorthand initialism for the name of the strategy, not the ticker for a fund.

Risk parity is a portfolio allocation strategy in which, consistent with Modern Portfolio Theory (MPT), risk is spread evenly among assets within the portfolio by looking at the volatility contributed by each asset, thereby attempting to optimize returns per unit of risk (Sharpe). I explained it more here. Parity between stocks and long treasuries is roughly achieved at 40/60.

The Hedgefundie strategy relies heavily on the negative correlation (or at least, uncorrelation) between stocks and long-term treasury bonds, wherein the bonds provide a buffer during stock drawdowns. Long-term treasuries are chosen precisely because they are more volatile than shorter-duration bonds and because of their degree of negative correlation to stocks, in order to sufficiently counteract the downward movement of a 3x leveraged stocks position in a crash. I delved into these specific benefits of treasury bonds here. This concept is based on the simple historical principle of improving risk-adjusted return (Sharpe) over long periods by holding uncorrelated assets, such as a traditional 60/40 stocks/bonds portfolio, as opposed to 100% stocks. In a nutshell, this is a way to hold UPRO long term in a much more sensible way.

Consistent with the idea of Lifecycle Investing, this heavily-leveraged strategy is better suited for young investors with a long time horizon who can afford to be risky early in their investment horizon. Hedgefundie advocates for treating this strategy like a “lottery ticket” and not using it with a significant portion of your total portfolio value.

Critics and naysayers reflexively exclaim the oft-cited, overblown, platitudinous “Leveraged ETF's aren't meant to be held long-term because of volatility decay,” but, in short, that doesn't concern me. Moreover, that same volatility decay can actually help when upward movement with positive momentum is occurring. I would also argue that as long as you can stomach the volatility, a major drop should [eventually] be followed by a major rebound; 3x hurts on the way down but helps on the way up. UPRO from ProShares and TMF from Direxion were chosen due to their low tracking error and high volume; again, we're getting 300% exposure to the S&P 500 and long-term treasury bonds, respectively.

The proposed strategy calls for quarterly rebalancing. Several different protocols/variations of the strategy emerged as the Excellent Adventure thread progressed, including monthly rebalancing, rebalancing using bands, and volatility targeting with various lookback periods. I'd keep it simple and avoid checking it often; I can see it being very easy to get emotional with this strategy and abandon your plan. It is recommended to implement the strategy within a Roth IRA on M1 Finance, to avoid tax implications and to make regular rebalancing seamless and easy.

I know this sounds saIes pitchy, but if you're wanting to use this strategy in a taxable account, I would argue it makes even more sense to use M1 Finance because if you're choosing to put in new deposits, the system will automatically rebalance the portfolio for you by directing new deposits to buy the underweight asset, thereby allowing you to avoid capital gains taxes that would otherwise be incurred with a manual rebalance. This is more impactful than it might sound at first. These are 3x leveraged ETFs; they can very quickly get out of balance. For example, let's say you start out at the prescribed 55/45 and stocks take off and bonds suffer, which causes it to stray to 75/25 after only a month. Not good. At this point you'd have to incur short term capital gains taxes (ouch!) just to get things back in balance. Granted, at a certain point, your new deposits may not be sufficiently large enough to provide the full rebalancing effect on their own, but that would be a great problem to have.

Utilizing a traditional, unleveraged 40/60 stocks/bonds portfolio, compared to an all-equities portfolio, has relatively low volatility and should produce higher risk-adjusted return (Sharpe) over long time periods, but would also likely underperform an all-equities portfolio in terms of total return. The solution, Hedgefundie maintains, is applying leverage. We're attempting to accept a risk profile similar to that of the S&P 500, but with much higher expected returns.

Hedgefundie updated the approach 6 months after posting the original strategy, opting to move to a 55/45 UPRO/TMF allocation from the previous 40/60 risk parity allocation. Hedgefundie's reasons are laid out here, based primarily on the premise that the stocks portion of the strategy is the primary driver of the strategy's returns and that the main purpose of holding the treasury bonds is essentially as “insurance” in case of a stock market crash.

Intrinsically, we're relying on US stocks and long-term treasuries not crashing in tandem. At the time of writing, these assets have a seemingly reliably negative correlation close to -0.5 on average. A key fundamental assumption of this strategy that Hedgefundie proposes is that the US will not return to pre-Volcker (pre-1982) monetary policy. That is, we'll be able to significantly mitigate or altogether avoid runaway inflation periods like the late 1970's, during which time bonds suffered greatly.

Stocks and long-term treasury bonds do not have a perfect -1 correlation. Sometimes they move in the same direction. This is actually a good thing. Historically, when these assets moved in the same direction, it was usually up. On days when stocks dropped, long-term treasuries fairly reliably rose significantly to mitigate the total loss.

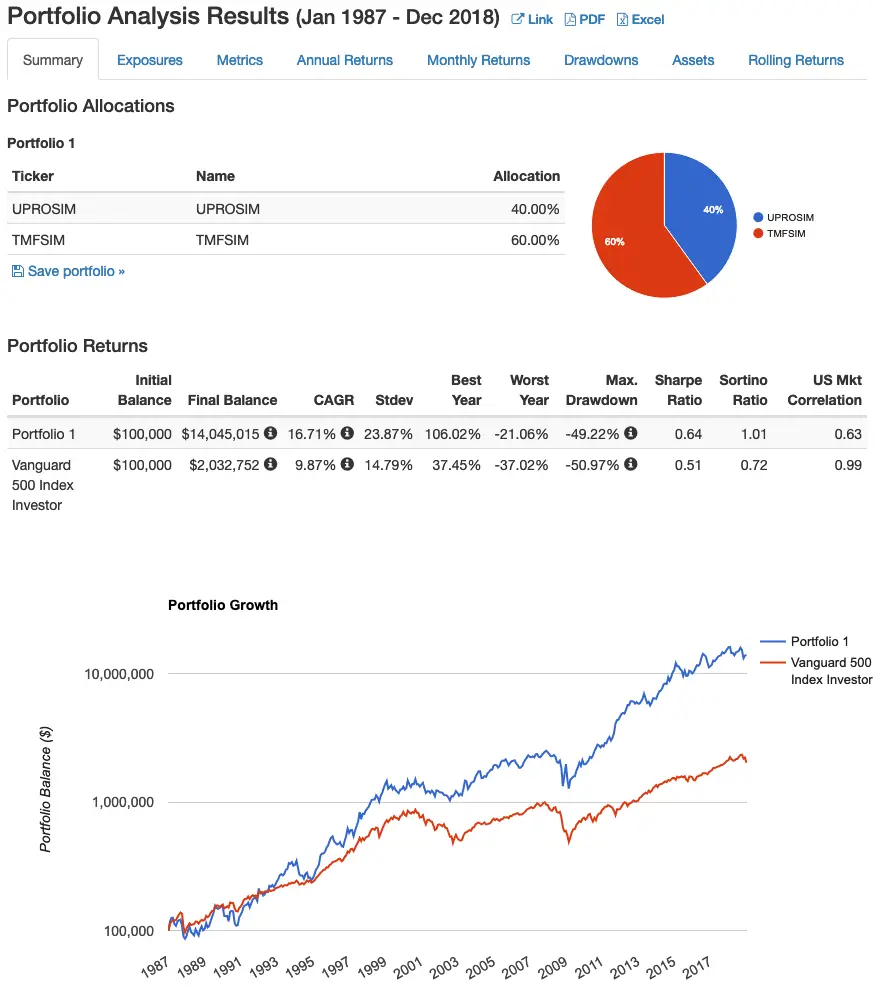

Simulated returns going back to 1987 look like this:

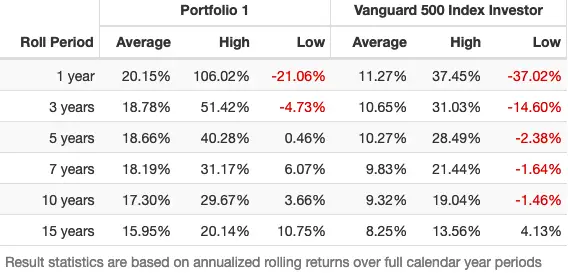

Here are the rolling returns:

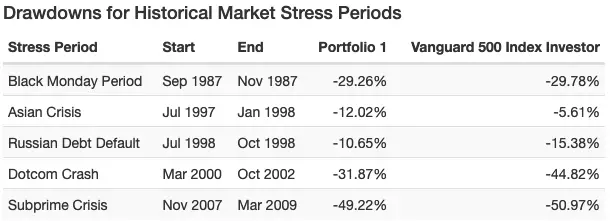

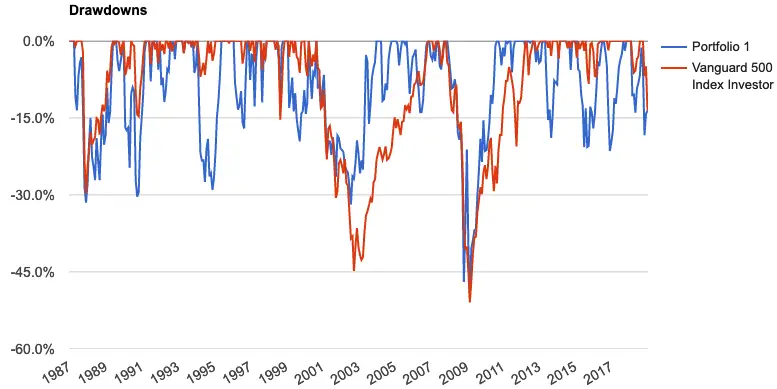

Below are the drawdowns. Notice the smaller drawdowns in most cases compared to the S&P 500:

I agree with Hedgefundie's assertion that extremely volatile assets like gold, commodities, small caps, etc. would suffer worse from volatility decay and would not improve the strategy's diversification and return. International developed markets may be a viable option to include, but Boglehead member siamond found issues with the DZK ETF, which ended up closing in October, 2020 anyway.

If you wanted to for some reason, you could also use the slightly more expensive SPXL instead of UPRO. Their liquidity and performance should be nearly identical.

Make no mistake that this is a risky strategy by its very nature. Read up on leverage and the nature of leveraged ETF's before employing this strategy. Do not put your entire portfolio in this strategy.

Read more details and nuances of the strategy on the original thread here. If you've got the time, there's a lot of learning to be had throughout the entire thread. The thread has expanded into a Part 2 here.

UPRO vs. TQQQ

Some users have added a dash of TQQQ (3x the NASDAQ 100 index) for a minor tech tilt, as Big Tech has had a stellar run recently. Others still are using TQQQ as the entire equities position for the HFEA strategy. I personally think this is unnecessary and is purely performance chasing as a product of recency bias.

Imagine for a second that this is January, 2010. After the previous decade, the S&P 500 is down by about 10% for that time period versus the Nasdaq 100 being down about 50%. Would you still be as enthused about TQQQ? Logically, we should be more willing to buy when prices are low, but I’d be willing to bet the honest answer to this question for most folks would be “no.” A rational investor should want to avoid expensive stocks and buy cheap stocks, but this unfortunately isn’t how investors’ highly-emotional brains work.

TQQQ has beaten UPRO historically in terms of sheer performance. But don’t succumb to recency bias. Past performance does not indicate future performance. More importantly, large cap growth stocks are now looking extremely expensive relative to history and are at the valuations we saw in 2000 at the height of the tech bubble, meaning they now have lower future expected returns. To make things worse, fundamentals of these companies do not explain these valuations. The current situation is simply the result of an expansion of price multiples.

Value stocks, on the other hands, are looking extremely cheap, meaning they now have greater expected returns. Of course, we expect Value to outperform every day when we wake up anyway due to what we think is a risk factor premium. If you buy TQQQ, you won’t own any Value stocks. TQQQ is purely large cap growth stocks, the segment with lower expected returns. You also won’t own any small- or mid-cap stocks, which have outperformed large stocks historically.

The valuation spread between Value and Growth was recently as large as it’s ever been. Historically, wide value spreads have also reliably preceded massive outperformance by Value. At the end of the day, we’re still paying for a discounted sum of all future cash flows; Growth cannot get more expensive forever. Unfortunately, there's no leveraged Value ETF.

People like to claim “tech is the future!” That may be true, but that doesn’t have much to do with stock market returns, which are not correlated with GDP. The economy is not the stock market, and the stock market is not the economy. Remember that extremely high expectations for these tech firms are already priced in, and they will have to exceed those expectations in order to beat the market. Moreover, good companies tend to make bad stocks and bad companies tend to make good stocks.

Also remember that you don’t need a “tech tilt” anyway; the market is already over 30% tech at this point. The NASDAQ 100 is basically a tech index at this point; it's realistically about 70% tech, posing a sector concentration risk, which is uncompensated risk.

While I don't employ or condone market timing, we also must acknowledge the fact that we may see rising interest rates sometime in the near future, and TQQQ inherently has more interest rate risk than UPRO. Moreover, TQQQ by definition excludes Financials, which tend to do well when interest rates rise.

Now may be the worst time to overweight large cap growth, but my time machine is broken. Only time will tell which index outperforms. We can’t know the future, but I would argue that’s the reason for broad diversification in the first place.

Why Not 100% UPRO?

If we're expecting UPRO to be the driver of the strategy's returns, why not go 100% UPRO? Hedgefundie addressed this in the original Bogleheads thread by pointing out that in doing so, we'd probably expect super deep drawdowns from which it may take decades to recover. Here's a backtest showing 40/60 UPRO/TMF (Portfolio 1) vs. 100% UPRO (Portfolio 2) to illustrate:

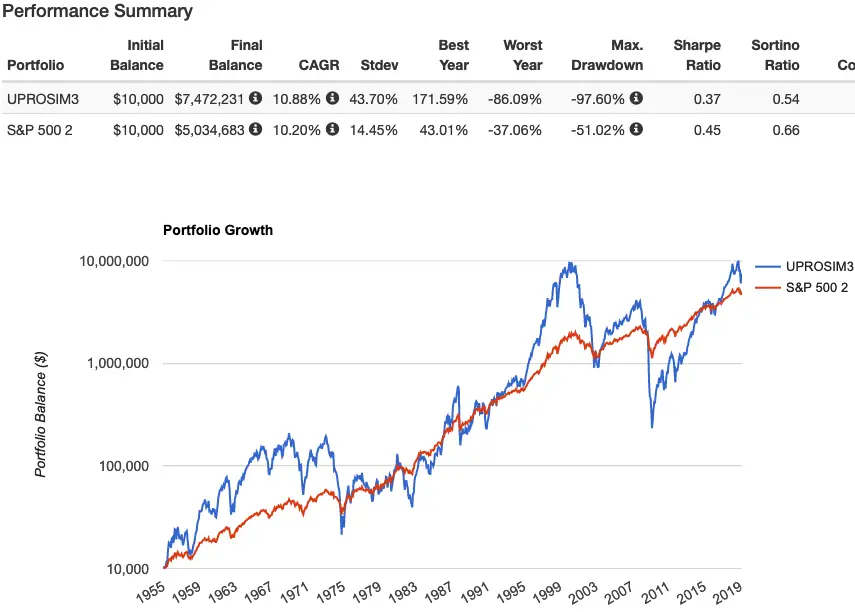

Here's UPRO vs. the S&P 500 going back to 1955:

My Hedgefundie Adventure Performance

Tracking the cumulative performance (quarterly change in performance relative to the initial value; no new deposits) of my Hedgefundie Adventure in my own portfolio starting October 1, 2019.

For example, an initial investment of $100 on October 1, 2019 means it became $126 (+26%) as of April 1, 2024.

01/01/2020: +7%

04/01/2020: -2%

07/01/2020: +35%

10/01/2020: +54%

01/01/2021: +79%

04/01/2021: +67%

07/01/2021: +105%

10/01/2021: +105%

01/01/2022: +150%

04/01/2022: +98%

07/01/2022: +14%

10/01/2022: -14%

01/01/2023: -10%

04/01/2023: +5%

07/01/2023: +11%

10/01/2023: -14%

01/01/2024: +16%

04/01/2024: +26%

07/01/2024: +28%

Alternative Options To the Hedgefundie Portfolio

If you want to utilize a leveraged strategy similar to that proposed by Hedgefundie but be completely hands off, PIMCO has been doing something similar for years with their StocksPLUS Long Duration Fund (PSLDX) since 2007. I reviewed the fund here. Note that you can only access this fund through certain brokers, and it may have a minimum investment requirement and transaction fees. Those details are beyond the scope of this post; ask your broker if it's available to you.

Similarly, if you're doing this with a small portion of your portfolio or if you want to employ a leveraged strategy in a taxable account, WisdomTree's NTSX may be a suitable option, effectively providing 1.5x leverage on a traditional 60/40 stocks/bonds portfolio. It holds 90% straight S&P 500 stocks and 10% treasury futures to achieve effective notional exposure of 90/60 stocks/bonds. I reviewed the fund here.

Bogleheads user MotoTrojan proposed a variant by which you can match the volatility of Hedgefundie's 55/45 UPRO/TMF, tone down the leverage a bit, and save some on the expense ratio of TMF by utilizing Vanguard's Extended Duration Treasury ETF (EDV) in a ratio of 43/57 UPRO/EDV. Here's an M1 pie for that. This variant would also be more tax-efficient than the original strategy that uses TMF if you're doing this in taxable.

Rapidly rising interest rates and/or runaway inflation are the primary risks for this strategy. If those concerns are material to you and make you hesitant about this strategy, or if you simply want more diversification across asset types, then a leveraged All Weather Portfolio may appeal to you. There are also some diversifiers listed below.

Addressing Concerns Over Long-Term Treasury Bonds

I've gotten a lot of questions about – and a lot of the discussion in the original Bogleheads thread has been about – the use, utility, and viability of long-term treasury bonds as a significant chunk of this strategy. I'll briefly address and hopefully quell these concerns below.

Again, by diversifying across uncorrelated assets, we mean holding different assets that will perform well at different times. For example, when stocks zig, bonds tend to zag. Those 2 assets are uncorrelated. Holding both provides a smoother ride, reducing portfolio volatility (variability of return) and risk.

Common comments nowadays about bonds include:

- “Bonds are useless at low yields!”

- “Bonds are for old people!”

- “Long bonds are too volatile and too susceptible to interest rate risk!”

- “Corporate bonds pay more!”

- “Interest rates can only go up from here! Bonds will be toast!”

- “Bonds return less than stocks!”

So why long term treasuries?

- It is fundamentally incorrect to say that bonds must necessarily lose money in a rising rate environment. Bonds only suffer from rising interest rates when those rates are rising faster than expected. Bonds handle low and slow rate increases just fine; look at the period of rising interest rates between 1940 and about 1975, where bonds kept rolling at their par and paid that sweet, steady coupon. Rates also rose steadily from 2016 to mid-2019, during which time TMF delivered a positive return.

- Bond pricing does not happen in a vacuum. Here are some more examples of periods of rising interest rates where long bonds delivered a positive return:

- From 1992-2000, interest rates rose by about 3% and long treasury bonds returned about 9% annualized for the period.

- From 2003-2007, interest rates rose by about 4% and long treasury bonds returned about 5% annualized for the period.

- From 2015-2019, interest rates rose by about 2% and long treasury bonds returned about 5% annualized for the period.

- New bonds bought by a bond index fund in a rising rate environment will be bought at the higher rate, while old ones at the previous lower rate are sold off. You're not stuck with the same yield for your entire investing horizon.

- We know that treasury bonds are an objectively superior diversifier alongside stocks compared to corporate bonds. This is also why I don't use the popular total bond market fund BND. It has been noted that this greater degree of uncorrelation between treasury bonds and stocks is conveniently amplified during periods of market turmoil, which researchers referred to as crisis alpha.

- Again, remember we need and want the greater volatility of long-term bonds so that they can more effectively counteract the downward movement of stocks, which are riskier and more volatile than bonds. We're using them to reduce the portfolio's volatility and risk. More volatile assets make better diversifiers. Most of the portfolio's risk is still being contributed by stocks. Let's use a simplistic risk parity example to illustrate. Risk parity for UPRO and TMF is about 40/60. If we want to slide down the duration scale, we must necessarily decrease UPRO's allocation, as we only have 100% of space to work with. Risk parity for UPRO and TYD (or EDV) is about 25/75. Parity for UPRO and TLT is about 20/80. etc. Simply keeping the same 55/45 allocation (for HFEA, at least) and swapping out TMF for a shorter duration bond fund doesn't really solve anything for us. This is why I've said that while it's not perfect, TMF seems to be the “least bad” option we have, as we can't lever intermediates (TYD) past 3x without the use of futures.

- This one's probably the most important. We're not talking about bonds held in isolation, which would probably be a bad investment right now. We're talking about them in the context of a diversified portfolio alongside stocks, for which they are still the usual flight-to-safety asset during stock downturns. Specifically, for this strategy, the purpose of the bonds side is purely as an insurance parachute in the event of a stock crash. Though they provided a major boost to this strategy's returns over the last 40 years while interest rates were dropping, we're not really expecting any real returns from the bonds side going forward, and we're intrinsically assuming that the stocks side is the primary driver of the strategy's returns. Even if rising rates mean bonds are a comparatively worse diversifier (for stocks) in terms of future expected returns during that period does not mean they are not still the best diversifier to use.

- Similarly, short-term decreases in bond prices do not mean the bonds are not still doing their job of buffering stock downturns.

- Historically, when treasury bonds moved in the same direction as stocks, it was usually up.

- Interest rates are likely to stay low for a while. Also, there’s no reason to expect interest rates to rise just because they are low. People have been claiming “rates can only go up” for the past 20 years or so and they haven't. They have gradually declined for the last 700 years without reversion to the mean. Negative rates aren't out of the question, and we're seeing them used in some foreign countries.

- Bond convexity means their asymmetric risk/return profile favors the upside.

- Again, I acknowledge that post-Volcker monetary policy, resulting in falling interest rates, has driven the particularly stellar returns of the raging bond bull market since 1982, but I also think the Fed and U.S. monetary policy are fundamentally different since the Volcker era, likely allowing us to altogether avoid runaway inflation environments like the late 1970’s going forward. Bond prices already have expected inflation baked in.

David Swensen summed it up nicely in his book Unconventional Success:

“The purity of noncallable, long-term, default-free treasury bonds provides the most powerful diversification to investor portfolios.”

Ok, bonds rant over. If you still feel some dissonance, the next section may offer some solutions.

Reducing Volatility and Drawdowns and Hedging Against Inflation and Rising Rates

It's unlikely that any of the following will improve the total return of the portfolio, and whether or not they'll improve risk-adjusted return is up for debate, but those concerned about inflation, rising rates, volatility, drawdowns, etc., and/or TMF's future ability to adequately serve as an insurance parachute, may want to diversify a bit with some of the following options:

- LTPZ – long term TIPS – inflation-linked bonds.

- FAS – 3x financials – banks tend to do well when interest rates rise.

- EDC – 3x emerging markets – diversify outside the U.S.

- UTSL – 3x utilities – lowest correlation to the market of any sector; tend to fare well during recessions and crashes.

- YINN – 3x China – lowly correlated to the U.S.

- UGL – 2x gold – usually lowly correlated to both stocks and bonds, but a long-term expected real return of zero; no 3x gold funds available.

- DRN – 3x REITs – arguable diversification benefit from “real assets.”

- EDV – U.S. Treasury STRIPS.

- TYD – 3x intermediate treasuries – less interest rate risk.

- UDOW – 3x the Dow – greater loading on Value and Profitability factors than UPRO.

- TNA – 3x Russell 2000 – small caps for the Size factor.

- TAIL – OTM put options ladder to hedge tail risk. Mostly intermediate treasury bonds and TIPS.

- CAOS – Very similar to TAIL but more complex and impressively has had positive carry.

- PFIX – OTC payer swaptions on interest rate changes; effectively shorting long bonds.

The Hedgefundie Portfolio ETF Pie for M1 Finance (UPRO/TMF)

Again, most users are utilizing M1 Finance to deploy the Hedgefundie strategy due to its dynamic rebalancing with new deposits, zero transaction fees, and its simple, 1-click rebalance that you can do quarterly. It takes no more than 30 seconds every 3 months. I wrote a comprehensive review of M1 Finance here.

The risk parity 40/60 portfolio would be this pie which looks like this:

- 40% UPRO

- 60% TMF

To add this pie to your portfolio on M1 Finance, just click this link and then click “Save to my account.”

The updated 55/45 portfolio would be this pie which looks like this:

- 55% UPRO

- 45% TMF

To add this pie to your portfolio on M1 Finance, just click this link and then click “Save to my account.”

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

Right now M1 is offering a transfer promotion of a 0.50% payout on settled transfers over $10,000 into Invest accounts before January 31 with a max payout of $25,000. Terms for this promotion are here.

Disclosures: I am long PSLDX, NTSX, UPRO, and TMF in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Great article – so if I did do this in M1 pie for taxable (not familiar with M1) – you were saying that upon rebalancing, with a click of a button, M1 could add cash that I have to bring everything back to 55/45 without selling anything and triggering a taxable event right? Then after a year if I needed to take anything off would they be able to take it from an older portion for long term cap gains?

Thanks, Nick! Even simpler than that. Any new deposits with M1 automatically go to the underweight asset. No need to click anything. The only time you’d click would be to manually rebalance, which would obviously incur taxes. But yes, theoretically after a year you could manually rebalance and get the LTCG rate.

Is the taxes due to PSLDX equivalent to managing the portfolio manually?

What are your thoughts on holding a slightly less leveraged Hedgefundie’s adventure in an IRA that incorporates US TIPS in order to simultaneously reduce over all costs and also combat the potential risk of sudden interest rates hikes?

Example:

https://ibb.co/Z2v6F4p

Stocks have been the best inflation hedge over the long term. TIPS are more for short time horizons e.g. retirees. There are also no leveraged TIPS products. But yes you could dedicate an allocation to TIPS if you want direct inflation protection. LTPZ for long, SCHP for intermediate.

Firstly, I want to express gratitude and thanks for your blog and summaries and introducing me to the bogle head forum. Really helps me understand using a passive strategy to invest. Keep up the good work!

1. Re: MotoTrojan’s variant above: Hedgefundie’s 55/45 UPRO/TMF, utilizing Vanguard’s Extended Duration Treasury ETF (EDV) in a ratio of 43/57 UPRO/EDV.

a. I wanted to make sure you meant 57/43 UPRO/EDV. M1 finance link should also be changed.

b. When simulated in portfoliovisualizer, returns on 55/45 UPRO/TMF seem to be better than 57/43 UPRO/EDV in last 10 years. Should I ignore and assume its essentially the same and save on the taxes and expense ratio?

2. If you are advocating this as only 10% of your portfolio, as a “lottery ticket”, it’s probably better than a lottery ticket, right? haha. Does this apply to the All weather x3 as well, i.e. only 10, maybe 25%? And if not, what particular portfolio strategies would you advocate for the 90% majority, basically any of the unleveraged portfolios in your blog summaries, like the all weather unleveraged, 60/40, 90/10, etc?

a. 43/57 UPRO/EDV. It’s correct as written. The M1 link is correct.

b. A 10 year backtest doesn’t tell us much of anything, and an investing decision should not be based on that alone. Sounds like you may not understand the intricacies of the strategy.

2. Yes.

When you’re running these backtests, are you accounting for the fact that a 3x fund would close if it drew down too quickly and went to zero? A 3x fund would go to zero if the underlying index went down -33% too quickly (how quickly, I don’t know). And the fund would close, you’d lose your money, and you wouldn’t have a chance to recover. So are you saying that, since the 1980s when these backtests start, at NO point in time would that have hypothetically happened with ANY of the individual leveraged funds…? I saw someone else on here post that Portfolio Visualizer only looks at monthly drawdowns instead of daily, wouldn’t that pose an issue as it relates to this? Also, is it looking at just the blended portfolio performance only, or accounting for each index? For example, if you had a 50/50 portfolio of X and Y, and in a certain month X went down -100% (let’s say X was a 3x index that went to zero) and Y went up 50%, your portfolio blended return is going to say -25% for that month. Then, the next month, X goes back up, great–but the problem is that your actual fund shares were closed out, and you’re not still invested so you don’t actually get to recover.

Love the article and these ideas, just questioning whether these backtests of 2-3x an index actually would have reflected reality, e.g., what the 2-3x leveraged fund would have done. If they don’t, that changes the picture pretty drastically. But maybe they do? And that’s what I’m trying to wrap my head around. I’ve been reading articles that say most 3x leveraged funds tend to converge to zero, given enough time. I see that owning bonds in the portfolio is a hedge to smooth out performance from volatility–but it’s still not going to stop the 3x fund from going to zero if it’s going to happen. And if it does, recovery afterward is out of the question.

The funds didn’t exist prior to about a decade ago. Can’t say for sure whether or not they would have closed. We have circuit breakers nowadays that pause trading so it’s impossible for them to actually go to zero. LETFs do close sometimes, so definitely a risk to consider.

But circuit breakers are only temporary. And as soon as they lift back up, the market can keep going down (and these would go down 3x as much). XIV was a 3x inverse volatility fund that went to zero (or close to it) and was forced to close in 2018. If these LETFs in this article would have gone to zero/closed during any point in history during these backtests, that would undermine the entire argument here of these hypothetical portfolios.

Sure, I guess. But it’s impossible to know what would have happened or what will happen. These are 2 highly liquid ETFs on broad indexes; much different than a volatility or oil ETF. But only time will tell, I suppose.

Did you ever backtest with data from the 70s to test this for a stagflation environment?

Adding that would provide great insight for concerns over long-term treasury bonds

It’s in the original BH thread. I’ll see if I can pull that in. Most of this isn’t my work; I just summarized it.

this is great…thank you

What are your thoughts on

AVDV – 7.4%

TMF – 14.8%

IXUS – 14.8%

UPRO – 14.8%

SCHP – 14.8%

VGIT – 14.8%

VBR – 18.5%

Not sure. Depends on one’s goals, time horizon, and risk tolerance.

I’ve updated my personal portfolio using your excellent guide. If you have any additional thoughts it would be much appreciate. Here’s a snapshot of it:

https://imgur.com/SNXJbzm

Thanks for your awesome blog

Thanks, Dorian. I can’t provide personalized advice.

Couldn’t find it myself but someone mentioned replacing UPRO with TQQQ and TNA. Have you seen this variant and what do you think of it?

I share your concerns about TQQQ but also note that TNA is contributing most of the return here. I imagine TNA has greater price swings and wonder whether it’s more likely to be wiped out but, we could just rebalance back into it if that happens, right? Small caps have a solid track record historically.

Not a fan of TQQQ. Performance chasing. Severely under-diversified. We can pick any subset of the market that has outperformed in the past decade. TNA is small caps, so volatility decay hurts more, as you suspected. Small caps are great for “normal” unleveraged funds. Not so great when we’re talking about 3x in my opinion.

Hey John,

I am amazed by the thoroughness of your blog. Thank you for the awesome content!

Just curious, did you happen to backtest the 45 / 55 allocation of Hedgefundie? How does it compare to the 40/60 in terms of drawdown, Sharpe, Sortino, US market correlation?

I also noted that you decided to invest in Hedgefundie versus 3 x AWF despite its seemingly superior risk-adjusted return. Any reason why you are attracted to Hedgefundie instead of 3 x AWF? I apologize if that’s been covered. Thank you.

Best,

Jeff

Thanks, Jeff! I don’t believe the 55/45 was ever fully backtested against the original 40/60. I’ll revisit the original thread and see if it was. Historical risk-adjusted return shouldn’t be the only or even the primary concern in choosing how to invest. I’m not a big fan of gold for the long term.

That was helpful. Thanks for clarifying that. What are the primary variables you consider? Just hoping to learn from your experience and develop my own “algorithm” if you will.

Thanks again,

Jeff

Broad diversification, low fees, appreciable factor loading, sufficient liquidity, positive expected returns.

Hi John,

Thank you for your blog and all the information that you have provided.

What are your thoughts on the HF modification that will include the VIXM? Max. Drawdown decreases, Sharpe ratio and Sortino ratio increase. For example, UPRO 55%, TMF 25%, VIXM 20%.

Thank you

Thanks, Vadim. Consensus on a VIX hedge seemed to be that it’s an insurance policy that is more expensive than it’s worth.

Thanks, John.

John, you have mentioned in other comments 3X 55/45 is more of a lottery ticket and very risky… Roughly 10% of your portfolio.

What are your thoughts on doing a 2X Hedgefundie 55/45 SSO/UBT with the majority (90%) of ones portfolio? Timeframe would be 30 years. Unless I’m missing something, this seems like an incredible was to beat the S&P 500 and minimizing ones risk. In comparison to the S&P, max drawdown would be less, CAGR would be more and Sharpe Ratio would be higher based on previous years (which I know do not indicate future results).

The future won’t look like the past. Still very risky by the very nature of LETFs. If you don’t understand why that’s the case, you shouldn’t be buying LETFs in the first place. Don’t put your entire portfolio in a strategy like this. Period.

Thank you so much for your website and articles! As you said, it is better to rebalance quarterly, my question is which date is preferable? I think institutions usually rebalance on 31st or 1st, is it a good idea to do that with them? thanks a lot!

1st of the month.

Wow, What a website and well researched and wise investment advice. I have been adventuring with TQQQ without any protection and am blown away by HedgeFundie’s portfolio low drawdowns and superb returns. Decided this is the way to go.

The rising interest rates seem to be a concern. I see you mentioned few alternatives. I tried back testing and all of them except intermediate treasuries have higher drawdowns (60% compared to 19% with TMF).

1) Do you personally swap TMF with any of these? I see you suggest these for those who are concerned about rates but it didn’t look if you are convinced swapping is the right thing to do.

2) Intermediate treasuries TYD seem to have lower drawdowns (22%) so they seem like a good alternative to swap TMF with. Can TYD fare better (compared to TMF) when interest rates rise?

Thanks!

1. They’re not meant to entirely replace TMF. So no.

2. Would TYD fare better than TMF if interest rates rise? Yes. Will it provide superior volatility reduction and drawdown protection over the long term? No.

Hey John-

Been tossing around the idea of trying to put a small part of my 401K portfolio into this. The challenge is my brokeragelink doesn’t allow for ETFs. I could use RYGBX (1.2x government long bond) and DXSLX (2x SP500). My thought was splitting 45 RYGBX and 55 DXSLX which would give me 90% SP500 and 66% Long bond. Any thoughts? Figured this could be a HFEA lite version

Would need to match the volatility of 2x S&P with much more allocation to 1.2x bonds. I don’t know anything about these funds.

Thanks for the quick response. I wish there was a 2x long term bond mutual fund there isn’t. When you say match, what percentages are you thinking?

For 50/50, for example, you’d need 1.67x (2 / 1.2) the bond fund, so 37.5% stocks and 62.5% bonds. This is a hypothetical example to illustrate the math and is not a recommendation.

Thanks John that actually aligns pretty closely to a HFAE for Cowards portfolio I saw. I am a little torn now between using my lottery ticket as that or All-Weather 2x.

Hello,

Thank you for this information. Can I use the 55/45 pie if I don’t have experience investing in hedge or leavareged funds?. Do you recommend this for a regular taxable account or a Roth IRA?.

Just make sure you fully understand what you’re getting into with this strategy. Not ideal for taxable.

Why isn’t it ideal for a taxable account? In other words, what about this makes it tax-inefficient?

Tax inefficiency of LETFs and the need for frequent rebalancing of the strategy.

You might want to put a caveat on your drawdowns. Portfolio visualizer is terrible at giving you accurate DDs because it uses monthly data. For example, if you run the 40/60 on PV just over the covid crash, it will tell you the DD is 23%. When you run the same backtest on quantconnect with minute data, the actual DD is 42%.

Good point. I often forget PV does that. Thanks.

To be fair the COVID crash was quite an outlier and the market doesn’t usually recover 17% within a month.

What drives the outperformance an equities/bond combination? Is it that rebalancing allows you to invest in equities when they have had a crash?

No. Bonds typically protect during stock drawdowns.

Hi John, amazing article. Quick question what do you think about using international governmental bonds as your hedge such as Igov. Also would it be safe to put your entire portfolio in 60% unleveraged index with 40% international bonds?

No leveraged int’l bond funds. Int’l bonds don’t offer much diversification anyway.

As in 60/40 VT/BNDX? Not a problem I guess, but weird. Just use BND or BNDW. This article is about a 3x leveraged strategy.

What rebalancing rules did you go for? Monthly, quarterly, % drift bands?

Started with monthly volatility targeting but recently decided to just keep it simple and switch to quarterly rebalancing.

Hi John, I’ve considered both UPRO and TQQQ in my triple leveraged ETF investment strategy. I chose to go 100% TQQQ because TECH is now a misnomer. AMZN is also a grocery store and clothing outlet. ABNB is a hotel. These are traded on Nasdaq, (I am no expert by the way, I’m green between the ears) so I don’t think UPRO is the safe way to go, I feel more comfortable in Nasdaq. In the future, will there be gasoline companies or tech companies fueling our cars? Will there be internet gambling or casinos? Thanks. And God bless.

So I’ll be painfully honest with you here. Forget the word “tech.” Replace it with “large cap growth,” which is precisely what the Nasdaq 100 is. And again, it’s severely under-diversified and looking extremely expensive. Feel free to tilt into those large cap growth companies a bit (e.g. 90% UPRO, 10% TQQQ), but using 100% TQQQ is inarguably, unequivocally performance chasing. There is no logical reason one should feel more “safe” or “comfortable” with the Nasdaq 100 over the S&P 500. Quite the opposite. The latter includes the former plus much more. Specifically, the former comprises about 42% of the latter. The S&P 500 is a proxy for the entire U.S. stock market. The Nasdaq 100 is a small, highly concentrated handful of stocks from a few sectors. One is not a replacement for the other. Both are market cap weighted; your comment about gasoline companies and tech companies is moot. If you don’t want to take my word for it, this discussion has been hashed out ad nauseam in the original Bogleheads thread.

All the best stocks are on Nasdaq. They should have 75% of the market cap. You’re not my dad.

Then why do you keep asking me for advice? Best of luck with your concentration risk.

Been doing some more fiddling with backtests of leveraged GAPs, All Weather, but now reading Hedgefundie again… I noticed a comment you made about gold / commodities / small cap volatility suffering from decay and not improving return etc. And the weirdness of DZK and international leveraging. And bond prices now baking in inflation. I know you’ve said picking sectors is like picking stocks, but also have used financials and utilities to diversify.

So what do you think about a Modified HedgeFundie 2 like this? (Besides being slightly better numbers across the board than plain HF2)

UPRO 50

TMF 35

CURE 7.5

VDC 7.5

Again, thank you, THANK YOU, THANK YOU for this website, it’s depth and breadth, but also the consistency across such a huge swathe of information.

Yea the idea of getting defensive with sectors and international instead of fully relying on TMF has become increasingly attractive, particularly with Utilities (UTSL) and Emerging Markets (EDC). CURE might be a good option. NEED (3x consumer staples) unfortunately got delisted. VDC is just 1x consumer staples; not really doing anything there. Others I listed above: UGL, DRN, FAS, etc.

What do you think of of something similar to above with UGE instead of VDC?

Better than 1x, I suppose, but terribly low AUM.

Hi John,

Thank you for your blog and all the information that you have provided, I appreciate all your efforts.

May I ask how you are able to simulate the returns from 1987 since portfoliovisualizer.com only has data from 2011?

Thank you

One can create their own simulation data for these LETFs and upload it to PV.

What rebalancing rules did you go for?

Hi John,

Question about how the use of leveraged ETFs should impact overall asset allocation decisions.

Consider a hypothetical portfolio that intends to hold 60% equities and 40% bonds. Further assume that the equity portions aims for 50% US (25% S&P 500, 25% SCV) and 50% international.

If, within this framework, one were to opt to allocate 10% of the total portfolio toward Hedgefundie (55% UPRO, 45% TMF), how should the 3x leverage be weighted when considering the overall weights? While the original $ investment to UPRO would only represent 5.5% of the total, should the leverage be taken into account such that the S&P 500 “exposure” here is actually 3x that (16.5%), resulting in significantly decreasing the S&P allocation in the standard, non-levered portion making up the total portfolio’s remaining 90%?

Or would one simply “silo” the 10% off as a completely separate entity and “let it ride,” without attempting to consider the factor implications on the overall portfolio?

Thanks for your superb contribution to investment education.

Great question, Jay, and one that was discussed back and forth at length in the original Bogleheads thread with differing opinions – should we include the Adventure as part of the larger portfolio or view it as a separate bucket? Some users chose the former and some chose the latter, so it’s largely just personal preference. If you choose the former, yes you’d use the exposure as the allocation, e.g. 100% UPRO is 300% stocks. A primary consideration here is I think if you’re throwing a relatively large % of your assets in the Adventure and then continuing to put new deposits in it, it almost certainly makes sense to include it as part of the larger portfolio if for no other reason than to keep the exposure and total leverage ratio in check. If however you’re just making a small one-time deposit and letting it ride, I’d treat it as a separate “lottery ticket,” which is what I did.

I know this is sort of a non-answer but I hope this line of thinking helps. And thanks for the kind words!

Hi John,

I looked the drawdown of the URPO/TMF combination during the March 2020 crash and the drawdown was much greater than the S&P 500 (46% vs 32% respectively). I am not sure TMF would do well in rising interest rate environment. It seems a little more volatile than the backtesting indicates.

We would expect UPRO/TMF to have greater drawdowns than the market; they’re 3x leveraged ETFs…