T Bills are ultra-short-term treasury bonds backed by the full faith and credit of the U.S. government. Here we'll check out the best T Bill ETFs to buy treasury bills in . Video - T-Bills Explained In this video, I explain what T-bills are, how they work, and why you might want to buy them. Keep scrolling for the list of ETFs. What Are T Bills? T … [Read more...] about The 9 Best T Bill ETFs (Treasury Bills) To Park Cash in 2025

Funds

The 10 Best ETFs for Retirement Portfolios in 2025

Retirees have unique needs when it comes to their investment portfolios. Here I've assembled what I think are the best ETFs for retirement portfolios in . Retirement ETFs Video Prefer video? Watch it here: Introduction - What Retirees Need From ETFs Obviously, many ETFs are perfectly suitable for both the young investor at age 20 and the retiree at age … [Read more...] about The 10 Best ETFs for Retirement Portfolios in 2025

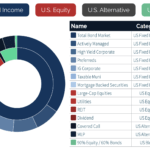

HNDL ETF Review – Is HNDL a Good Investment? (7HANDL™ ETF)

HNDL is a proprietary fund-of-funds income ETF from Strategy Shares with a target 7% yield. But is it a good investment? I review it here. Introduction - What Is HNDL and How Does It Work? HNDL is fund-of-funds ETF from Strategy Shares. The sub-advisor is Rational Capital LLC. "Fund-of-funds" just means it's a single fund that holds other funds inside it. HNDL is … [Read more...] about HNDL ETF Review – Is HNDL a Good Investment? (7HANDL™ ETF)

DIVO ETF Review – Amplify CWP Enhanced Dividend Income ETF

DIVO is an income ETF from Amplify. It uses active management to select blue chip stocks and then write covered calls on them. I review it below. Video Prefer video? Watch it here: Introduction - What Is DIVO and How Does It Work? DIVO is an ETF from Amplify, the folks who brought you SWAN. Its name is the Amplify CWP Enhanced Dividend Income ETF. As the … [Read more...] about DIVO ETF Review – Amplify CWP Enhanced Dividend Income ETF

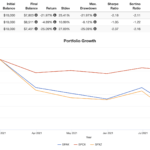

NUSI ETF Review – Is NUSI a Good Investment?

NUSI is an option collar strategy ETF for the NASDAQ 100 Index designed to manage risk and generate income. But is it a good investment? I review it here. NUSI ETF Review Video Prefer video? Watch it here: Introduction - What Is NUSI and How Does It Work? Nationwide makes ETFs. This one is called the Nationwide Risk-Managed Income ETF. NUSI is an option … [Read more...] about NUSI ETF Review – Is NUSI a Good Investment?

2 Best Emerging Markets Value ETFs for 2025 (Not AVEM or AVES)

Emerging Markets have paid a significant risk premium historically. So have Value stocks. Here are the best Emerging Markets Value ETFs to capture this narrow intersection across different cap sizes. Spoiler: They're not AVEM or AVES. Introduction - Why Emerging Markets Value ETFs? If you've landed on this page because you're looking for an Emerging Markets Value … [Read more...] about 2 Best Emerging Markets Value ETFs for 2025 (Not AVEM or AVES)

The 7 Best Ecommerce ETFs for Online Shopping Stocks in 2025

Ecommerce is exploding. The global pandemic accelerated that shift to shopping online from retailers. Here we look at the best ecommerce ETFs to ride this trend in . Introduction - Why Ecommerce Stocks? People shop online. Period. Look at the huge growth of companies like Amazon. Commerce is going digital, away from traditional brick-and-mortar stores. This has … [Read more...] about The 7 Best Ecommerce ETFs for Online Shopping Stocks in 2025

3 Best SPAC ETFs To Invest in SPACs in 2025 – But Should You?

SPACs are hot right now. Should you invest in them? Maybe. Are they just a fad? Only time will tell. Here we'll explore what SPACs are, talk about their characteristics and risks, and check out the best SPAC ETFs to invest in SPACs in . Introduction - What Are SPACs? SPACs are Special Purpose Acquisition Companies. They are companies that merge with or acquire … [Read more...] about 3 Best SPAC ETFs To Invest in SPACs in 2025 – But Should You?

ITOT vs. VTI – U.S. Stock Market ETFs – iShares or Vanguard?

Here we look at 2 ETFs for the total U.S. stock market - ITOT and VTI - from iShares and Vanguard, respectively. In a hurry? Here are the highlights: ITOT and VTI are the two most popular ETFs for the total U.S. stock market.ITOT is from iShares. VTI is from Vanguard.ITOT tracks the S&P Total Market Index. VTI tracks the CRSP US Total Market Index.ITOT and VTI cost … [Read more...] about ITOT vs. VTI – U.S. Stock Market ETFs – iShares or Vanguard?

VOO vs. VOOV vs. VOOG – Vanguard S&P 500, Value, or Growth?

While these 3 ETFs from Vanguard look very similar based on their tickers, they are in fact very different. Here I explore VOO, VOOV, and VOOG. In a hurry? Here are the highlights: Video Prefer video? Watch it here: VOO vs. VOOV vs. VOOG - Methodology If you've arrived on this page, you likely already know that stocks are a significant driver of … [Read more...] about VOO vs. VOOV vs. VOOG – Vanguard S&P 500, Value, or Growth?

VXUS vs. VEU – Which Vanguard Total International ETF?

VXUS and VEU are two popular index funds from Vanguard for the total international stock market outside the U.S. Here we'll dive into their differences, similarities, performance, and why you might want one over the other. In a hurry? Here are the highlights: Video Prefer video? Watch it here: VXUS vs. VEU - Methodology, Composition, Fees, AUM, and … [Read more...] about VXUS vs. VEU – Which Vanguard Total International ETF?

QQQ vs. SPY & VOO – NASDAQ 100 vs. the S&P 500

QQQ from Invesco tracks the NASDAQ 100 Index. SPY from SPDR (and VOO from Vanguard) tracks the S&P 500. These are two very different funds that track very different indexes. I compare them here. In a hurry? Here are the highlights: QQQ and SPY are two very different funds.QQQ from Invesco tracks the NASDAQ 100 Index. SPY from SPDR tracks the S&P 500 Index.QQQ … [Read more...] about QQQ vs. SPY & VOO – NASDAQ 100 vs. the S&P 500

VT vs. VTI – Global Stock Market vs. Total U.S. Stock Market

VT and VTI are two very popular index funds from Vanguard. Here we'll dive into their differences, similarities, performance, and why you might want one over the other. In a hurry? Here are the highlights: VT vs. VTI - Video Prefer video? Watch it here: VT vs. VTI - Methodology, Composition, and Reasoning First and foremost, understand that even … [Read more...] about VT vs. VTI – Global Stock Market vs. Total U.S. Stock Market

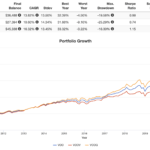

RPAR Risk Parity ETF Review – An All Weather Portfolio ETF?

RPAR is a single fund solution for an all-weather portfolio strategy based on risk parity - one ETF to be fully diversified across multiple assets. I review it here. RPAR ETF Review Video Prefer video? Watch it here: What Is the RPAR Risk Parity ETF? To discuss the RPAR ETF, we first have to talk about the concept of an "all-weather portfolio." As the … [Read more...] about RPAR Risk Parity ETF Review – An All Weather Portfolio ETF?

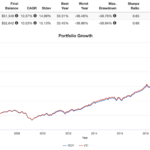

PSLDX – A Review of the PIMCO StocksPLUS® Long Duration Fund

PIMCO have been quietly beating the market and doing a version of the famous Hedgefundie Adventure for years with their mutual fund PSLDX. But is it a good investment? I review it here. PSLDX Review Video Prefer video? Watch it here: What Is PSLDX? To talk about PSLDX, let's first talk briefly about the famous Hedgefundie Adventure. Ironically, you're … [Read more...] about PSLDX – A Review of the PIMCO StocksPLUS® Long Duration Fund

The 7 Best Value ETFs To Buy Value Stocks in 2025

Is the Value premium dead? Probably not. With Value suffering a beating for a decade, let's hope it's time for its resurgence. Here we look at the best Value ETFs to buy value stocks in . Video Prefer video? Watch it here: Introduction - Why Value ETFs? If you've landed on this page because you're looking for a Value ETF, you probably already know the … [Read more...] about The 7 Best Value ETFs To Buy Value Stocks in 2025

QQQ vs. QQQM – NASDAQ 100 Index ETFs from Invesco

QQQ from Invesco is one of the most popular funds out there. It tracks the NASDAQ 100 Index. QQQM is new on the scene and tracks the same index. What's the deal? In a hurry? Here are the highlights: QQQ and QQQM are two funds from Invesco that both track the NASDAQ 100 Index.The index is mostly tech companies and is not well-diversified across sectors.QQQ launched in … [Read more...] about QQQ vs. QQQM – NASDAQ 100 Index ETFs from Invesco

SPHD vs. VYM – High Dividend ETFs from Invesco and Vanguard

The Invesco S&P 500 High Dividend Low Volatility ETF (SPHD) and the Vanguard High Dividend Yield ETF (VYM) are two popular dividend-oriented ETFs. Let's compare them. First, I don't get excited about dividends. But I know that income investors often like to use dividends as current income, particularly in retirement, and thus seek out high-dividend-yield funds. Others … [Read more...] about SPHD vs. VYM – High Dividend ETFs from Invesco and Vanguard

SCHD vs. VYM – Dividend ETFs from Schwab and Vanguard

Two popular dividend-focused ETFs are the Schwab U.S. Dividend Equity ETF (SCHD) and the Vanguard High Dividend Yield ETF (VYM). Let's compare them. First, note that I don't chase dividends. But I recognize that many investors use dividends to supplement their current income, particularly in retirement. Others just irrationally prefer dividend-paying stocks. I even designed … [Read more...] about SCHD vs. VYM – Dividend ETFs from Schwab and Vanguard

SWAN – A Review of the Amplify BlackSwan ETF for Downturns

Black swan events are impactful and unpredictable. The Amplify BlackSwan Growth & Treasury Core ETF (SWAN) was designed to protect against them. Let's dive into it. Video Prefer video? Watch it here: What Is a Black Swan Event? The term black swan is used to describe an extremely rare, inherently unpredictable event that has severe negative … [Read more...] about SWAN – A Review of the Amplify BlackSwan ETF for Downturns