VIG is Vanguard's dividend growth ETF. VOO and VTI are their broad market index funds for the S&P 500 Index and total U.S. stock market, respectively. Let's compare them. In a hurry? Here are the highlights: Video Prefer video? Watch it below. If not, keep scrolling to keep reading. VIG vs. VOO and VTI - Methodology and Composition We can compare … [Read more...] about VIG vs. VOO & VTI – Vanguard Dividend Growth ETF vs. Broad Market

Funds

SPHD vs. SCHD – Invesco Dividend ETF vs. Schwab Dividend ETF

Two popular dividend-focused ETFs are SPHD, the Invesco S&P 500 High Dividend Low Volatility ETF, and SCHD, the Schwab U.S. Dividend Equity ETF. Let's compare them. First, note that I don't chase dividends. But I recognize that many investors use dividends to supplement their current income, particularly in retirement. Others just irrationally prefer dividend-paying … [Read more...] about SPHD vs. SCHD – Invesco Dividend ETF vs. Schwab Dividend ETF

SCHD vs. VIG – Schwab Dividend ETF vs. Vanguard Div. Growth ETF

Two popular dividend-focused ETFs are the Schwab U.S. Dividend Equity ETF (SCHD) and the Vanguard Dividend Appreciation ETF (VIG), but they differ more than you may realize. Let's compare them. First, note that I don't chase dividends. But I recognize that many investors use dividends to supplement their current income, particularly in retirement. Others just irrationally … [Read more...] about SCHD vs. VIG – Schwab Dividend ETF vs. Vanguard Div. Growth ETF

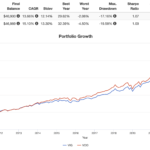

SCHD vs. VOO & VTI – Schwab Dividend vs. Vanguard Total Market

SCHD is a popular dividend ETF from Schwab. VOO and VTI are broad market index funds from Vanguard for the S&P 500 and total U.S. stock market. Let's compare them. In a hurry? Here are the highlights: SCHD is a popular dividend fund from Schwab.VOO and VTI are very popular broad U.S. stock funds from Vanguard.SCHD tracks the Dow Jones U.S. Dividend 100 Index. VOO … [Read more...] about SCHD vs. VOO & VTI – Schwab Dividend vs. Vanguard Total Market

SPAXX vs. FZFXX, FDIC, FCASH, FDRXX – Fidelity Core Position

If you've got a Fidelity investment account, you've probably encountered several options for your "core position" for cash: SPAXX, FDIC, FCASH, FDRXX, and/or FZFXX. Is there a best option? I compare them here. Note that the yields and fees for these options change all the time, so the information and numbers you see on this page may be outdated by the time you see them. Be … [Read more...] about SPAXX vs. FZFXX, FDIC, FCASH, FDRXX – Fidelity Core Position

The First NFT ETF Is Here – Exploring NFTZ from Defiance

NFTs now have an ETF - NFTZ from Defiance ETFs. Let's check it out. Introduction - What Are NFTs? NFT stands for non-fungible token. NFTs allow for ownership of digital goods, as they are unique, verifiable tokens that exist on a blockchain. Blockchain is the digital database framework of cryptocurrencies like Bitcoin. Some of these words may sound foreign to you. … [Read more...] about The First NFT ETF Is Here – Exploring NFTZ from Defiance

IEMG vs. VWO – Which ETF for Emerging Markets?

Here we look at 2 index ETFs for Emerging Markets stocks - IEMG from iShares and VWO from Vanguard. In a hurry? Here are the highlights: Video Prefer video? Watch it here: IEMG vs. VWO - Differences in Methodology and Composition If you've landed here, you probably already know that index funds are a great way to get instant diversification across … [Read more...] about IEMG vs. VWO – Which ETF for Emerging Markets?

3 Hedge Fund ETFs To Invest Like a Hedge Fund in 2024

Hedge funds are typically only accessible by the ultra rich. Here we'll explore what hedge funds are, why you may or may not want to act like one, and some ETFs to invest like a hedge fund in . What Is a Hedge Fund? As the name suggests, a hedge fund is quite literally, in its simplest explanation, a fund that holds different assets as hedges to each other in an … [Read more...] about 3 Hedge Fund ETFs To Invest Like a Hedge Fund in 2024

SPD ETF Review – Simplify US Equity PLUS Downside Convexity ETF

SPD offers exposure to U.S. large cap stocks while protecting from severe downturns with put options. I review it here. Introduction - What Is SPD and How Does It Work? SPD is an ETF from Simplify designed to provide broad equity exposure to U.S. stocks while also offering some downside protection for market crashes. It's called the Simplify US Equity PLUS … [Read more...] about SPD ETF Review – Simplify US Equity PLUS Downside Convexity ETF

The Hunt for a Leveraged Value ETF – 3 Contenders for 2024

So you like leveraged ETFs and you like Value. Can we combine them? Here I discuss the current options for a leveraged value ETF. Video Prefer video? Watch it here: Why a Leveraged Value ETF? If you've landed on this page, hopefully leveraged ETFs require no explanation. If they do, go read this post first explaining how they work. Basically, we're … [Read more...] about The Hunt for a Leveraged Value ETF – 3 Contenders for 2024

A Telemedicine ETF To Invest in Telehealth in 2024

The pandemic supercharged the growth of telemedicine and digital health services. Here we'll check out the best telemedicine ETFs to capture telehealth exposure in . Introduction - Why Telemedicine Stocks? As with most disruptive technologies, consumers were wary at first of a digital model for healthcare. Then the 2020 pandemic hit, forcing people to stay inside … [Read more...] about A Telemedicine ETF To Invest in Telehealth in 2024

JEPI ETF Review – JPMorgan Equity Premium Income ETF

JEPI is a covered call ETF for the S&P 500 Index designed to mitigate volatility and generate income. But is it a good investment? I review it here. JEPI ETF Review Video Prefer video? Watch it here: Introduction - What Is JEPI and How Does It Work? JEPI is an income ETF from J.P. Morgan. It's called the JPMorgan Equity Premium Income ETF. In a … [Read more...] about JEPI ETF Review – JPMorgan Equity Premium Income ETF

The 5 Best T Bill ETFs (Treasury Bills) To Park Cash in 2024

T Bills are ultra-short-term treasury bonds backed by the full faith and credit of the U.S. government. Here we'll check out the best T Bill ETFs to buy treasury bills in . T Bill ETFs Video Prefer video? Watch it here: Introduction - Why T Bills ETFs? T Bills, short for treasury bills, are just ultra-short-term bonds from the U.S. government. These … [Read more...] about The 5 Best T Bill ETFs (Treasury Bills) To Park Cash in 2024

The 10 Best ETFs for Retirement Portfolios in 2024

Retirees have unique needs when it comes to their investment portfolios. Here I've assembled what I think are the best ETFs for retirement portfolios in . Retirement ETFs Video Prefer video? Watch it here: Introduction - What Retirees Need From ETFs Obviously, many ETFs are perfectly suitable for both the young investor at age 20 and the retiree at age … [Read more...] about The 10 Best ETFs for Retirement Portfolios in 2024

HNDL ETF Review – Is HNDL a Good Investment? (7HANDL™ ETF)

HNDL is a proprietary fund-of-funds income ETF from Strategy Shares with a target 7% yield. But is it a good investment? I review it here. Introduction - What Is HNDL and How Does It Work? HNDL is fund-of-funds ETF from Strategy Shares. The sub-advisor is Rational Capital LLC. "Fund-of-funds" just means it's a single fund that holds other funds inside it. HNDL is … [Read more...] about HNDL ETF Review – Is HNDL a Good Investment? (7HANDL™ ETF)

DIVO ETF Review – Amplify CWP Enhanced Dividend Income ETF

DIVO is an income ETF from Amplify. It uses active management to select blue chip stocks and then write covered calls on them. I review it below. Video Prefer video? Watch it here: Introduction - What Is DIVO and How Does It Work? DIVO is an ETF from Amplify, the folks who brought you SWAN. Its name is the Amplify CWP Enhanced Dividend Income ETF. As the … [Read more...] about DIVO ETF Review – Amplify CWP Enhanced Dividend Income ETF

NUSI ETF Review – Is NUSI a Good Investment?

NUSI is an option collar strategy ETF for the NASDAQ 100 Index designed to manage risk and generate income. But is it a good investment? I review it here. NUSI ETF Review Video Prefer video? Watch it here: Introduction - What Is NUSI and How Does It Work? Nationwide makes ETFs. This one is called the Nationwide Risk-Managed Income ETF. NUSI is an option … [Read more...] about NUSI ETF Review – Is NUSI a Good Investment?

2 Best Emerging Markets Value ETFs for 2024 (Not AVEM or AVES)

Emerging Markets have paid a significant risk premium historically. So have Value stocks. Here are the best Emerging Markets Value ETFs to capture this narrow intersection across different cap sizes. Spoiler: They're not AVEM or AVES. Introduction - Why Emerging Markets Value ETFs? If you've landed on this page because you're looking for an Emerging Markets Value … [Read more...] about 2 Best Emerging Markets Value ETFs for 2024 (Not AVEM or AVES)

The 7 Best Ecommerce ETFs for Online Shopping Stocks in 2024

Ecommerce is exploding. The global pandemic accelerated that shift to shopping online from retailers. Here we look at the best ecommerce ETFs to ride this trend in . Introduction - Why Ecommerce Stocks? People shop online. Period. Look at the huge growth of companies like Amazon. Commerce is going digital, away from traditional brick-and-mortar stores. This has … [Read more...] about The 7 Best Ecommerce ETFs for Online Shopping Stocks in 2024

3 Best SPAC ETFs To Invest in SPACs in 2024 – But Should You?

SPACs are hot right now. Should you invest in them? Maybe. Are they just a fad? Only time will tell. Here we'll explore what SPACs are, talk about their characteristics and risks, and check out the best SPAC ETFs to invest in SPACs in . Introduction - What Are SPACs? SPACs are Special Purpose Acquisition Companies. They are companies that merge with or acquire … [Read more...] about 3 Best SPAC ETFs To Invest in SPACs in 2024 – But Should You?