An investment policy statement is a formal document that defines one's investing objectives and strategy. Here we'll look at how to write one, the benefits of having one, a template, and an example. Video Prefer video? Watch it here: Introduction - What Is an Investment Policy Statement? An investment policy statement is a document that outlines the … [Read more...] about How To Write an Investment Policy Statement – Template & Example

Investing 101

Tax Loss Harvesting To Defer Taxes – The Ultimate Guide

Tax loss harvesting may sound fancy and complicated, but I promise it's super simple, and you'll have a better understanding of it after reading this guide. Here we'll explore what tax loss harvesting is, why and how you'd want to do it, the rules, limits, and deadlines involved, examples, and how to avoid the infamous "wash sale" in your portfolio. Video Prefer … [Read more...] about Tax Loss Harvesting To Defer Taxes – The Ultimate Guide

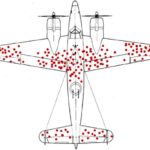

Tail Risk – What It Is and How To Hedge Against It

Tail risk refers to the probability of an extreme outcome from a rare event. Here we'll look at what it is, how it affects portfolio construction, and hedging strategies for it. Introduction - What Is Tail Risk? Tail risk describes the likelihood of rare events at the ends of a probability distribution. Specifically, greater tail risk would suggest that the … [Read more...] about Tail Risk – What It Is and How To Hedge Against It

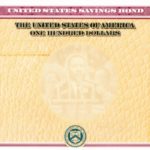

I Bonds Explained (US Savings Bonds) – Ultimate Guide (2024)

I bonds are low-risk, inflation-linked savings bonds from the U.S. government. Here we'll review why, when, where, and how to buy them. Update - January 2023: I bonds are now paying a composite rate of 6.89% for savings bonds issued between November 1, 2022 and April 30, 2023. I Bonds Video Prefer video? Watch it here: Introduction - Inflation and the … [Read more...] about I Bonds Explained (US Savings Bonds) – Ultimate Guide (2024)

Sharpe Ratio vs. Sortino vs. Calmar – Risk Adjusted Return

In this post I explore what risk-adjusted return is and some different ways to measure it, including Sharpe, Sortino, and Calmar ratios. Introduction - What Is Risk Adjusted Return? So we explored the concept of portfolio risk here recently. A good armchair definition of risk is the permanent loss of capital, though many erroneously conflate volatility - the … [Read more...] about Sharpe Ratio vs. Sortino vs. Calmar – Risk Adjusted Return

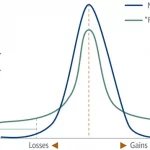

Portfolio Risk Explained – How To Think About Risk and Volatility

In using the term "risk," different investors and advisors mean different things. There are several different types and definitions of portfolio risk. Some are more useful than others. Here we'll explore how to think about risk and volatility when it comes to investing. Portfolio Risk Defined So I think it's important to qualify and define what exactly we're … [Read more...] about Portfolio Risk Explained – How To Think About Risk and Volatility

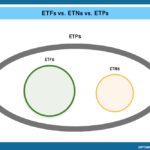

ETF vs. ETN vs. ETP – Differences, Similarities, Risks, Etc.

ETF. ETN. ETP. So many initialisms. Here we'll explore what these things are and what differences exist among them. Video Prefer video? Watch it here: ETF vs. ETN vs. ETP - What Do the Letters Mean? First, here's what these initialisms stand for: ETF - Exchange Traded FundETN - Exchange Traded NoteETP - Exchange Traded Product Secondly, I created … [Read more...] about ETF vs. ETN vs. ETP – Differences, Similarities, Risks, Etc.

23 Investing Biases and How To Avoid Them

Humans are inherently susceptible to irrational preferences called biases. Since investors are human, there are a number of investing biases to be aware of and try to avoid. Video Prefer video? Watch it below. If not, keep scrolling to keep reading. Introduction - What Are Investing Biases? Classical economics assumes humans make perfectly rational … [Read more...] about 23 Investing Biases and How To Avoid Them

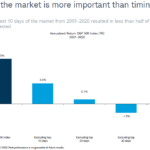

Market Timing – Time in the Market Beats Timing the Market

Market timing refers to trying to predict future market movement to buy or sell at the best price. Here we'll look at why it doesn't work, and why you should stay the course and go ahead and invest as soon as possible to maximize time in the market. In short, time in the market beats timing the market. I'll show you why below. Market Timing Video Prefer video? … [Read more...] about Market Timing – Time in the Market Beats Timing the Market

The 7 Best Inflation Hedge Assets and ETFs for 2024

Inflation fears are always lingering. Here we'll look at what inflation is, why it occurs, how it's measured, and the best assets to hedge against it with their corresponding ETFs for . Video Prefer video? Watch it here: Introduction - What Is Inflation? Simply put, inflation refers to an aggregate increase in prices, commonly measured by the Consumer … [Read more...] about The 7 Best Inflation Hedge Assets and ETFs for 2024

The 4% Rule for Retirement Withdrawal Rate – A Revisitation

With high stock valuations and low bond yields, is the "4 percent rule" for retirement withdrawal rate still valid for the 21st-century investor? Let's dive in. What Is the 4% Rule? The 4% rule refers to what is widely accepted as a safe withdrawal rate (SWR) for retirees from their investment account. Using this figure and assumptions about future expenses and … [Read more...] about The 4% Rule for Retirement Withdrawal Rate – A Revisitation

How To Calculate Investment Returns (ROI and CAGR)

Here's how to calculate investment returns (known as return on investment, or ROI for short) to see your portfolio's performance. Introduction - Return on Investment Return on Investment (ROI) measures the gain or loss of an investment, as a percentage, relative to its cost. ROI is used in business to evaluate revenue performance, such as the return from marketing … [Read more...] about How To Calculate Investment Returns (ROI and CAGR)

No, Covered Call Options Are Not a Free Lunch

Covered calls are pitched as a "free lunch" and a way to "collect rent" on your stocks for buy-and-hold investors. Let's explore why that's not the case. What Are Covered Call Options? Options contracts are derivatives that allow traders to speculate on the value of the underlying security. Call options allow the holder to buy an asset at a set price within a given … [Read more...] about No, Covered Call Options Are Not a Free Lunch

Portfolio Diversification – How To Diversify Your Portfolio

Portfolio diversification is considered to be the only free lunch in investing. In this post, I'll show you why and how to diversify your portfolio. What Is Portfolio Diversification? Portfolio diversification simply means combining different assets in one's investment portfolio, effectively spreading out your risk. As the related adage says, "Don't put all your … [Read more...] about Portfolio Diversification – How To Diversify Your Portfolio

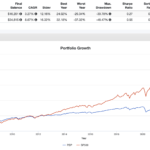

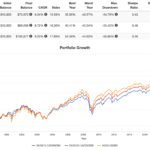

Dollar Cost Averaging vs. Lump Sum Investing (DCA vs. LSI)

Dollar cost averaging and "lump sum investing" are two different timing strategies for getting cash into the market. Let's compare them. Video Prefer video? Watch it here: What Is Dollar Cost Averaging (DCA)? Dollar cost averaging (DCA for short), also sometimes called a constant dollar plan, is a systematic investment timing strategy in which the … [Read more...] about Dollar Cost Averaging vs. Lump Sum Investing (DCA vs. LSI)

VEA vs. VWO vs. VXUS – Which Vanguard International ETF?

Three of the most popular Vanguard international ETFs are VWO, VEA, and VXUS. Is there one that reigns supreme to hold alongside U.S. stocks? Video Prefer video? Watch it here: Diversifying with International Stocks Index investors in the U.S. usually know it's a good idea to diversify in equities outside the United States. At global market weights, U.S. … [Read more...] about VEA vs. VWO vs. VXUS – Which Vanguard International ETF?

The 3 Best Commodities ETFs To Invest in Commodities in 2024

Commodities offer a diversification benefit in a long-term investment portfolio. Here we look at how to invest in commodities broadly with the best commodities ETFs. Video Prefer video? Watch it here: Introduction - Why Commodities ETFs? Commodities - metals, energy, livestock, and agriculture - offer what's called an uncorrelation to the stock market, … [Read more...] about The 3 Best Commodities ETFs To Invest in Commodities in 2024

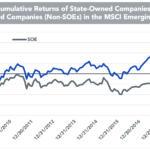

Should You Avoid State-Owned Enterprises in Your Portfolio?

State-owned enterprises typically have inherently lower operating efficiency due to compromised business interests. It may be prudent to avoid them in your international portfolio. Here we'll see what the data has to say. What Are State-Owned Enterprises? State-owned enterprises, or SOEs, refer to companies with at least partial government ownership. The … [Read more...] about Should You Avoid State-Owned Enterprises in Your Portfolio?

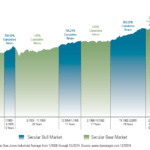

Sequence of Return Risk in Retirement Explained

Sequence of return risk may very well ruin your financial retirement plans, and all from sheer bad luck. Here we’ll look at the nature and implications of sequence of return risk in retirement, and some proposed solutions to at least mitigate its potential negative impact. What Is Sequence of Return Risk? Sequence of return refers to the variability of … [Read more...] about Sequence of Return Risk in Retirement Explained

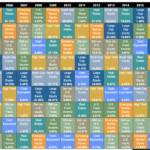

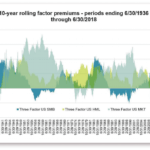

Factor Investing and Factor ETFs – The Ultimate Guide

Factor investing refers to specifically targeting independent risk factors in securities markets that explain the differences in returns between diversified portfolios. Here we'll look at what factor investing is, various factor models from the research, and how to do it using factor ETFs. What Is Factor Investing? Factor investing means targeting specific drivers … [Read more...] about Factor Investing and Factor ETFs – The Ultimate Guide