Everyone always asks how I invest my own money. Some have basically pieced it together from various mentions across the blog, but I finally got around to laying it out in detail. I've named it the Ginger Ale Portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Foreword – A Brief History of My Investing Journey

I hate when recipe websites tell an unnecessary, long-winded story before getting to the recipe, so feel free to skip straight to the portfolio by clicking here.

Starting around age 18, I spun my wheels for nearly a decade stock picking and trading options on TradeKing (which Ally later acquired), usually underperforming the market. I was naive and egotistical enough to think that I could outsmart and out-analyze other traders, at least on average.

Unfortunately, a math degree with a focus in statistics strengthened my faulty conviction for a few more years before I finally converted to index investing. Thinking back on that time and the way I traded (I don't think I can even call it investing) makes me cringe now, so these days I try to do whatever I can to help others – particularly new, young investors – avoid those same pitfalls I succumbed to. I'd be much further ahead now had I just indexed from the start.

Since I had previously only traded U.S. securities and entirely ignored international assets, when I converted to index investing, I went 100% VTI for the total U.S. stock market (U.S. companies do business overseas, right?) and wrote myself an Investment Policy Statement (IPS) to avoid stock picking as a hard rule going forward. I was also still tempted to try to time the market using macroeconomic indicators and by selectively overweighting sectors around this time before realizing that sector bets are just stock picking lite, market timing tends to be more harmful than helpful, and the broad index fund does the self-cleansing and sector rearranging for me.

Then I dug deeper into the Bogleheads philosophy and realized I was still being ignorant by avoiding international stocks (more on this below), so I decided to throw in some VXUS at about 80/20 U.S. to international. I kept reading and researching and digging and concluded that I still had way too much home country bias. The U.S. is only one country out of many around the world! So I switched to 100% VT. Global stock market, market cap weighted. Can't go wrong. And “100% VT” would still be my elevator answer for a young investor just starting out.

Then I got further into the nuances of evidence-based investing as well as the important behavioral aspects of investing and what the research had to say about these things – Fama and French, Markowitz and MPT, efficient markets, leverage, Black and Scholes, Merton Miller, asset allocation, risk tolerance, sequence risk, factors, dividend irrelevance, asset correlations, risk management, etc.

I started realizing that, in short, 100% VT is objectively suboptimal in terms of both expected returns and portfolio risk. Emerging Markets only comprise 11% of the global market. Small cap stocks make up an even smaller fraction. And we should probably avoid small cap growth stocks. And certain funds have superior exposure to Value than others based on their underlying index's selection methodology. And can I stomach the drawdowns that accompany a 100% cap weighted stocks position during a crash? This line of thinking led me to books and lazy portfolios from present-day advisors like William Bernstein, Larry Swedroe, Ray Dalio, Paul Merriman, and Rick Ferri, all of whom influenced my thought process and subsequent portfolio construction.

I also realized there's an observable tradeoff between simplicity and optimization. I'm a tinkerer by nature and tend to default to the latter, probably to a fault (i.e. overfitting and data mining), which is why this blog's name is what it is, for better or for worse. People say indexing is boring, but it doesn't have to be. There's still plenty of learning to be had, and subsequent research-backed improvements to be made in the pursuit of optimization if you choose to tinker.

But don't get me wrong. Simplicity is – and probably should be – a desirable characteristic of one's portfolio for most people. Whatever allows you to sleep at night, stay the course, and not tinker during market downturns is the best strategy for you. It can take some time (and probably a market crash) to figure out what that strategy is. The portfolio below will seem “simple” to a stock picker with 100 holdings; it may seem complex to the indexer who is 100% VT.

So below I've pieced together what I think is optimal for me, based on my understanding of what the research thus far has to say about expected returns, volatility, diversification, risk, cognitive biases, and reliability of outcome, all while realizing I may get it wrong and that I may want to change it in the future.

About the Ginger Ale Portfolio

Update July 2021: Got way too many emails from people using this portfolio and then asking me about TIPS and Emerging Markets gov't bonds (what they are, what they're for, etc.). They clearly didn't understand what they were buying. That's not good. So I removed those pieces.

I'm bad at thinking of clever names for things. When writing posts, I usually sip on a can of ginger ale, so the Ginger Ale Portfolio seemed like an appropriate name.

Aside from “lottery ticket” fun money in the Hedgefundie Adventure and my taxable account in NTSX, this portfolio is basically how my “safe” money is invested. Leverage, while perhaps useful on paper for any investor, is probably not appropriate for most investors purely because of the emotional and psychological fortitude its usage requires during market turmoil.

Thus, for a one-size-fits-most portfolio, I can't in good conscience just recommend a leveraged fund. Moreover, whatever I put below will likely just be blindly copied by many novice investors who won't even bother reading or understanding the details, so I have to take that fact into consideration and be at least somewhat responsible.

This portfolio is 90/10 stocks to fixed income using a long duration bond fund to, again, accommodate sort of a one-size-fits-most asset allocation for multiple time horizons and risk tolerances. I'd call it medium risk simply because it has some allocation to fixed income. It is a lazy portfolio designed to match or beat the market return with lower volatility and risk.

It heavily tilts toward small cap value to diversify the portfolio's factor exposure. It is also diversified across geographies and asset classes. Specifically, this portfolio is roughly 1:1 large caps to small caps and for U.S. investors, it has a slight home country bias of 5:4 U.S. to international, nearly matching global market weights.

In selecting specific funds, I looked for sufficient liquidity, appreciable factor loading (where the expected premium would outweigh the fee), low tracking error, and low fees.

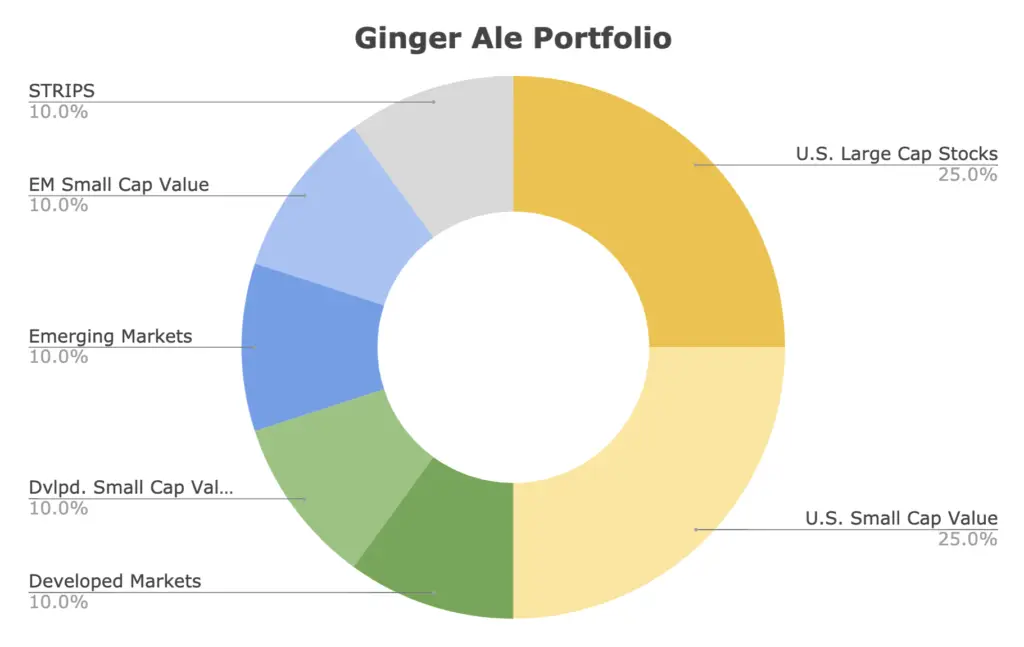

Here's what it looks like:

Ginger Ale Portfolio Allocations:

- 25% U.S. Large Cap Stocks

- 25% U.S. Small Cap Value

- 10% Developed Markets (ex-US)

- 10% Developed Markets (ex-US) Small Cap Value

- 10% Emerging Markets

- 10% Emerging Markets Small Cap Value

- 10% U.S. Treasury STRIPS

Below I'll explain the reasoning behind each asset in detail.

U.S. Large Cap Stocks – 25%

Most lazy portfolios use U.S. stocks – and specifically large-cap U.S. stocks – as a “base.” This one is no different, but they're still only at 25%. You'll see why later.

Not much to explain here. The U.S. stock market comprises a little over half of the global stock market and has outperformed foreign stocks historically. I don't feel comfortable going completely small caps for the equities side so we're keeping large caps here to diversify across cap sizes, as large stocks beat small stocks during certain periods, while small stocks beat large stocks over other periods.

This segment captures household names like Amazon, Apple, Google, Johnson & Johnson, Microsoft, etc. Specifically, we're using the S&P 500 Index – considered a sufficient barometer for “the market” – via Vanguard's VOO.

Why not use VTI to capture the entire U.S. stock market including some small- and mid-caps? I'll answer that in the next section.

U.S. Small Cap Value – 25%

I don't use VTI (total U.S. stock market) because I want to avoid those pesky small-cap growth stocks which don't tend to pay a risk premium. Even mid-cap growth hasn't beaten large cap blend on a risk-adjusted basis. Using VTI would also dilute my target large cap exposure.

Specifically, small cap growth stocks are the worst-performing segment of the market and are considered a “black hole” in investing. The Size factor premium – small stocks beat large stocks – seems to only apply in small cap value. As Cliff Asness from AQR says, “Size matters, if you control your junk.” Basically, if you want to bet on small caps, the evidence suggests you want to do so in small cap value, preferably while also screening for profitability.

By “risk premium,” I'm referring to the independent sources of risk identified by Fama and French (and others) that we colloquially call “factors.” Examples include Beta, Size, Value, Profitability, Investment, and Momentum. I delved into those details in a separate post that I won't repeat here, but I'll be referring to these factors and their benefits quite a few times below. Though it may sound like magic, the evidence suggests that overweighting these independent risk factors both increases expected returns over the long term and decreases portfolio risk by diversifying the specific sources of that risk, as the factors are lowly correlated to each other and thus show up at different times. The reason I don't want to go 100% factors like Larry Swedroe is because A) I don't have the stomach and conviction he has, and B) there's always the possibility of being wrong.

I know the exclusion of mid-caps entirely seems bizarre at first glance too. Factor premia tend to get larger and more statistically significant as you go smaller. That is, ideally you want to factor tilt within the small cap universe. That's exactly what we're doing here by basically taking a barbell approach in U.S. equities: using large caps and small caps to put the risk targeting exactly where we want it while still diversifying across cap sizes and equity styles. Essentially, we're letting large caps be our Growth exposure in the U.S. and consciously avoiding small- and mid-cap growth stocks.

In short, small cap value stocks have smoked every other segment of the market historically thanks to the Size and Value factor premiums. “Value” refers to underpriced stocks relative to their book value. Basically, cheaper, sometimes crappier, downtrodden stocks have greater expected returns. Small cap value stocks are smaller and more value-y than mid-cap value stocks. Thus, no mid-caps. (As an aside, Alpha Architect basically takes this idea to the extreme – finding the absolute smallest, cheapest stocks and concentrating in only 50 of them; talk about a wild ride.)

I don't want it to seem like I think this is some profound, contrarian approach. Using VTI (total stock market) instead of VOO (S&P 500) would be perfectly fine, and at only 25% of the portfolio, the difference is admittedly probably negligible. The simple point is that I've already decided on a specific small cap allocation, and I'm choosing to get that exposure through a dedicated small cap value fund rather than through VTI. Similarly, I've also already decided on a specific “pure,” undiluted large cap allocation, and I'm choosing to get that exposure through the S&P 500 Index.

Previously, the S&P Small Cap 600 Value index (VIOV, SLYV, IJS) was basically the gold standard for the U.S. small cap value segment. AVUV, the new kid on the block from Avantis, has provided some extremely impressive exposure – superior to that of those funds – in its relatively short lifespan thus far, so much so that it recently replaced VIOV in my own portfolio. I went into detail about this in a separate “small value showdown” post here. In a nutshell, it has been able to capture smaller, cheaper stocks than its competitors, with convenient exposure to the Profitability factor, all while considering Momentum in its trades, and we would expect the premium to more than make up for its slightly higher fee.

Including small caps also took the famous 4% Rule up to 4.5% historically.

Developed Markets – 10%

Developed Markets refer to developed countries outside the U.S. – Australia, Canada, Germany, the UK, France, Japan, etc.

At its global weight, the U.S. only comprises about half of the global stock market. Most U.S. investors severely overweight U.S. stocks (called home country bias) and have an irrational fear of international stocks.

If you're reading this, chances are you're in the U.S. As I just pointed out, odds are favorable that you also overweight – or only have exposure to – U.S. stocks in your portfolio. The U.S. is one single country out of many in the world. By solely investing in one country's stocks, the portfolio becomes dangerously exposed to the potential detrimental impact of that country's political and economic risks. If you are employed in the U.S., it's likely that your human capital is highly correlated with the latter. Holding stocks globally diversifies these risks and thus mitigates their potential impact.

Moreover, no single country consistently outperforms all the others in the world. If one did, that outperformance would also lead to relative overvaluation and a subsequent reversal. During the period 1970 to 2008, an equity portfolio of 80% U.S. stocks and 20% international stocks had higher general and risk-adjusted returns than a 100% U.S. stock portfolio. Specifically, international stocks outperformed the U.S. in the years 1986-1988, 1993, 1999, 2002-2007, 2012, and 2017. For the famous “lost decade” of 2000-2009 when U.S. stocks were down 10% for the period, international Developed Markets were up 13%.

For U.S. investors, holding international stocks is also a way to diversify currency risk and to hedge against a weakening U.S. dollar, which has been gradually declining for decades. International stocks tend to outperform U.S. stocks during periods when the value of the U.S. dollar declines sharply, and U.S. stocks tend to outperform international stocks during periods when the value of the U.S. dollar rises. Just like with the stock market, it is impossible to predict which way a particular currency will move next.

Moreover, U.S. stocks' outperformance on average over the past half-century or so has simply been due to increasing price multiples, not an improvement in business fundamentals. That is, U.S. companies did not generate more profit than international companies; their stocks just got more expensive. And remember what we know about expensiveness: cheap stocks have greater expected returns and expensive stocks have lower expected returns.

Dalio and Bridgewater maintain that global diversification in equities is going to become increasingly important given the geopolitical climate, trade and capital dynamics, and differences in monetary policy. They suggest that it is now even less prudent to assume a preconceived bet that any single country will be the clear winner in terms of stock market returns.

In short, geographic diversification in equities has huge potential upside and little downside for investors.

I went into the merits of international diversification in even more detail in a separate post here if you're interested.

Vanguard offers a low-cost fund called the Vanguard FTSE Developed Markets ETF. Its ticker is VEA.

Developed Markets (ex-US) Small Cap Value – 10%

We can also specifically target small cap value in ex-US Developed Markets stocks. It costs a bit more to do so, and some who tilt small cap value in the U.S. don't feel the need to do so in foreign stocks, but I think it's a prudent move considering the factor premia – in this case Size and Value – have shown up at different time periods across different geographies throughout history.

Remember we also get a diversification benefit here in doing so; it's not just for the greater expected returns. The earnings of large international corporations are more closely tied to global market forces, whereas smaller companies are more affected by local, idiosyncratic economic conditions. This means they are perfectly correlated with neither their large-cap counterparts nor with U.S. stocks.

Until just about a year ago, an expensive dividend fund from WisdomTree (DLS) was arguably the best way to access this segment of the global market. Now, Avantis has launched a fund available to retail investors that specifically targets international small cap value – AVDV. It is the only fund available to the public that specifically targets Size and Value (and conveniently, Profitability) in ex-US stocks. AVDV is also roughly half the cost of the former option DLS.

Emerging Markets – 10%

Emerging Markets refer to developing countries – China, Taiwan, India, Brazil, Thailand, etc.

Investors sometimes shy away from these countries due to their unfamiliarity and greater risk. I would argue that makes them more attractive. Stocks in these countries have paid a significant risk premium historically, compensating investors for taking on their greater risk.

Arguably more importantly, Emerging Markets tend to have a reliably lower correlation to U.S. stocks compared to Developed Markets, and thus are a superior diversifier. Of course, we would expect this, as these developing countries have unique risks – regulatory, liquidity, political, financial transparency, currency, etc. – that do not affect developed countries, or at least not the same extent. I delved into this in a little more detail here. For the previously mentioned “lost decade” of 2000-2009 when the S&P 500 delivered a negative 10% return, Emerging Markets stocks were up 155%.

Emerging Markets only comprise about 11% of the global stock market. This is why I don't use the popular VXUS (total international stock market) – because its ratio of Developed Markets to Emerging Markets is about 3:1. Here we're using a 1:1 ratio of Developed to Emerging Markets.

Vanguard's Emerging Markets ETF is VWO.

Emerging Markets Small Cap Value – 10%

Just like we just did with Developed Markets above, we can focus in on small cap value stocks within Emerging Markets as well.

Here we’re using a small cap dividend fund from WisdomTree as a proxy for Value within small caps in Emerging Markets. Don’t let this sound discouraging. The fund also screens for liquidity and strong financials and has appreciable loadings across Size, Value, and Profitability. Factor investors are wise to this fact, as this fund boasts nearly $3 billion in assets.

The fund is DGS, the WisdomTree Emerging Markets SmallCap Dividend Fund.

Factor investors like myself thought AVES, Avantis’s newest offering for more aggressive factor tilts in Emerging Markets, might dethrone DGS when it launched in late 2021. While it’s certainly no slouch and would still be a fine choice, I still prefer the looks of DGS, even with its higher fee. I compared these specifically here.

U.S. Treasury STRIPS – 10%

No well-diversified portfolio is complete without bonds, even at low, zero, or negative interest rates.

By diversifying across uncorrelated assets, we mean holding different assets that will perform well at different times. For example, when stocks zig, bonds tend to zag. Those 2 assets are uncorrelated. Holding both provides a smoother ride, reducing portfolio volatility (variability of return) and risk. We used the same concept above in relation to risk factor exposure. Now we're talking about entirely separate asset classes, but we're also taking advantage of a risk premium in fixed income: term. I delved into the concept of asset diversification in detail in a separate post here.

STRIPS (Separate Trading of Registered Interest and Principal of Securities) are basically just bonds where the coupon payment is rolled into the price, so they are zero-coupon bonds. Here we're using a fund that is essentially just very long duration treasury bonds (25 years).

I can see the waves of comments coming in, which I see all the time on forums and Reddit threads:

- “Bonds are useless at low yields!”

- “Bonds are for old people!”

- “Long bonds are too volatile and too susceptible to interest rate risk!”

- “Corporate bonds pay more!”

- “Interest rates can only go up from here! Bonds will be toast!”

- “Bonds return less than stocks!”

So why long term treasuries? Here are my brief rebuttals to the above.

- Bond duration should be roughly matched to one's investing horizon, over which time a bond should return its par value plus interest. Betting on “safer,” shorter-term bonds with a duration shorter than your investing horizon could be described as market timing, which we know can't be done profitably on a consistent basis. This is also a potentially costlier bet, as yields tend to increase as we extend bond duration, and long bonds better counteract stock crashes. More on that in a second.

- Moreover, in regards to bond duration, we know market timing doesn't work with stocks, so why would we think it works with bonds and interest rates? Bonds have returns and interest payments. A bond's duration is the point at which price risk and reinvestment risk – the components of what we refer to as a bond's interest rate risk – are balanced. In this sense, though it may seem counterintuitive, matching bond duration to the investing horizon reduces interest rate risk and inflation risk for the investor. An increase in interest rates and subsequent drop in a bond's price is price risk. A decrease in interest rates means future coupons are reinvested at the lower rate; this is reinvestment risk. A bond's duration is an estimate of the precise point at which these two risks balance each other out to zero. If you have a long investing horizon and a short bond duration, you have more reinvestment risk and less price risk. If you have a short investing horizon and a long bond duration, you have less reinvestment risk and more price risk. Purposefully using one of these mismatches in expectation of specific interest rate behavior is intrinsically betting that your prediction of the future is better than the market's, which should strike you as unlikely.

- It is fundamentally incorrect to say that bonds must necessarily lose money in a rising rate environment. Bonds only suffer from rising interest rates when those rates are rising faster than expected. Bonds handle low and slow rate increases just fine; look at the period of rising interest rates between 1940 and about 1975, where bonds kept rolling at their par and paid that sweet, steady coupon.

- Bond pricing does not happen in a vacuum. Here are some more examples of periods of rising interest rates where long bonds delivered a positive return:

- From 1992-2000, interest rates rose by about 3% and long treasury bonds returned about 9% annualized for the period.

- From 2003-2007, interest rates rose by about 4% and long treasury bonds returned about 5% annualized for the period.

- From 2015-2019, interest rates rose by about 2% and long treasury bonds returned about 5% annualized for the period.

- New bonds bought by a bond index fund in a rising rate environment will be bought at the higher rate, while old ones at the previous lower rate are sold off. You're not stuck with the same yield for your entire investing horizon. The reinvested higher yield makes up for any initial drop in price over the duration of the bond.

- We know that treasury bonds are an objectively superior diversifier alongside stocks compared to corporate bonds. This is also why I don't use the popular total bond market fund BND.

- At such a low allocation of 10%, we need and want the greater volatility of long-term bonds so that they can more effectively counteract the downward movement of stocks, which are riskier and more volatile than bonds. We're using them to reduce the portfolio's volatility and risk. More volatile assets make better diversifiers. The vast majority of the portfolio's risk is still being contributed by stocks. Using long bonds also provides some exposure to the term fixed income risk factor.

- We're not talking about bonds held in isolation, which would probably be a bad investment right now. We're talking about them in the context of a diversified portfolio alongside stocks, for which they are still the usual flight-to-safety asset during stock downturns. It has been noted that this uncorrelation of treasury bonds and stocks is even amplified during times of market turmoil, which researchers referred to as crisis alpha.

- Similarly, short-term decreases in bond prices do not mean the bonds are not still doing their job of buffering stock downturns.

- Bonds still offer the lowest correlation to stocks of any asset, meaning they're still the best diversifier to hold alongside stocks. Even if rising rates mean bonds are a comparatively worse diversifier (for stocks) in terms of expected returns during that period does not mean they are not still the best diversifier to use.

- Historically, when treasury bonds moved in the same direction as stocks, it was usually up.

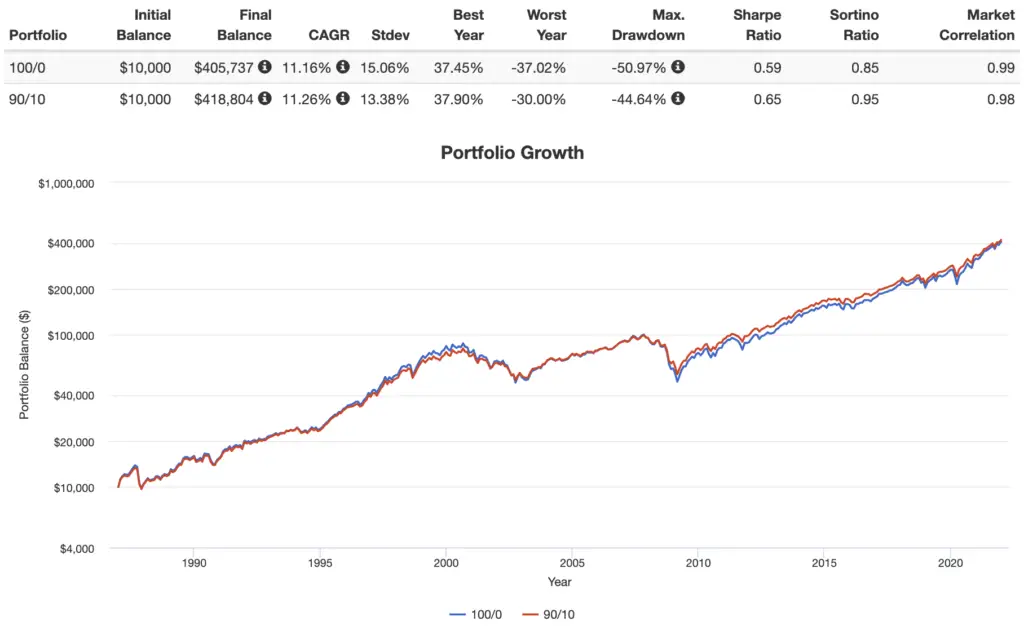

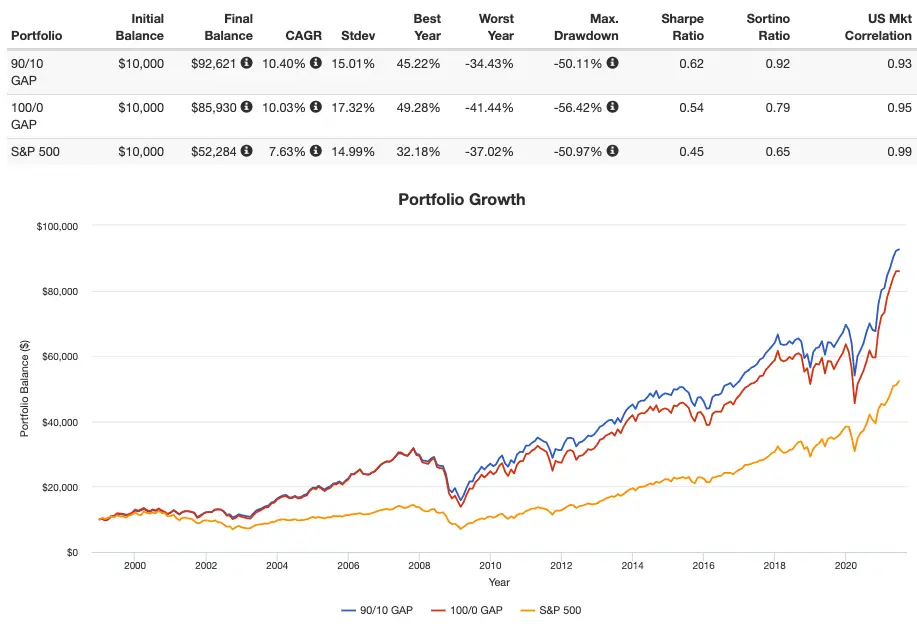

- Long bonds have beaten stocks over the last 20 years. We also know there have been plenty of periods where the market risk factor premium was negative, i.e. 1-month T Bills beat the stock market – the 15 years from 1929 to 1943, the 17 years from 1966-82, and the 13 years from 2000-12. Largely irrelevant, but just some fun stats for people who for some reason think stocks always outperform bonds. Also note how I've shown below that a 90/10 portfolio using STRIPS outperformed a 100% stocks portfolio on both a general and risk-adjusted basis for the period 1987-2021.

- Interest rates are likely to stay low for a while. Also, there’s no reason to expect interest rates to rise just because they are low. People have been claiming “rates can only go up” for the past 20 years or so and they haven't. They have gradually declined for the last 700 years without reversion to the mean. Negative rates aren't out of the question, and we're seeing them used in some foreign countries.

- Bond convexity means their asymmetric risk/return profile favors the upside.

- I acknowledge that post-Volcker monetary policy, resulting in falling interest rates, has driven the particularly stellar returns of the raging bond bull market since 1982, but I also think the Fed and U.S. monetary policy are fundamentally different since the Volcker era, likely allowing us to altogether avoid runaway inflation like the late 1970’s going forward. Stocks are also probably the best inflation “hedge” over the long term.

Here's that backtest mentioned above showing a 90/10 portfolio using STRIPS beating a 100% stocks portfolio for 1987-2021:

David Swensen summed it up nicely in his book Unconventional Success:

“The purity of noncallable, long-term, default-free treasury bonds provides the most powerful diversification to investor portfolios.”

Ok, bonds rant over.

For this piece, I'm using Vanguard's EDV, the Vanguard Extended Duration Treasury ETF.

Ginger Ale Portfolio – Historical Performance

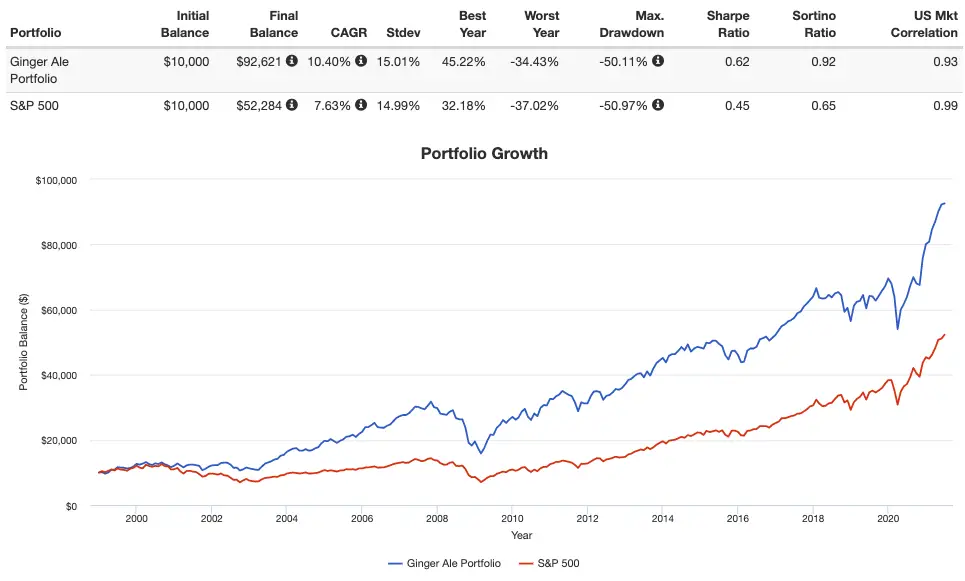

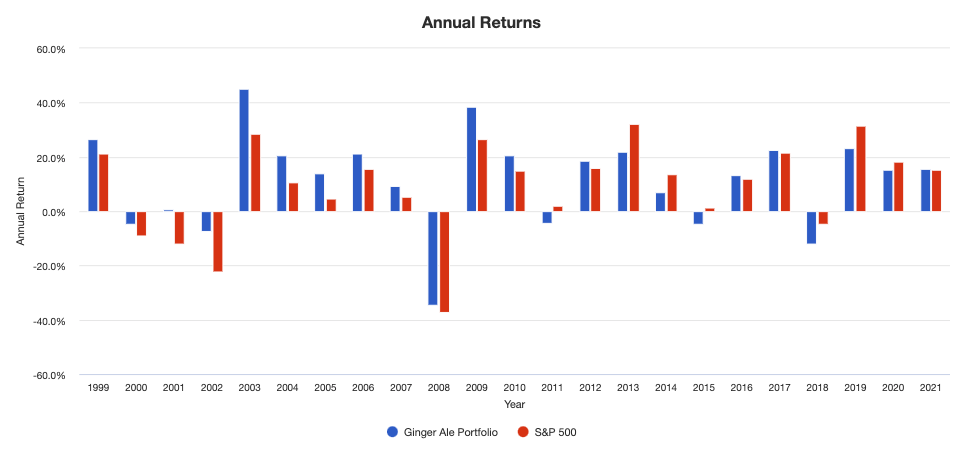

Some of these funds are pretty new, so I had to use comparable mutual funds from Dimensional in some cases to extend this backtest and give us a rough idea of how this thing would have performed historically. The furthest I could get was 1998, going through June 2021:

Here are the annual returns:

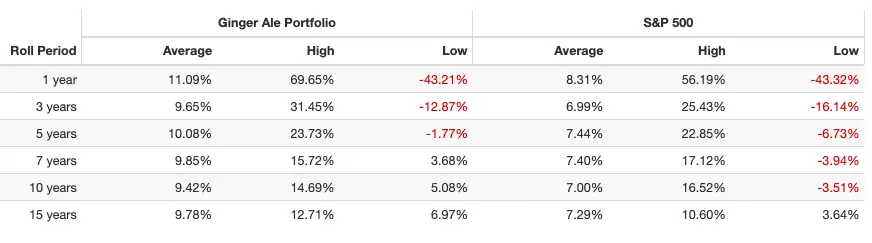

Here are the rolling returns:

Keep in mind the Size and Value premia and international stocks suffered for the decade 2010-2020, otherwise I think the differences in performance metrics would have been even greater.

Ginger Ale Portfolio Pie for M1 Finance

So putting the funds together, the resulting Ginger Ale Portfolio looks like this:

- VOO – 25%

- AVUV – 25%

- VEA – 10%

- AVDV – 10%

- VWO – 10%

- DGS – 10%

- EDV – 10%

You can add this pie to your portfolio on M1 Finance by clicking this link and then clicking “Save to my account.”

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

Being More Aggressive with 100% Stocks

I'd like to think I made a pretty good case for why you shouldn't fear bonds, but if you're young and/or you have a very high risk tolerance, you might still be itching to ditch the bonds and go 100% stocks. Here's a more aggressive version, basically giving an extra 5% each to VOO and AVUV for more of a U.S. tilt:

- VOO – 30%

- AVUV – 30%

- VEA – 10%

- AVDV – 10%

- VWO – 10%

- DGS – 10%

Here's the pie link for that one.

Just note that historically this would have resulted in worse performance than the original 90/10:

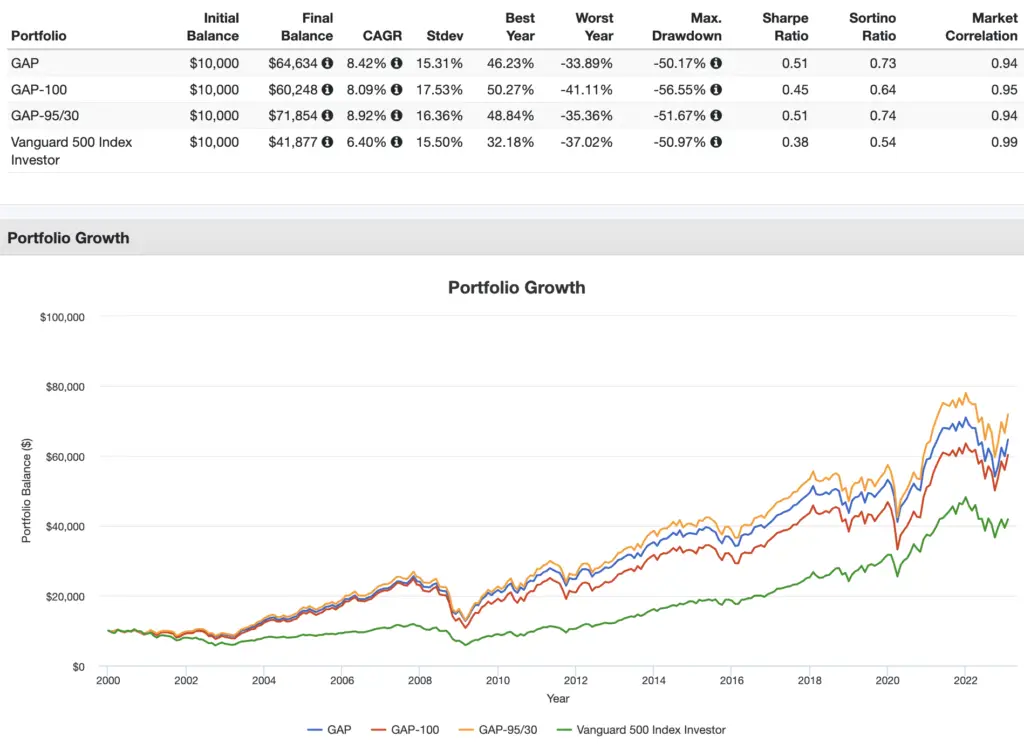

Incorporating NTSX, NTSI, NTSE

A lot of people know I'm a huge fan of WisdomTrees line of “Efficient Core” funds like NTSX and have explicitly asked about replacing the stocks index funds from the aggressive version with these new 90/60 funds from WisdomTree, so I've added this section to briefly address that. If this idea sounds foreign to you, maybe go read this post that explains how NTSX works first and then come back here.

Making those substitutions of the WisdomTree Efficient Core Funds (NTSX, NTSI, and NTSE) for the broad index funds for the S&P 500 (VOO), ex-US Developed Markets (VEA), and Emerging Markets (VWO) is absolutely fine, but I've tried to explain to a few people in the comments that this doesn't materially change the exposure too much from the original Ginger Ale Portfolio simply because EDV packs quite a volatile punch since it's extended duration treasury bonds. That was the whole point of its inclusion.

In other words, going 6x on intermediate treasury bonds (what the WisdomTree funds do) is nearly the same exposure as what EDV provides.

This is illustrated in the backtest below that shows the original Ginger Ale Portfolio, the aggressive 100% stocks version, and a version substituting in NTSX/NTSI/NTSE that delivers effective exposure of 95/35:

Making those substitutions, that 95/30 portfolio looks like this:

NTSX – 30%

AVUV – 30%

NTSI – 10%

AVDV – 10%

NTSE – 10%

DGS – 10%

Also keep in mind this one has a much greater expense ratio. You can get this pie here.

Adjusting This Portfolio For Retirement

I've also had a lot of people ask me how I plan to adjust this portfolio as I near and enter retirement. The answer is pretty simple and straightforward. I don't care about dividends or using them as income, so I plan to simply decrease stocks, increase bonds, decrease bond duration, add some TIPS, and sell shares as needed. Factor tilts and geographical diversification would remain intact.

For example, a 40/60 version using intermediate nominal and real bonds might look something like this:

- 10% VOO – U.S. Large Caps

- 10% AVUV – U.S. Small Cap Value

- 5% VEA – Developed Markets (ex-US)

- 5% AVDV – Developed Markets (ex-US) Small Cap Value

- 5% VWO – Emerging Markets

- 5% DGS – Emerging Markets Small Cap Value

- 30% VGIT – Intermediate U.S. Treasury Bonds

- 30% SCHP – Intermediate TIPS

That pie is here if you want it for some reason.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Questions, comments, concerns, criticisms? Let me know in the comments.

Disclosure: I am long VOO, AVUV, VEA, VWO, AVDV, DGS, and EDV.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

John, I just found your site, and WOW, what great content. Thanks for your hard work and sharing with others. And I am completely falling for the sales pitch on M1. I intend to open an account beginning of the year. I can’t wait to automate my monthly investing. Such a hassle currently with Wells.

I hope you haven’t answered this elsewhere (that I can find), but how would this portfolio change for a taxable account? The vast majority of my retirement is in a taxable account and I am loath to add treasuries. Should I use a different portfolio all together, use Muni bonds, skip bonds altogether or just bite the bullet and pay the taxes? I could place bonds in my backdoor roth or 401k, but not sure that’s enough or desirable since I would guess appreciated assets would be better in a roth?

thanks

Thanks for the kind words, Barry! Glad you’ve found the content useful. Portfolio wouldn’t really change for taxable. If you really wanted to get in the weeds, bond funds and small cap value funds are comparatively less tax efficient, but nothing to obsess over. Munis unfortunately don’t offer much protection compared to treasuries; I touched on that here.

Was this portfolio constructed having in mind it would be for non-taxable accounts? I was hoping to use this as a primary and basically sole portfolio in a single pie on M1.

How would you change it with a long time horizon for a taxable account, if at all?

I already replied to your other comment here.

Hello,

I have some money invested using M1, not thrilled about customer support, but what I like about it is the hands off rebalancing feature, unlike other bigger platforms which you have to do it manually. I recently discovered your site and like it a lot. I am using your Ginger Ale portfolio, invested in it through the link provided in support of you and your site. Continue the good work.

Happy Holidays!

Thanks, Carlos! Indeed, the rebalancing features of M1 are criminally underrated in my opinion. Happy holidays to you as well!

Hi John,

So many great articles!

Given your articles on leverage, I’m surprised that your personal portfolio doesn’t include leveraged positions. I know that you say some people may just copy it, but if this is really your *personal* portfolio, the possibility that people may copy it shouldn’t change how you invest for yourself.

Thanks, Russ. I do have some play money in the Hedgefundie strategy, an IRA in PSLDX, and a taxable account in NTSX. Got plenty of leverage. EDV could also be described as pseudo leverage.

First off, this is one of the most informative articles I’ve read, thanks for putting in the time to share it!

Apologies if I missed this – I really like the theory behind cutting out small-cap growth, but can you help me understand why VBK has significantly outperformed VBR since inception (2004)?

Is it just that in recent history the market has been favorable for growth, and we need to be looking at a longer time horizon for value to outperform, or am I missing something else here? Thanks!

Thanks! Exactly, James. Value has suffered in recent years. I touched on this here and here.

Ran into your blog and have been binge reading your articles. Thank you for sharing your knowledge.

I have a dumb question: If I wanted to invest $30,000 in a portfolio like you described above, is it advisable to do it all at once or spread it out over a few months? Is there an objectively more correct way?

Just curious, is there any particular reason that you chose not to use gold as a diversifier? I ask because you mentioned Ray Dalio as one of the investors you have been influenced by and gold is a prominent presence in his portfolio.

Thanks for the comment, Jim! Glad you’ve found the articles useful. Not a dumb question at all. It largely comes down to emotion on that one. On average, in terms of performance, investing “all at once” – what we call “lump sum investing” – tends to beat spreading it out – what we call “averaging in” – over longer time periods, simply because the market goes up more than it goes down. But of course most people feel safer by averaging in. I went into detail on that in this post that you may find helpful in your decision process.

I’ve touched on gold in several places like this post. In a nutshell, it does seem to help reduce volatility and risk but has a real expected return of about zero, so I have no use for it right now since I have a long time horizon. If I were approaching or in retirement, I might consider it.

I have learnt a ton reading through your site and wanted to say thanks. Being an investor in the UK there are far fewer options when it comes to ETF’s. I have tried as best I can to replicate your Ginger Ale portfolio, however there just aren’t the options available – eg small cap value ETF’s. Have you considered tweaking the portfolio for EU/UK based readers? I think it would be an interesting experiment.

Thanks

Thanks, Remy. Haven’t considered that. I’m not familiar with the products available outside the U.S. The vast majority of my readership is in the U.S.

Hey, I noticed that in the time I’ve had this portfolio, only AVUV and VOO have had net gains, the other positions have net losses. Do you think this is a short term effect from coronavirus delaying economic recovery outside the US, or an effect that you anticipated to happen?

Max, it sounds like you’ve already got tracking error regret. If you’re having these thoughts about short-term performance, this portfolio probably isn’t for you. This is a strategy for the long term. As Bogle said, stay the course and ignore the noise.

Hi John,

I’m curious which funds you used for the backtest and how they might differ from the funds in the portfolio?

Thanks!

DFA’s mutual funds

Hi John,

Thanks for sharing your insights on portfolio strategies and management. I have what I call my Negligent Portfolio, LOL, and I’m trying to bring order to chaos ahead of my retirement next year. I have a question about the large cap selection you made: would you ever consider splitting that into value and growth funds so you could lean it one way or the other? Thanks!

Thanks for the comment, Greg. Probably not. I’m not trying to time style drift, so I’m happy with market weights in large caps.

* UK Flavour Ginger Ale Pension Portfolio *

This is an incredibly helpful article John. I’m the first to put my hand up and admit that I’m a complete beginner at investing. I’ve spent a lot over the last few weeks, reading various opinions, working through a few books and online courses. All of which has taught me the following about myself:

– willing to take on medium-high risk in the form of 100% equity at this point of my life

– looking to invest in the portfolio for at least 20 years, possibly adding bonds gradually towards the end of this period

– have no interest in creating a portfolio of individual stocks, as I don’t have the time to research and actively monitor/change them

– best able to relate to the Bogle school of thought of investing in an index related fund, instead of individual stocks

Your Ginger Ale portfolio is a fantastic example of a simple yet elegant portfolio, which you explain very clearly and succinctly.

I’ve recently started an account with Vanguard Investing here in the UK, which as I’m sure you’ll know already has fewer options to pick from than the funds on the US Vanguard platform. For both fun and serious possibility for starting a UK ‘Flavoured’ Ginger Ale portfolio, I’ve tried to follow your approach with the limited Mutual Funds that I’m able to choose from. I decide to go with just Mutual Funds, instead of ETFs, as I only want to invest £150 pm for the first 12 months while I get to grips with creating a portfolio for the first time. Plus, based on my small amount of knowledge ETFs do not allow fractional unit purchases, e.g. I can only purchase the minimum of 1 (one) unit of the S&P 500 UCITS ETF.

The allocation that I’ve applied to each of the 3 funds I’ve included are based on:

– spreading risk across the Global funds, as I don’t have the ideal options for US only funds that can be complemented by ex-US funds, e.g. Developed Markets (ex-US) Small Cap Value

– spread the risk across All Cap, as I don’t have options for Small/Large cap funds

– attempted to keep portfolio geographical regions similar to their global market value, e.g. US ~50%, Emerging Markets ~10%, remaining Developed Markets (ex-US) ~40%

The Fund Allocate that I came up with is:

– ESG Emerging Markets All Cap Equity Index Fund (Accumulation) 5%

– ESG Developed World All Cap Equity Index Fund (Accumulation) 45%

– FTSE Global All Cap Index Fund (Accumulation) 50%

With the breakdown of calculations here.

Can you think of a way that I can evaluate the past performance of this portfolio, over at least 5 years, compared to the S&P 500 in a similar way to how you have done in the ‘Ginger Ale Portfolio – Historical Performance’ section of this incredibly helpful article?

Thanks for the kind words, Luke. You should be able to put your funds in a backtesting tool like Portfolio Visualizer.

Hi John, excellent article. I never come across any blog that is so much detail oriented as yours.

I am a bit positively shocked to see GAP beating SandP and tried to use the portfoliovisuliser to see how to see it myself. Unfortunately, it is not possible to see the comparison graph beyond 2019. After reading the article carefully, I came to know that you have used different tickers as some of the recommended stocks for the GAP are very new. May I know what are the exact tickers you used for the comparison graph shown in the article. Please refer to any other article or a comment where you addressed this, if you have already done that.

Don’t remember the tickers off the top of my head right now. Refer to Dimensional’s mutual funds.

Hey John,

can you expain why you choose EDV over something like VGLT?

Longer duration

Hi,

I have one question, the results are from 1998. What would be the situation (difference) if we started from 2001?

Thanks!

Sorry, wanted to say 2010.

Probably underperforming the market due to Value and Size suffering over the past decade. Why would we care about looking at a shorter time period?

Hi John,

I found your site recently and am simply floored by the quality and quantity of the content. Thank you for that.

Curiously, how might you handle the bond allocation in the Ginger Ale Portfolio if you were mid40s, such as percentages and funds? How would that change if you were on track to receive a decent pension as well?

Thanks for any additional insights you might share. Everything I’ve read so far has been super educational and helpful.

Thanks for the kind words, Brian! My post on asset allocation should help there. It’s got some calculations for bond allocation by age.

Great article! Can you clarify how you add funds over time to this. If after setting this up i want to add 10,000 dollars to the portfolio. Would you just always put the above percentages e.g 2500 into VOO, 2500 in AVUV etc and leave the initial deposits alone.

Or would you have to sell and rebalance the existing amounts so that the entire portfolio stays at those percentages at all times? In which case you may add 1500 to VOO and 3000 to AVUV to rebalance the portfolio? Have you ever done a backtest so see which of those two methods works best?

I only ask as I don’t have access to M1 which does the auto balancing as I don’t live in the USA. I do have a charles schwab account though.

Thanks, Andrew! Yes, at a traditional broker you’d have to do individual buys based on percentages to keep things in balance any time you deposit new money. You may also need to rebalance periodically, but be aware of any tax implications in a taxable environment. These are not two opposing methods, just different things.

Hello John. Really liked your proposal.

Just out of curiosity, why you didn´t include Large Caps Value stocks on it?

You believe that VALUE roles is already well represented on the small caps?

Regards

Just didn’t want to take as much of a bet on Value, and it’s more powerful within small caps. But tilting large cap value with a fund like RPV would be perfectly sensible.

This is a test. Left a comment a few minutes ago but don’t see it anywhere.

I have to approve comments before they’re live.

Hi John,

Really enjoyed reading your analysis of US Treasury Bonds vs Corporate Bonds. You make a very good case for holding treasuries instead of corporates for their diversifying power relative to US equities.

I have two questions:

1. You wrote a little about foreign bonds at https://www.optimizedportfolio.com/bogleheads-4-fund-portfolio/#bonds. Have you written any more about that subject? What I’m wondering is if there is significant diversifying effect of holding Foreign Government Bonds to diversify the holdings of Foreign Equities?

2. In your Ginger Ale lazy portfolio, you made a comment that your removed Emerging Markets gov’t bonds from it due to reader confusion. Is there a place where I can read your rational for including Emerging Markets gov’t bonds initially? My assumption is that it was for diversifying effect.

Thanks and keep up the good work!!

Thanks, Curtis!

1. I haven’t written much about this other than that brief mention. I probably won’t since I’m a US investor. But maybe I’ll look deeper into it.

2. Let me see if I can dig up what I had written before. It was pretty brief, and yes mainly about them being uncorrelated to US stocks, foreign stocks, and US bonds.

I’m curious about your equal weight for Large Cap and Small Cap Value (25%+25%) as well as your equally weighing for all International (10%+10%+10%+10%).

Most other portfolios usually have small cap at maybe 33% and Large cap at 67%, and usually have a much higher percentage for Developed Markets.

Would you consider your tilts to SCV extremely aggressive? Why the equal dispersions?

“Extremely aggressive?” No. Swedroe advocates for 100% SCV. Getting away from market beta requires larger allocations to factors. Moreover, factors by definition are long/short portfolios. Going long only also requires higher allocations. I have no interest in simply doing what “most other portfolios” do. I also explained the allocation to Developed and Emerging in detail in the post.

Great portfolio, though a little more complicated than my present one. Do you have any suggestions on how to rank each of these funds for tax-advantageousness? The wiki I’ve seen in the past is a little confusing. I have access to 401k, Trad IRA, Roth IRA, and Taxable.

How would you rank these funds in order of most desirous to have Roth vs Trad vs Taxable? Thanks!

Probably broad index funds > small cap value funds > bonds, from most to least efficient.

Do you have a portfolio strictly tailored to roth IRA or would it not differ from ginger ale?

It wouldn’t differ.

Hi John, I have read several of your articles and they have been of great help! Thank you for taking the time to share your knowledge. I have two questions regarding the U.S. large Cap allocation. Would there be any negatives or positives to using VUG instead of VOO? I read in your earliest comment about the trend of growth stocks over the last few years. And do you hold the same asset allocation and portfolio across all of your accounts (taxable (individual) and non-taxable)?

Thank you.

Thanks for the comment, Megan! Really glad you’ve been finding them helpful. With VUG, you’d only own half of the S&P 500 – the Growth half. So you’d be missing out entirely on US large cap Value stocks. So I prefer the greater diversification of VOO. To illustrate another way, essentially, 50% VUG + 50% VTV = VOO.

This portfolio you see here is basically representative of my total portfolio across multiple accounts. I allocate based on tax efficiency whenever possible.

Hope this helps.

John,

Thank you so much for the reply! That makes complete sense. I initially purchased VUG, but would rather have fewer funds to look after, so I’ll keep what I have and move on to VOO.

Thank you for clarifying your personal strategy as well.

Best wishes,

Megan

Awesome. Anytime!

Hi John,

Been absolutely loving reading your posts!

I was wondering if you could elaborate, or point me to a post that elaborates, on how you allocate this portfolio across your accounts. And do you do it all through M1? I have a Roth and a taxable in M1. I’m curious to know what other account types even come into play here.

Thanks so much,

Brian

Thanks, Brian! Glad you’ve found them useful. It’s not all through M1. I’ve got accounts across multiple brokers from old 401k’s rolled over into IRAs, one of which is at Ally where I hold PSLDX, employer 401k, taxable and Roth with M1, a Solo 401k, as well as an HSA. It’s sort of evolved to be somewhat of a mess out of necessity. But basically I just try to allocate based on tax efficiency whenever possible.

Hey John, I’m 21 and new to investing and I have been very interested in modelling my portfolio after one of the lazy portfolios on your site, specifically this one. I am aiming to have a pretty long investment horizon, but currently I have only opened a taxable with M1, as I am currently unsure what kind of tax advantaged accounts I would like to open.

As you’ve stated, you have this portfolio spread across accounts to be as tax effecient as possible, and I would prefer to do the same. Do you have any suggestions for how or if I should start allocating into my taxable first? Would you have any sources for people to start learning exactly which specific assets are more tax effecient for each account type?

At the moment I don’t see myself as having too low of an income to effectively start maxing out contributions each year to something like a Roth IRA, although that could change later for better or worse. Yet, since all of this is very new to me I don’t want to immediately overextend myself. Any and all advice is appreciated, I love reading through your site!

In a perfect world, the bonds and small cap value funds would be in tax-advantaged space. Nothing to obsess over though. Thanks for the kind words!

I just finished allocating the equities portion of my self-directed 401k after your Ginger Ale Portfolio. I really like the reasoning behind small-cap value stocks throughout international markets and I am also a convert to your thinking on long-term treasuries as an uncorrelated asset. It really does make sense.

I’m a 52 year old guy that has scaled back my working hours but I feel comfortable sitting with this portfolio. I went much, much longer than you picking stocks haphazardly with little to show for it but underperformance and jumping in and out of the markets at the wrong time. Humans really are awful at controlling emotions. Equities make up 50% of my retirement portfolio. The other 50% is in real estate notes which consistently give me 8% to 10%. The notes will be a bit of a drag on this portfolio but the drawdowns will be smoothed significantly.

Now the challenge is to incorporate a lazy portfolio into my taxable accounts. Thinking of NTSX as a core holding.

Thanks for the comment! Glad you found it helpful.

One other quick question. What are good bonds funds to compliment this portfolio at a 20% bond allocation? With a 20+ yr horizon.

Do you also recommend mixing in EE or I bonds, or is that not worth the hassle?

VGLT might be good. Match bond duration to the investing horizon. I do own I bonds.

Have you found a solid choice in the EM Small Cap, or are you sticking with DGS?

DGS is solid. Sticking with it for now. AVES is very new but I’m keeping my eye on it.

Love you articles and learning so much. About this portfolio. In back testing doesn’t just 100% VTI outperform this. Switching the Advantis for DLS and VIOV so you can back further.

Keep up the good work.

Thanks! No.

Generally one would switch them for DFSVX DISVX etc. DFA equivalents as Avantis pulls from the DFA methodologies first and foremost. DLS and VIOV do not have nearly the same methodology. You can read more about Avantis’s methodology here.